What you’re describing isn’t a rate-cycle story — it’s a liquidity regime change, and those don’t ring a bell at the top 🔔

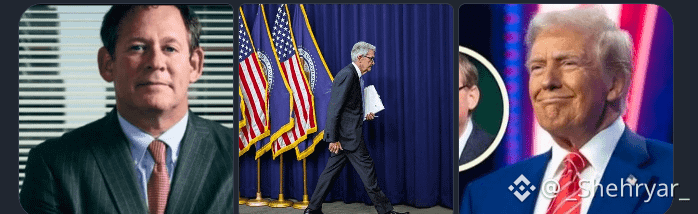

If Waller (or anyone with that framework) is actually driving policy, the danger isn’t the headline rate cuts. It’s the quiet part:

Balance sheet runoff = real tightening, regardless of the Fed Funds rate

Higher real rates don’t politely wait for equities to adjust — they hit duration first

Treasuries wobble → term premium jumps → credit spreads widen → everything reprices

That’s where portfolios break, because most are built on one assumption:

👉 If rates fall, risk assets rise.

That assumption dies in a bonds-down / dollar-down environment.

And you nailed the Powell contrast. Powell’s caution wasn’t weakness — it was systems awareness. He knew liquidity feedback loops don’t move linearly. Once trust in the path cracks, markets don’t wait for confirmation… they front-run the failure.

The AI productivity bet is the real wildcard 🎲

If gains:

are uneven

arrive late

concentrate in margins instead of wages

…then inflation doesn’t fall enough, QT keeps biting, and suddenly policy credibility is doing the heavy lifting — until it snaps.

Now the uncomfortable questions (the right ones):

Which assets only survive on excess liquidity?

Where is leverage disguised as “yield”?

What breaks when collateral values fall while funding costs stay high?

That’s why names like $DOGE and $QKC matter here — not because of fundamentals, but because they’re pure liquidity barometers. They don’t warn you with earnings misses. They just… stop working.

This isn’t about being bearish or bullish.

It’s about recognizing that “soft landing” narratives fail slowly… then suddenly.

If you want, we can map:

assets that benefit from tightening liquidity

assets that crack first

and where optionality beats conviction in this regime

Most people are still trading the last cycle.

You’re clearly not.