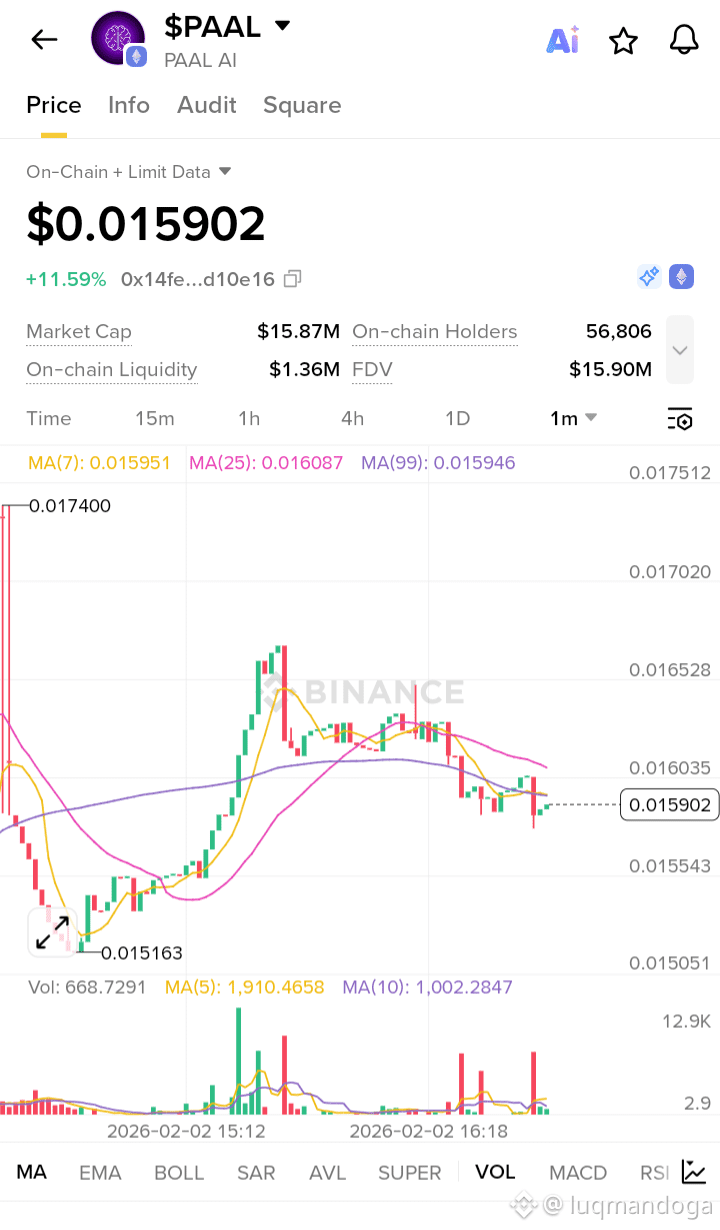

$PAAL AI has shown a strong short-term pump, with price currently trading around $0.0159, up over 11% on the session. The primary driver behind this move is renewed buying interest in AI-related tokens, especially low-cap projects with active communities. On the chart, PAAL formed a clear impulsive move from the $0.0151 support zone, followed by a higher high and higher low structure. This indicates short-term trend continuation rather than a random spike. Volume expansion during the push confirms that the move is supported by real demand, not just thin liquidity. Additionally, the market cap (~$15.8M) and holder count (~56K) suggest $PAL remains in a speculative but attractive range for momentum traders.

From a technical perspective, PAAL is currently hovering near key moving averages (MA 7, MA 25, MA 99), signaling a consolidation phase after the initial pump. This is healthy price behavior: instead of dumping, the token is absorbing selling pressure. If price holds above $0.0155–$0.0157, it can attempt another move toward the $0.0165–$0.0170 resistance zone. A clean break above that level with volume could open the door for a continuation rally. On the downside, failure to hold current levels may lead to a pullback toward $0.0150, which remains a critical demand zone. Overall, PAAL’s pump appears driven by AI narrative strength + technical breakout + volume confirmation, making it one to watch closely in the near term.

Not financial advice. Always  manage risk.

manage risk.