The first time I looked seriously at Dusk Foundation, I assumed it was just another privacy chain — and I was completely wrong. What pulled me in was not secrecy for its own sake, but a deeper idea: modern finance had become paradoxically visible and yet fundamentally untrustworthy. Every transaction could be tracked, every wallet analyzed, yet institutions still hesitated to move real value on-chain. Dusk made me realize that the missing ingredient was not more transparency, but selective confidentiality — a system where you can prove truth without revealing everything.

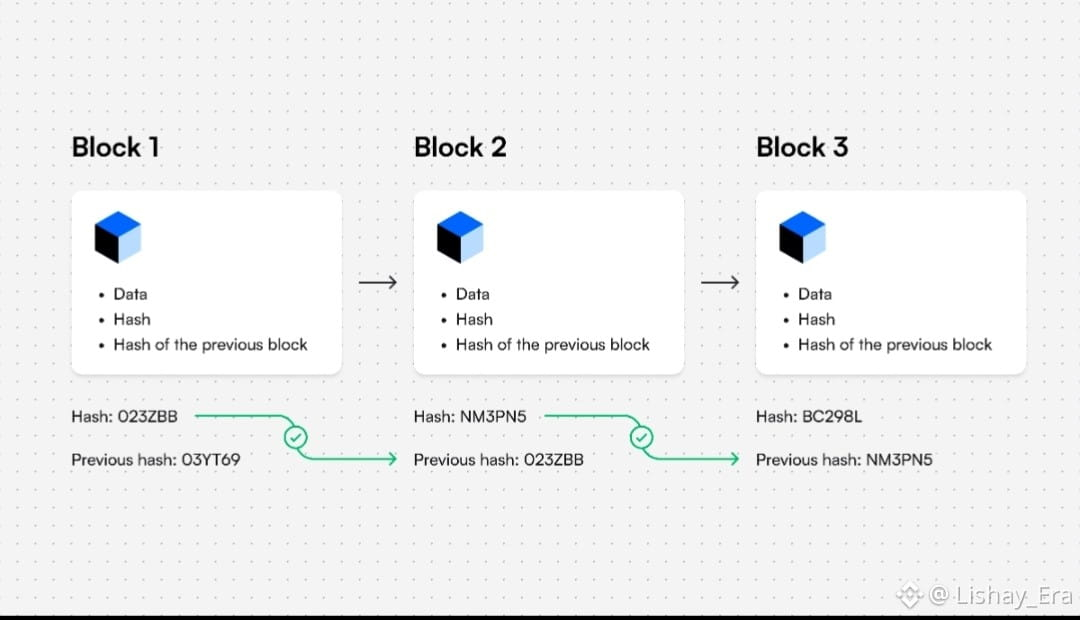

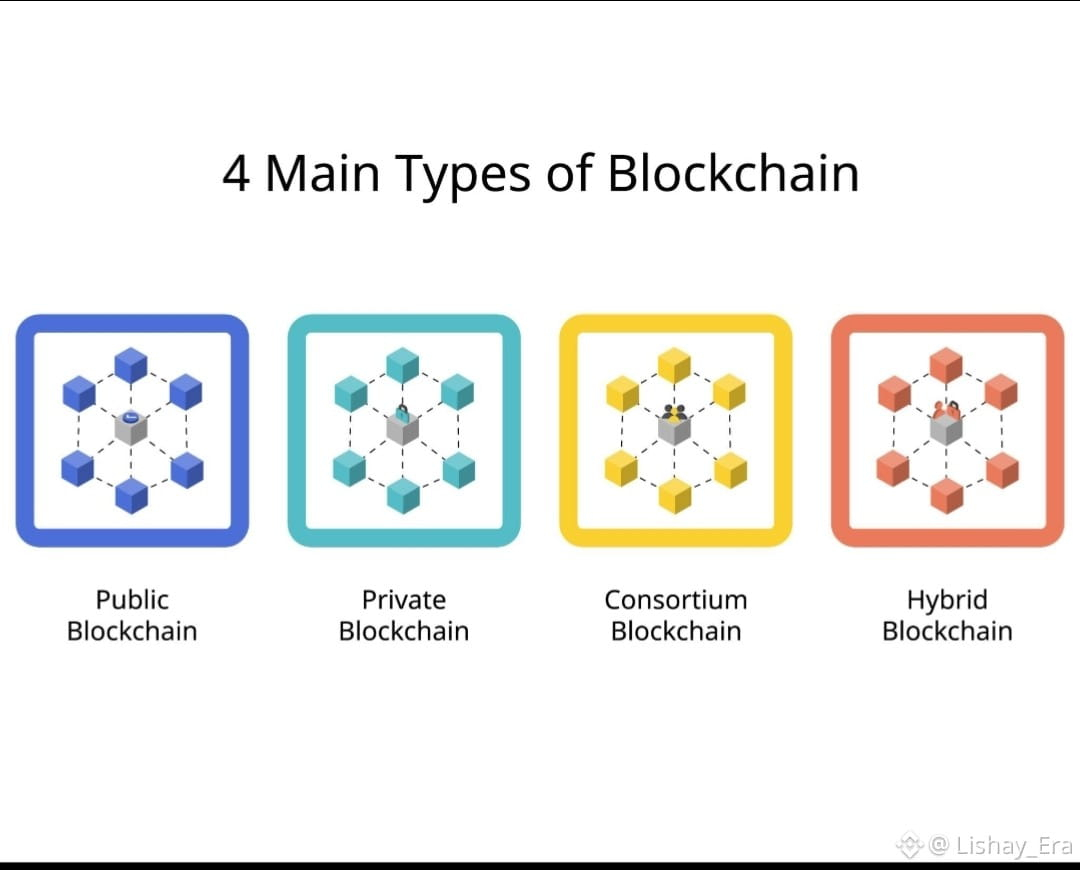

I began my journey by reflecting on how traditional blockchains handle data. Public ledgers give absolute visibility, which is powerful for accountability but deeply impractical for banks, asset managers, or regulated institutions. No serious financial player wants their strategy, positions, or client data exposed to the entire world. As I studied Dusk, I started seeing it not as a privacy tool, but as a bridge between blockchain ideals and real-world finance.

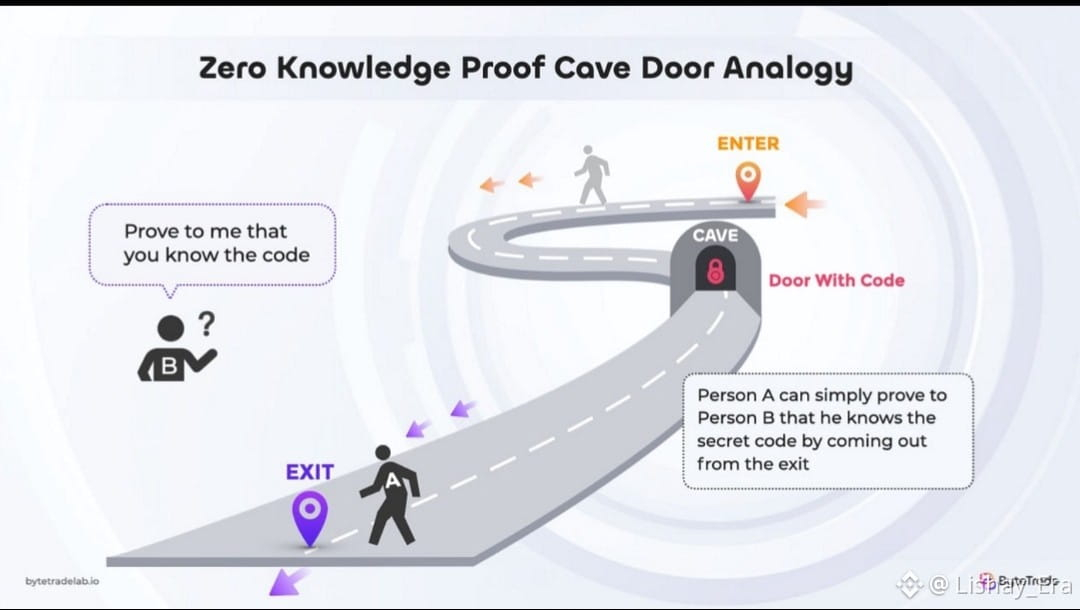

What struck me early on was Dusk’s philosophical stance: privacy is not about hiding wrongdoing; it is about preserving commercial integrity. In legacy markets, confidentiality is standard practice — negotiations, settlements, and contracts rarely happen in public view. Dusk simply brings that same professional expectation into Web3 using zero-knowledge cryptography instead of trust in intermediaries.

At the technical core of Dusk lies zero-knowledge proofs, but what fascinated me was how elegantly they are integrated. Instead of forcing users to reveal everything or nothing, Dusk enables selective disclosure. You can prove that a transaction is valid, compliant, and properly authorized without exposing the underlying details. To me, this felt like the first truly institution-ready blockchain design.

As I dug deeper, I realized that Dusk is not trying to replace public chains — it is creating a parallel lane for regulated digital finance. Think of Ethereum as a global open internet, while Dusk resembles a secure financial intranet where rules, identities, and compliance can exist without sacrificing decentralization.

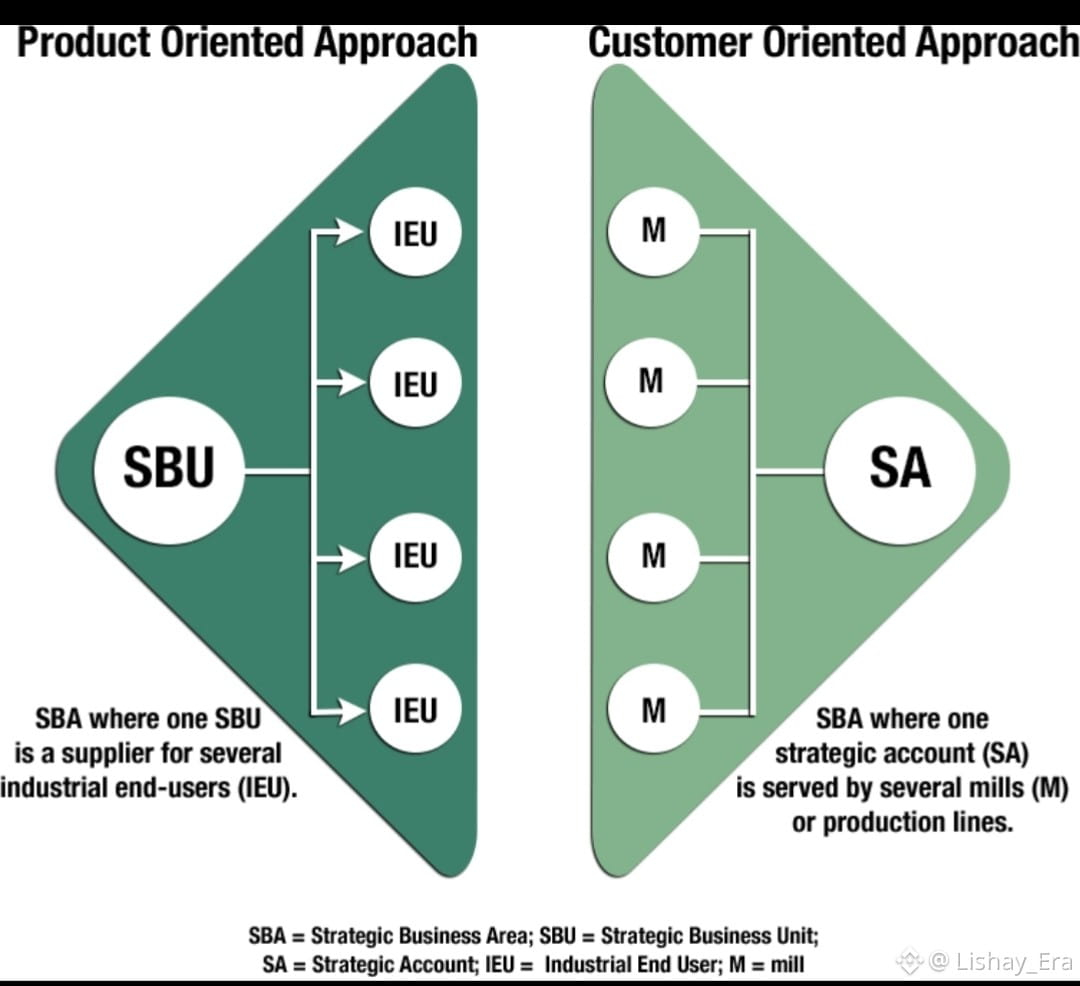

A turning point in my understanding came when I studied Dusk’s SBA (Synchronized Byzantine Agreement) consensus. Unlike traditional Proof of Work or Proof of Stake, SBA focuses on efficiency, finality, and predictable settlement. I saw this as critical for institutions that cannot tolerate long confirmation times or probabilistic finality. In Dusk, transactions settle cleanly and deterministically — something traditional finance actually demands.

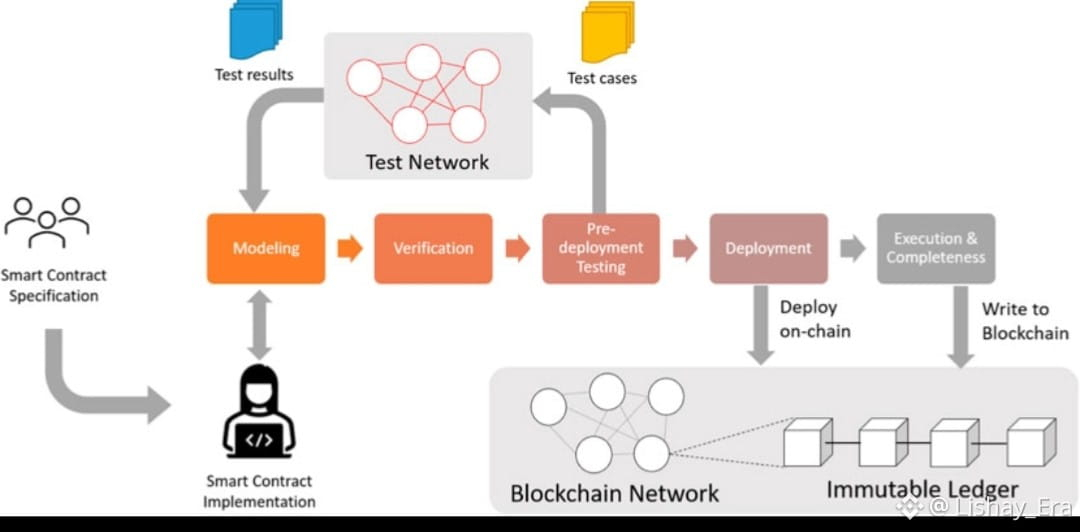

What impressed me further was Dusk’s native support for confidential smart contracts. Instead of transparent code that exposes all logic and state, contracts on Dusk can operate privately while remaining verifiable. This opens the door to real-world use cases like private securities, institutional DeFi, and confidential settlements that would be impossible on fully public chains.

I began imagining how regulated assets could live on Dusk. Tokenized bonds, equities, or real estate could be traded on-chain without leaking sensitive data to competitors or the public. Compliance could be baked into the protocol itself through programmable rules rather than off-chain enforcement.

At this stage, I started thinking beyond pure finance and toward AI-driven economies. Autonomous systems handling capital need privacy just as much as humans do. AI agents executing trades, managing portfolios, or negotiating contracts cannot operate in a completely transparent environment without creating systemic risks. Dusk provides a framework where machine-driven finance can remain secure, auditable, and confidential.

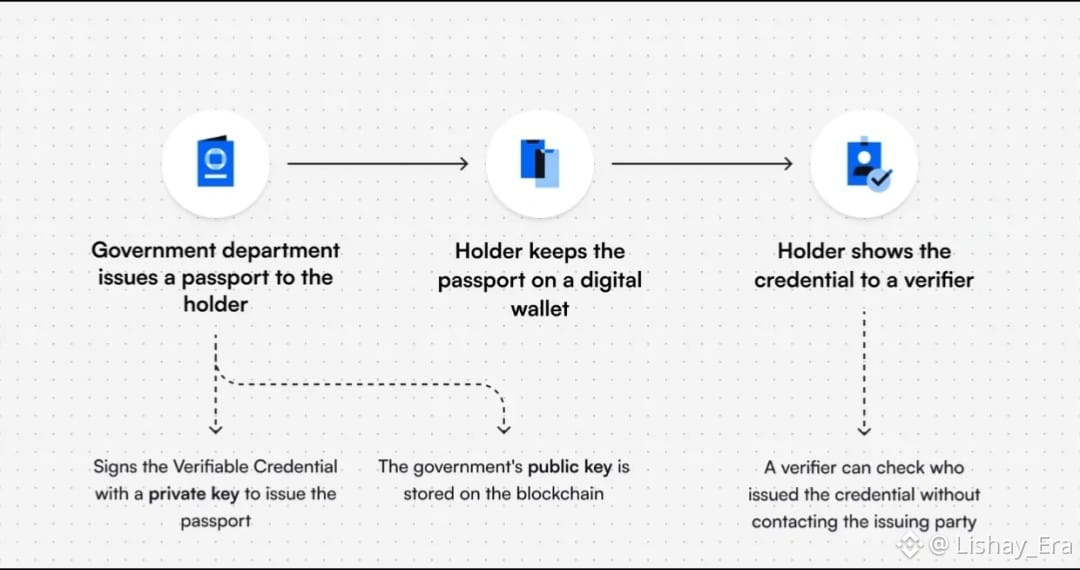

Another insight that shaped my perspective was how Dusk reframes identity. Instead of anonymous chaos or full public exposure, Dusk supports verifiable credentials. You can prove that you are authorized, accredited, or compliant without revealing your full identity. This felt like a mature approach to digital identity — practical rather than ideological.

I also appreciated how Dusk positions itself as infrastructure rather than a speculative token playground. The network is built around real-world financial needs: predictable fees, reliable performance, and regulatory compatibility. It does not chase hype; it chases utility.

As I compared Dusk with other privacy solutions, its design stood out. Many privacy chains either sacrifice compliance or usability. Dusk manages to balance confidentiality with accountability through cryptographic guarantees instead of centralized gatekeepers.

The more I reflected, the more I saw Dusk as a missing layer in the blockchain stack. Public chains democratized value transfer, but they did not solve institutional adoption. Dusk fills that gap by offering confidential, programmable, and compliant settlement rails.

One of my most personal realizations was how narrow my earlier view of blockchain had been. I used to think transparency was always good and privacy was suspicious. Dusk taught me that sophisticated systems require nuance — sometimes privacy is what makes trust possible.

Looking ahead, I believe Dusk will play a crucial role in bridging Web3 with traditional capital markets. As more real-world assets move on-chain, confidentiality will not be optional; it will be essential.

In a broader sense, Dusk represents a shift in how we think about decentralization. It is not about exposing everything to everyone; it is about creating systems where truth can be verified without exploitation.

By the end of my research, I no longer saw Dusk as just a privacy chain. I saw it as the foundation for a new era of regulated, confidential, and programmable finance — one that could finally make blockchain relevant to institutions without betraying its core principles.

If public blockchains are the marketplace of ideas, Dusk is the professional boardroom where deals can be struck with dignity, security, and mathematical certainty.