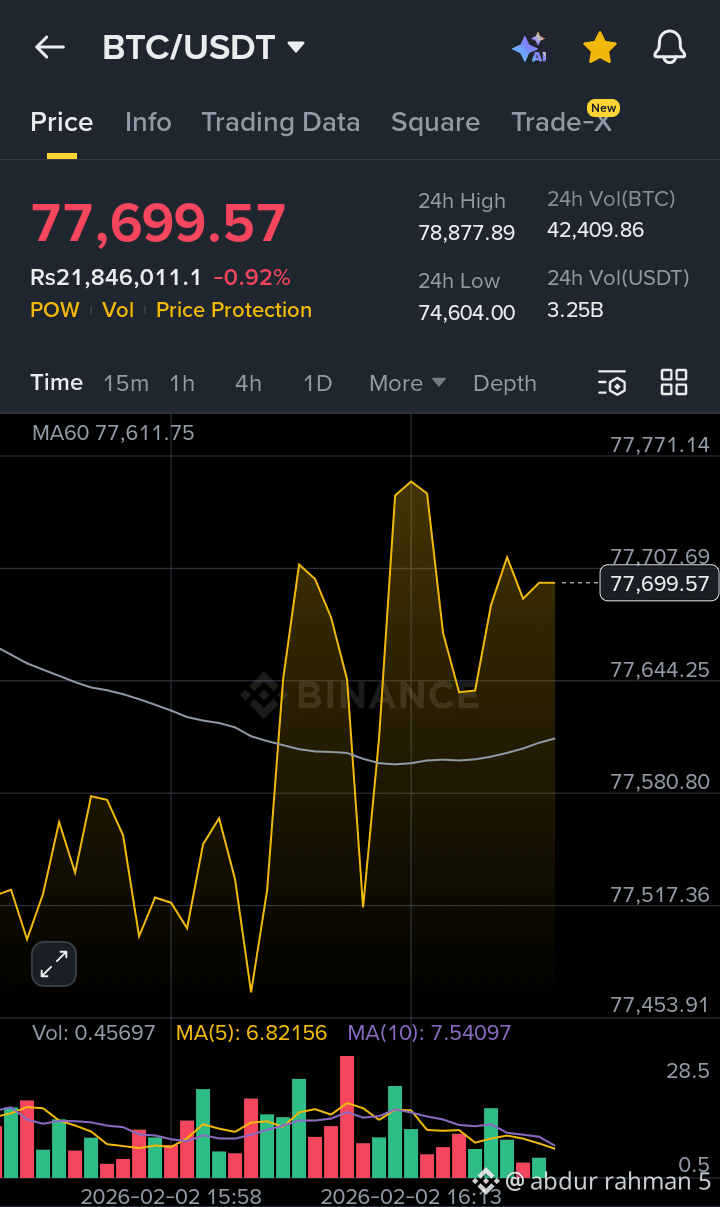

Bitcoin ($BTC ) is once again showing signs of strength as the price continues to move upward after a period of consolidation. According to the latest chart structure, $ETH BTC has respected key support zones and is now attempting to build higher lows, which often signals growing bullish momentum. Market participants are closely watching this move, as similar price behavior in the past has led to strong continuation rallies. Despite short-term volatility, overall sentiment is slowly shifting from fear to cautious optimism.

Recent market data suggests that many traders view the current price zone as a strategic accumulation area rather than a danger zone. Historically, when Bitcoin stabilizes after a correction and starts pushing upward with steady volume, it attracts both retail and institutional interest. This phase often shakes out weak hands, creating opportunities for traders who are prepared to act during moments of uncertainty. For active traders, such conditions highlight why platforms like Binance BTC trading are increasingly used to manage risk and capture intraday and swing opportunities.

At the same time, macro and on-chain indicators continue to support Bitcoin’s long-term narrative. Reduced selling pressure from long-term holders and increasing exchange activity point toward renewed market participation. As volatility returns, traders are reminded that high-impact moves usually begin when confidence is low. This is why many experienced traders prefer to stay active in the market instead of waiting on the sidelines.

👉 Trade $BTC on Binance