$ETH Ethereum continues to bleed lower, and while price action may look slow and controlled on the surface, tension beneath the market is building rapidly. This is not just another routine pullback. $ETH is approaching a critical liquidation band where market mechanics shift from human decision-making to forced execution.

Once ETH drifts into a very specific price range, things stop being “manageable” — and start becoming automatic.

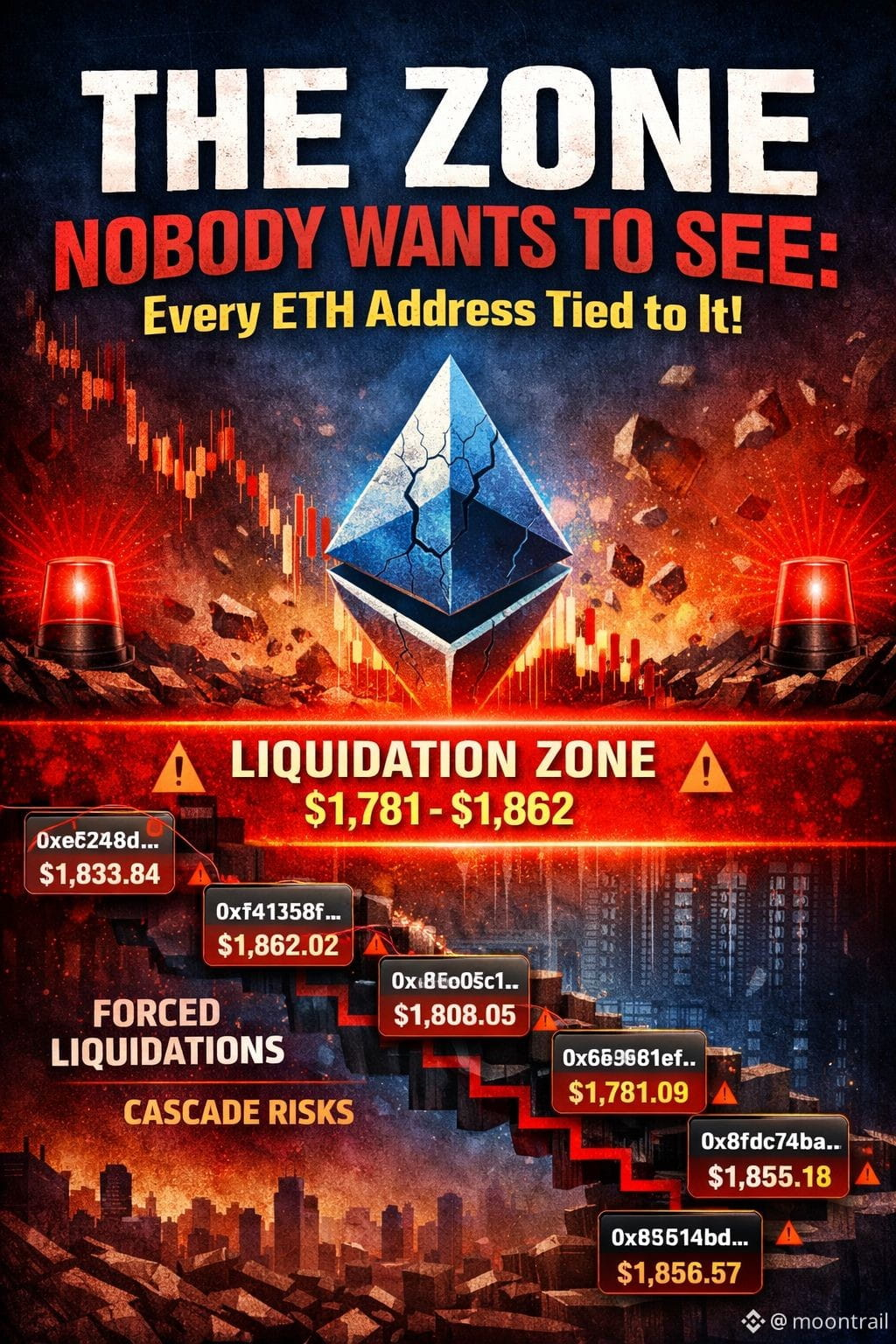

⚠️ The Critical Liquidation Band: $1,781 – $1,862

If ETH enters the $1,781 to $1,862 zone, liquidation pressure begins for one of the largest and most influential players in the ecosystem: Trend Research.

This isn’t a single overleveraged bet. It’s a carefully layered leverage structure spread across multiple wallets, each with its own liquidation threshold. The danger lies not in a sudden crash — but in a slow, grinding drift downward.

🐋 Inside Trend Research’s ETH Exposure

Trend Research currently controls 618,245.96 ETH, distributed across six wallets, using approximately $1.33 billion worth of WETH as collateral to borrow around $939 million in stablecoins.

This structure resembles a staircase — not a cliff.

Each step lower in price activates a new layer of liquidation risk.

🔍 Wallet-by-Wallet Breakdown

🔹 Largest Exposure

Wallet: 0xe5c248d8d3f3871bd0f68e9c4743459c43bb4e4c

Collateral: 169,891 ETH

Borrowed: $258M

Liquidation Price: ~$1,833.84

This wallet sits right in the middle of the danger zone — meaning even modest downside pressure could trigger forced selling.

🔹 Highest Liquidation Threshold

Wallet: 0xfaf1358fe6a9fa29a169dfc272b14e709f54840f

Collateral: 175,843 ETH

Borrowed: $271M

Liquidation Price: ~$1,862.02

This is one of the earliest dominoes. If ETH slips below this level, market stress could escalate quickly.

🔹 Mid-Zone Exposure

Wallet: 0x85e05c10db73499fbdecab0dfbb794a446feeec8

Collateral: 108,743 ETH

Borrowed: $163M

Liquidation Price: ~$1,808.05

This level acts as a transition point — once reached, liquidation risk accelerates rather than stabilizes.

🔹 The Lowest Floor

Wallet: 0x6e9e81efcc4cbff68ed04c4a90aea33cb22c8c89

Collateral: 79,510 ETH

Borrowed: $117M

Liquidation Price: ~$1,781.09

This is the final step. If ETH reaches here, the structure becomes extremely fragile.

🔹 Tightly Clustered Upper Wallets

Wallet: 0x8fdc74bad4aa20904a362d4b69434a0cf4d97f43

43,025 ETH | $66.25M borrowed

Liquidation: ~$1,855.18

Wallet: 0xb8551abd2bb66498f6d257ae181d681fd2401e8a

41,034 ETH | $63.23M borrowed

Liquidation: ~$1,856.57

These sit dangerously close to each other, increasing the risk of clustered liquidations.

🧠 Why This Zone Matters

This is not about ETH collapsing in a single candle.

It’s about time and gravity.

ETH doesn’t need to crash

It doesn’t need panic

It just needs to drift… slowly… awkwardly… lower

Once price enters this band, liquidation engines don’t care about:

Reputation

Fund size

Past performance

Market narratives

They execute — automatically.

And forced selling creates feedback loops:

Liquidations → selling pressure → lower price → more liquidations

📉 Broader Market Implications

If these liquidations trigger:

On-chain ETH supply increases

Stablecoin liquidity tightens

Volatility spikes across DeFi

Altcoins feel amplified downside pressure

This zone could become a systemic stress test for the Ethereum ecosystem.

🧩 Final Thought

For now, the structure holds.

But once ETH enters this range, control quietly shifts from traders to algorithms.

This isn’t fear — it’s mechanics.

The market won’t ask who is holding the position.

It will only ask where the liquidation price is.

What’s your take — does ETH stabilize before the zone… or does the staircase begin? 👀📊