Crypto me har dusra project “faster” aur “cheaper” hone ka claim karta hai.

Plasma ko dekh ke pehli cheez jo alag lagti hai, wo ye hai ki ye race me compete hi nahi kar raha.

Ye simply ek aur generic Layer-1 banne ki koshish nahi karta.

Iska starting point hi different hai:

stablecoins first, baaki sab baad me.

Idea simple hai — agar real world me crypto ka sabse zyada actual use ho raha hai, to wo trading ya NFTs nahi, balki stablecoins ka movement hai. Payments, remittances, settlements. Plasma wahi layer optimize kar raha hai.

Stablecoins as Money, Not Tokens

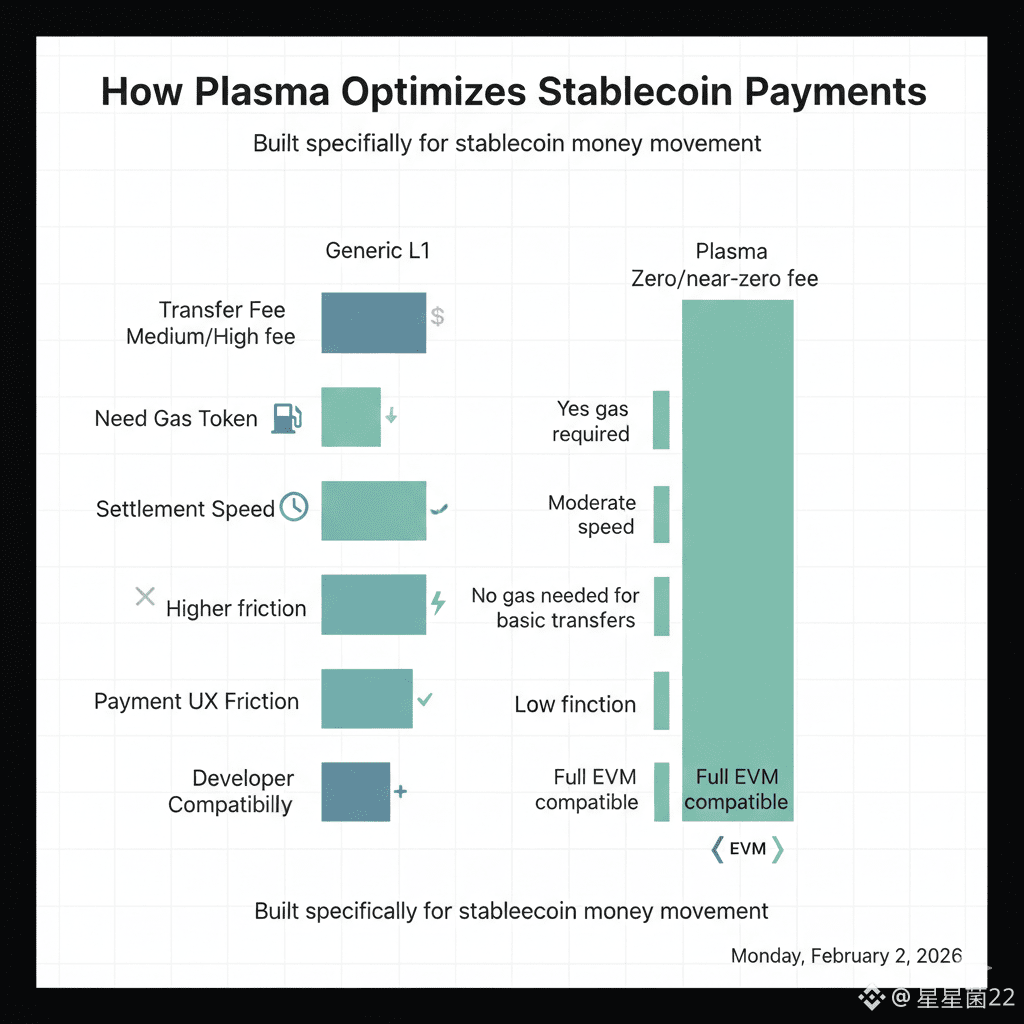

Most chains stablecoins ko sirf “ek aur token” treat karte hain.

Plasma unhe core primitive maanta hai.

Network ka design hi is tarah ka hai ki simple USD₮ transfers frictionless ho jayein. Matlab agar tum sirf stablecoin bhejna chahte ho, to tumhe gas token hold karne ki zarurat hi nahi.

Basic transfers zero-fee ho sakte hain.

Ye chhota lag sakta hai, lekin payments ke context me ye massive difference hai.

Agar har transaction pe gas calculate karna pade, to everyday money ka use practical nahi rehta.

Plasma ye friction quietly remove karta hai.

Mainnet Launch Aur Early Liquidity

Interesting part ye tha ki Plasma theory se start nahi hua.

Mainnet beta ke time hi network par billions worth stablecoins active the. Multiple DeFi protocols aur liquidity partners already connected the.

Isse ek cheez clear hoti hai — ye sirf whitepaper project nahi tha.

Infra pehle se ready tha, phir traffic aaya.

Under the Hood — Tech Without Drama

Technology side pe bhi approach practical lagti hai.

Consensus fast finality ke liye tuned hai.

Execution layer EVM compatible hai, to developers ko naya stack seekhne ki zarurat nahi.

Ethereum jaisa tooling use karo, deploy karo, done.

Aur Bitcoin anchoring jaisi cheezein long-term security mindset dikhati hain.

Yahan flashy innovation se zyada “reliability” pe focus hai.

$XPL Ka Role Straightforward Hai

Token mechanics unnecessarily complex nahi rakhe gaye.

$XPL ka kaam simple hai:

Network secure karo (staking)

Complex transactions ka gas pay karo

Governance me participate karo

Bas.

Koi confusing multi-utility ya gimmicks nahi.

Simple utility = predictable economics.

Payments Se Aage — Real Products

Plasma sirf chain bana ke ruk nahi raha.

Unka direction clearly payments infra ki taraf hai — wallets, integrations, aur even consumer facing products jahan stablecoins directly spend ho sakein.

Ye approach typical “DeFi farming” narrative se kaafi different hai.

Yahan focus hai:

send

receive

settle

spend

Jaise normal money behave karta hai.

Big Picture

Stablecoins already global scale pe use ho rahe hain.

Lekin abhi bhi unhe run karne ke liye chains originally DeFi/trading ke liye bani hui hain.

Plasma ka thesis simple hai:

“agar stablecoins main use case hain, to unke liye dedicated rails banao.”

Ye hype play nahi lagta.

Ye infra play lagta hai.

Aur infra projects usually slow start hote hain…

lekin agar adoption aa gaya, to wahi backbone ban jaate hain.

Short take:

Plasma speculation ke liye nahi bana.

Ye money movement ke liye bana hai.

Agar real-world payments on-chain scale hote hain, to Plasma jaisi chains naturally relevant ho jaati hain.

Baaki sab execution pe depend karega.