Most traders think price moves randomly around funding time.

It doesn’t. It moves because of funding.

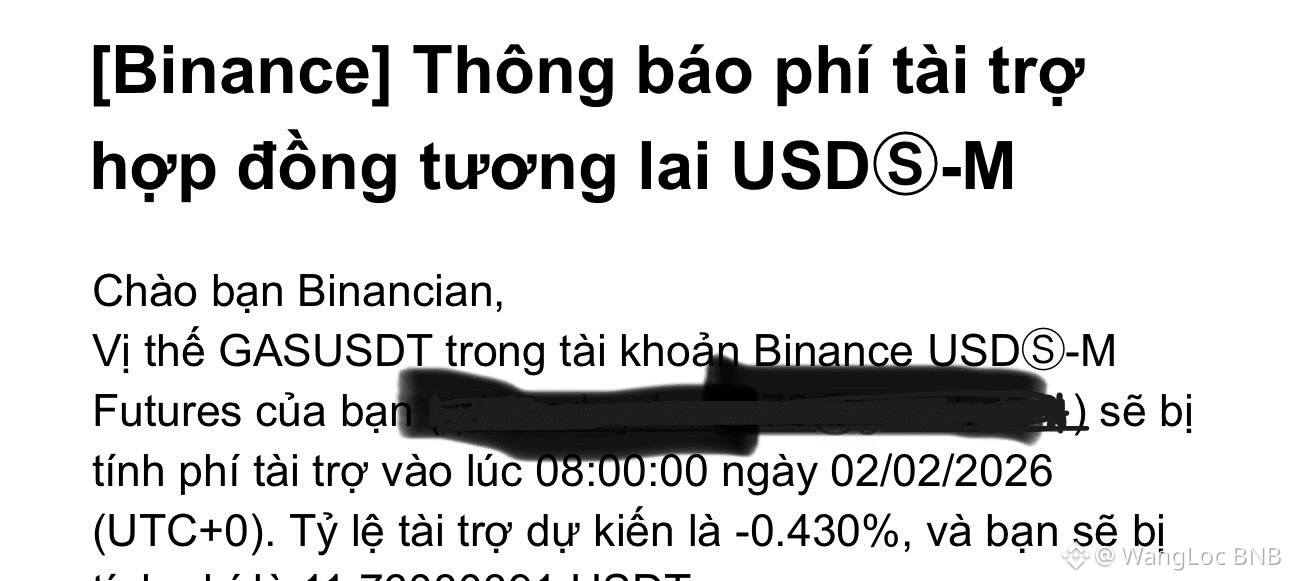

The math nobody wants to talk about At current funding levels:

10x leverage → ~4.3% capital lost per funding cycle

20x leverage → ~8.6% capital gone, even if price goes nowhere

You’re not “holding a position”. You’re paying a continuous penalty just to stay in the trade.

Sideways market? You bleed. Small pullback? You panic. One spike against you? You’re forced out.

This is how traders lose without ever being wrong on direction.

Why price always misbehaves near funding settlement

Ever noticed price suddenly:

Wicks against the trend

Spikes aggressively

Or dumps right before funding hits?

That’s not bad luck. That’s structure doing its job.

When funding is extreme:

One side is overcrowded

Open interest is leverage-heavy

The market becomes fragile

So price moves just enough to:

Trigger liquidations

Force early exits

Reset positioning

Normalize funding

The market isn’t hunting stops. It’s restoring balance.

The real divide in this market

Retail asks: “Where is price going?”

Professionals ask: “Who is paying to stay here?”

High funding =

Crowded trade

Emotional positioning

Weak hands controlling size

And weak hands always get shaken out first.

Funding doesn’t predict direction. It predicts who is vulnerable.

If you’re trading leverage and ignoring funding:

Your R:R is distorted

Your timing is late

Your edge is incomplete

Price action tells where. Funding tells when pressure breaks.

That’s the difference between trading the chart…and trading the market.

#fundingrate #Marketstructure #cryptotrading $SOL $ETH