Most chains fight for users.

Plasma looks like it’s trying to become plumbing.

That difference is subtle but dangerous.

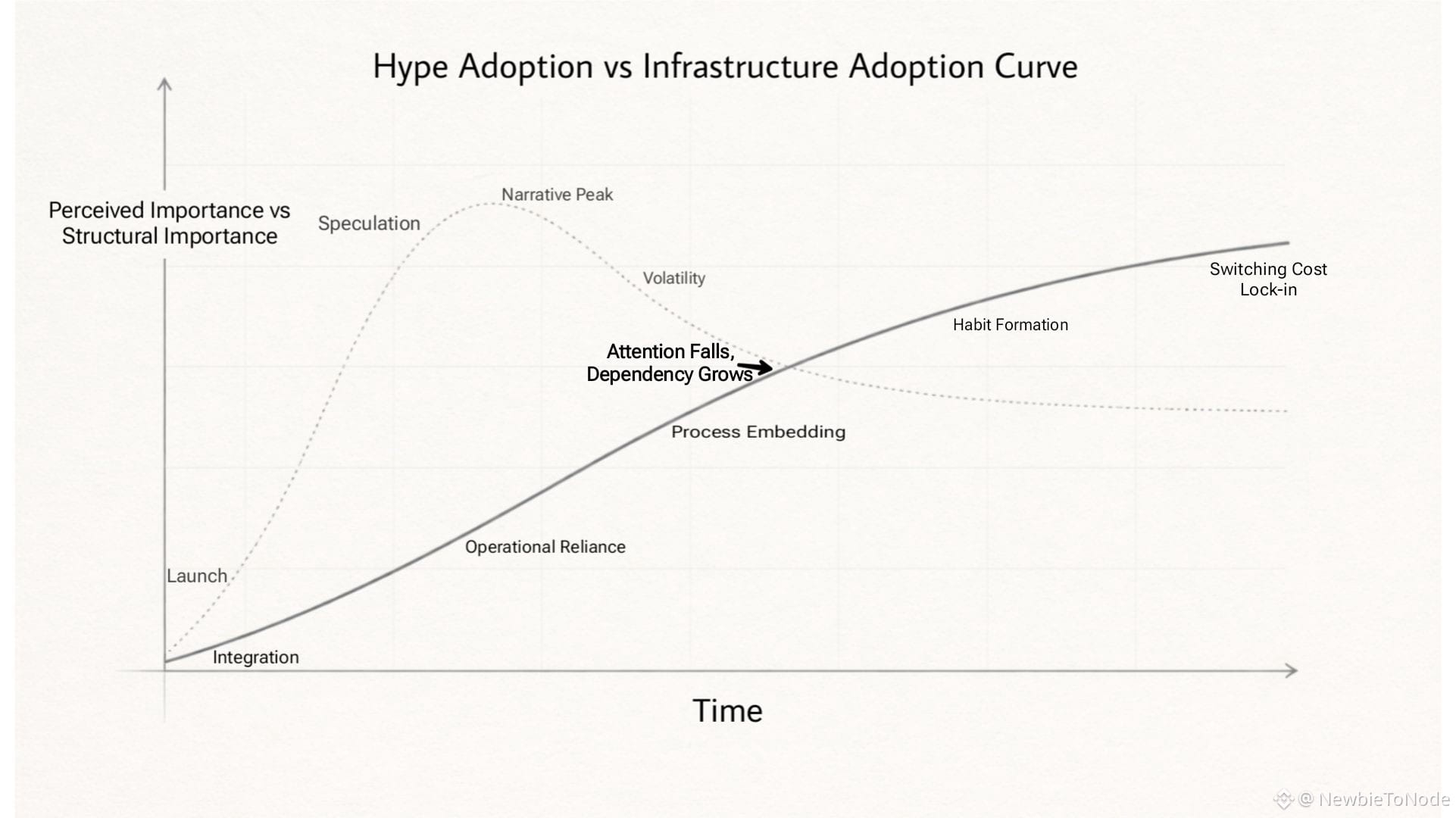

User platforms grow through excitement. Infrastructure grows through dependency. Once systems depend on you, switching costs rise quietly, but so do expectations.

Plasma’s stablecoin-first model is pulling it into that second category faster than its market cap suggests.

Large pools, settlement corridors, cross-chain routing, merchant rails, these are not features that create hype cycles. They create operational reliance. And reliance behaves differently from speculation.

Speculative activity tolerates volatility. Infrastructure use does not.

This means Plasma is entering a phase where the network is judged less like a startup and more like a service layer. The success metric stops being TVL growth and starts being behavioral stability. Funds don’t just arrive. They settle into routines.

That’s how payment rails mature: first usage, then habit, then dependency.

This is the point where a network stops being chosen and starts being assumed. A treasury team doesn’t debate settlement rails every week. A payment corridor doesn’t migrate because another chain is slightly faster. Once operational routines form, stability becomes more valuable than novelty.

That transition is powerful but uncomfortable. Markets understand explosive growth stories. They struggle to price slow, compounding dependency.

A chain can double in TVL overnight and still be replaceable. But when payment corridors, treasury workflows, and cross-chain settlement routes begin relying on a specific environment, exit becomes harder than entry.

Plasma’s architecture points toward that direction. Stablecoin movement becomes predictable, fee noise fades, settlement feels routine. None of this is dramatic. But routine is exactly what infrastructure needs to become invisible.

Invisible systems rarely trend. They become assumed.

That is the paradox Plasma faces. If adoption deepens, excitement metrics might flatten even as systemic importance rises. It starts looking less like a crypto play and more like financial middleware.

Markets tend to reward noise before they reward necessity.

But necessity compounds differently. Once flows normalize around a certain rail, displacing them requires more than better tech. It requires breaking habits, integrations, and accounting assumptions.

That’s a higher barrier than TVL competition.

Plasma’s risk is not that it fails to grow. It’s that it succeeds in becoming boring before the market recognizes the value of boring systems.

And boring infrastructure is usually the last thing to reprice until it suddenly does.