The first time I truly questioned stablecoins, it wasn’t during a market crash — it was while watching AI systems interact with financial rails in real time. I had always treated stablecoins as neutral digital dollars, but I began to see them differently when I imagined autonomous agents relying on them. Humans can tolerate occasional friction, delays, or unexpected peg deviations. Machines cannot. That realization pulled me toward Plasma ($XPL), not as an investment story, but as an engineering experiment in what “machine-native money” should look like.

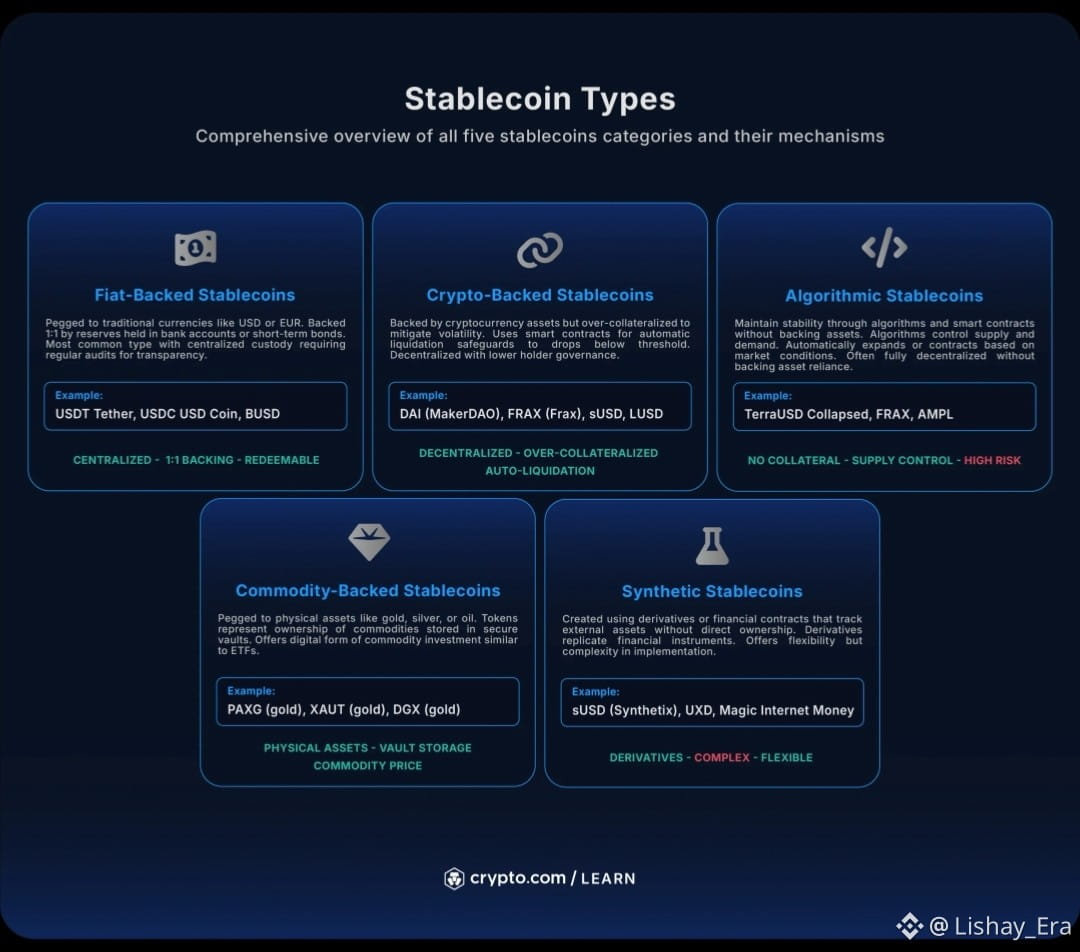

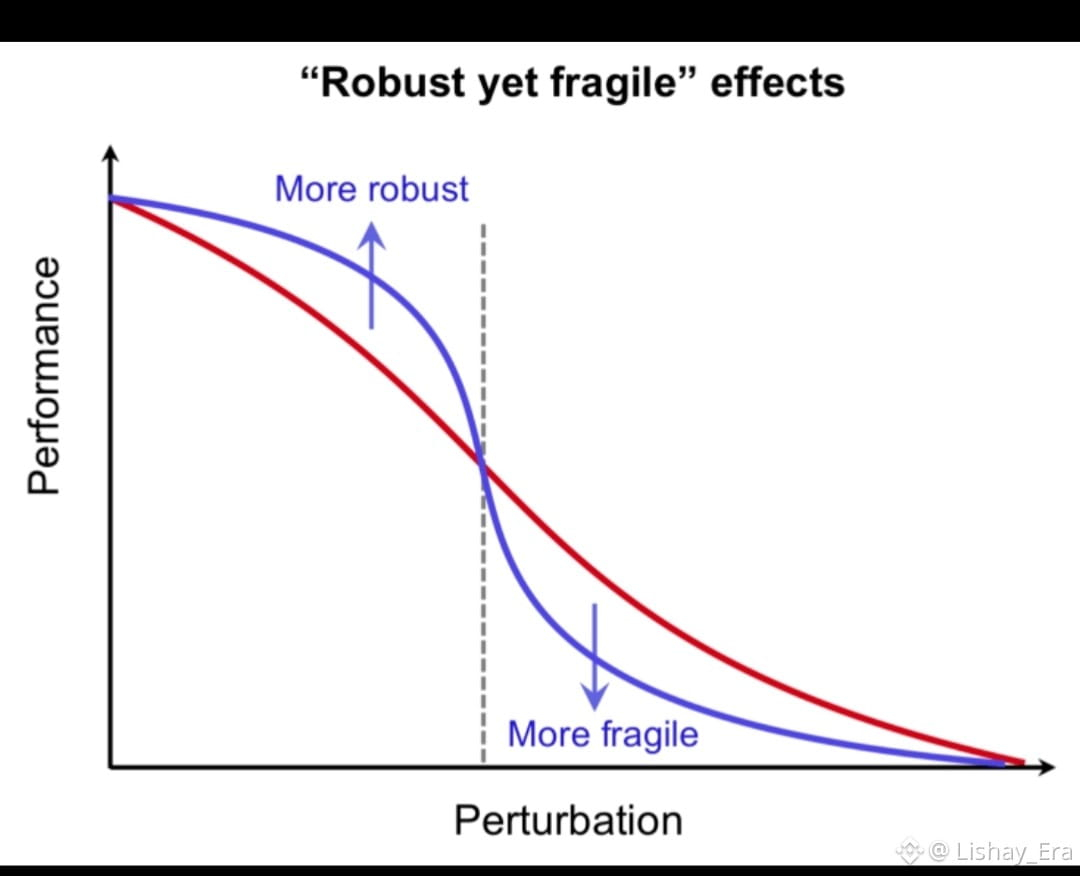

At the surface, most stablecoins appear reliable because they maintain a one-to-one peg under normal conditions. Yet when I dug deeper, I noticed how heavily they depend on external incentives, market liquidity, or discretionary intervention. I started seeing this as a design flaw rather than a temporary weakness. If money is going to power AI-driven economies, its stability cannot depend on human emotion, governance drama, or temporary liquidity programs.

Plasma reframed this entire problem for me. Instead of asking how to “defend a peg,” Plasma asks how to make stability a property of the system itself. That shift felt subtle but profound. Rather than reacting to volatility, Plasma tries to prevent fragility from emerging in the first place through deterministic rules, transparent risk parameters, and algorithmic guardrails.

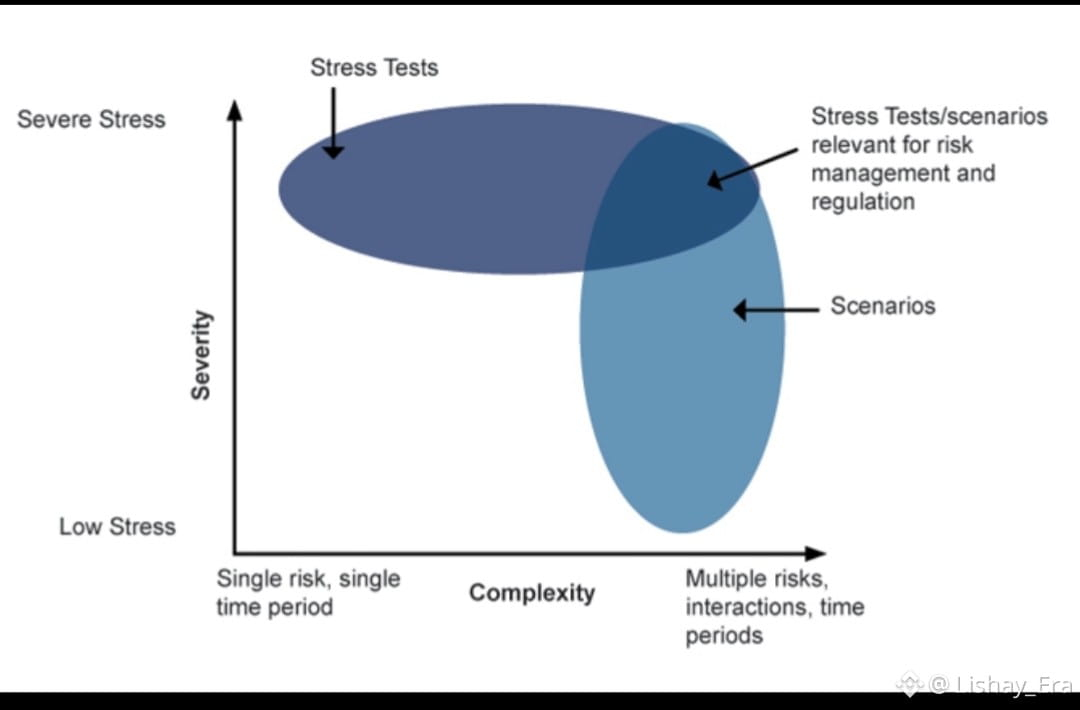

One of my key insights came when I compared traditional stablecoins to physical infrastructure like bridges or power grids. We don’t keep bridges standing with incentives — we engineer them to withstand stress. Plasma treats money the same way: stability is engineered, not subsidized. This approach immediately made more sense to me in a world where machines, not humans, increasingly move capital.

As I explored Plasma’s architecture, I was struck by how it centers around predictable collateral mechanics rather than speculative market behavior. Instead of chasing yield or liquidity mining, Plasma focuses on ensuring that collateral relationships remain mathematically sound across market conditions. This felt like finance designed by systems engineers rather than traders.

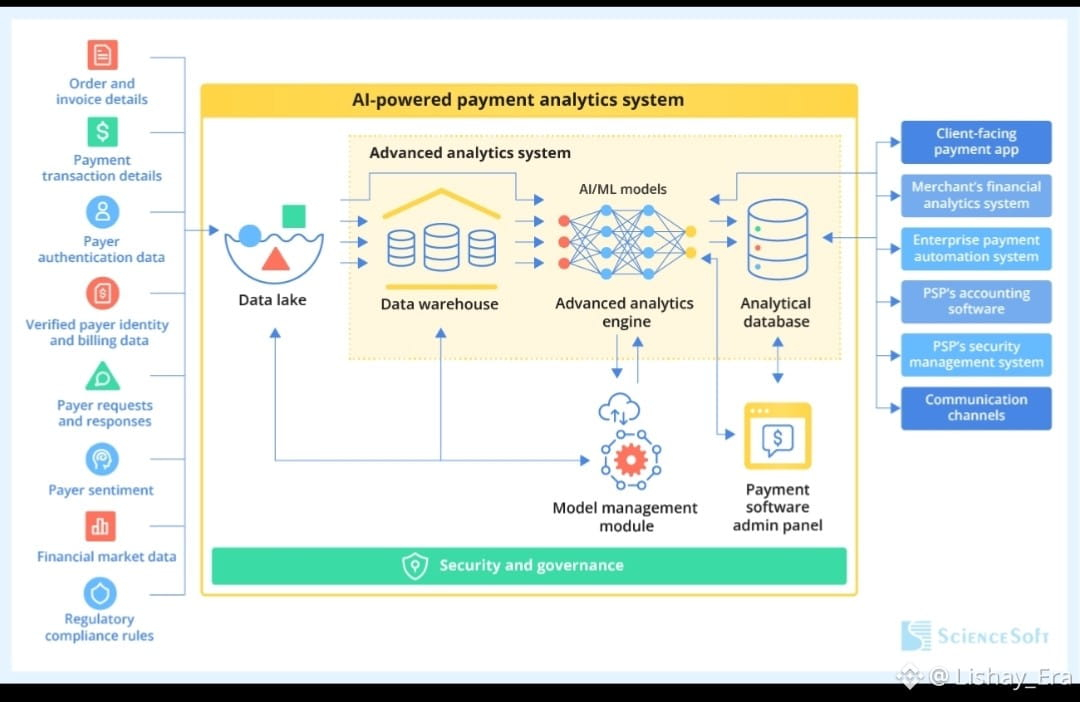

What really separated Plasma in my mind was its emphasis on determinism. Every rule governing issuance, redemption, and risk management is clearly defined and machine-verifiable. AI agents can understand and interact with these rules without ambiguity. In contrast, many existing stablecoins rely on opaque governance decisions that machines cannot interpret.

I also began to appreciate how Plasma treats liquidity differently. Instead of assuming that markets will always provide enough liquidity, Plasma builds predictable liquidity behavior into the protocol itself. Even under stress, the system is designed to behave consistently rather than panic. That predictability is critical for autonomous systems making real-time decisions.

At this stage, I started thinking about how AI agents actually operate. They request data, execute micro-transactions, optimize outcomes, and move capital at speeds far beyond human capability. For them, money must be fast, reliable, and mathematically transparent. Plasma feels like one of the first stablecoin systems built with this reality in mind.

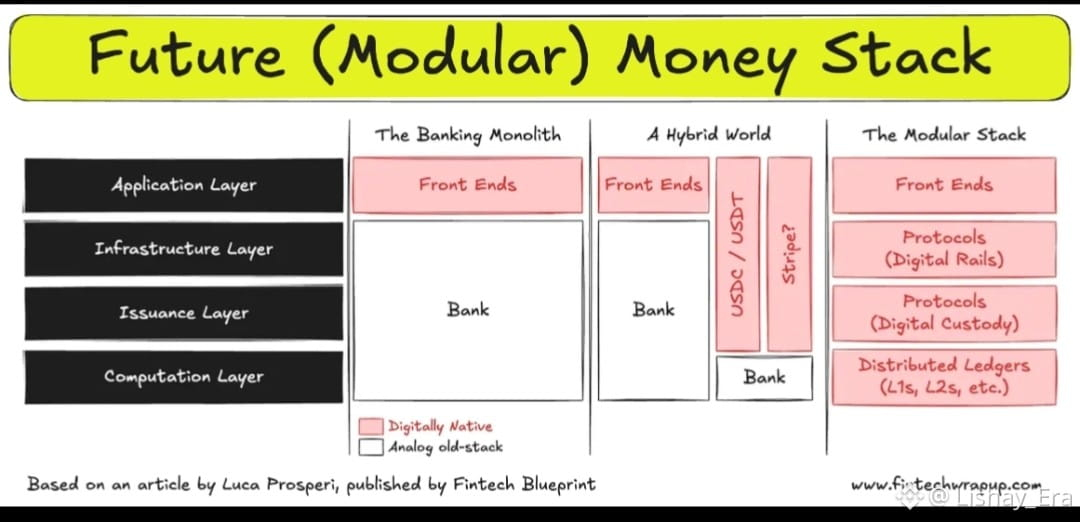

Another layer that intrigued me was how Plasma positions itself as infrastructure rather than a product. It doesn’t try to dominate payments or DeFi; instead, it provides a stable foundation upon which other applications — especially AI-driven ones — can be built. In that sense, $XPL is less a token and more a protocol-level instrument.

I also saw Plasma as part of a broader shift in how we think about value in digital economies. Traditional finance assumes human decision-making. Plasma assumes algorithmic participation. This subtle difference changes everything from risk management to settlement design.

As I reflected further, I began connecting Plasma to other decentralized infrastructure like Walrus. If Plasma represents deterministic money, Walrus represents deterministic memory. Together, they form a stack where AI systems can reliably store, access, and transact with data and value without centralized intermediaries.

From a creator and builder perspective, Plasma opens interesting possibilities. Digital marketplaces, AI-native applications, and autonomous services could rely on a stable unit of account that behaves consistently even during market turbulence. That reliability is far more valuable than speculative upside.

What impressed me most was Plasma’s commitment to transparency without chaos. The system is open and auditable, yet it avoids the instability that comes from purely market-driven models. It balances clarity with control in a way that feels mature and practical.

Looking ahead, I believe deterministic stablecoin infrastructure will become essential rather than optional. As AI agents scale, we cannot afford fragile money systems that collapse under stress. Plasma feels like an early answer to this looming challenge.

On a personal level, studying Plasma forced me to rethink what “stability” actually means. It is not about price alone — it is about reliability, predictability, and systemic resilience. In that sense, Plasma represents a philosophical evolution as much as a technical one.

In the end, Plasma changed how I see digital money. Instead of viewing stablecoins as tools for trading, I now see them as foundational infrastructure for autonomous economies. If the future belongs to machines as much as humans, then our money must be built for both. Plasma, to me, is one of the first serious attempts to make that future possible.