In most crypto conversations, a “Layer 1” is assumed to be a general-purpose execution environment: smart contracts, composability, tokens, governance, and a long tail of developer experimentation. Plasma (XPL) does not fit comfortably into that mental model—and that is precisely the point.

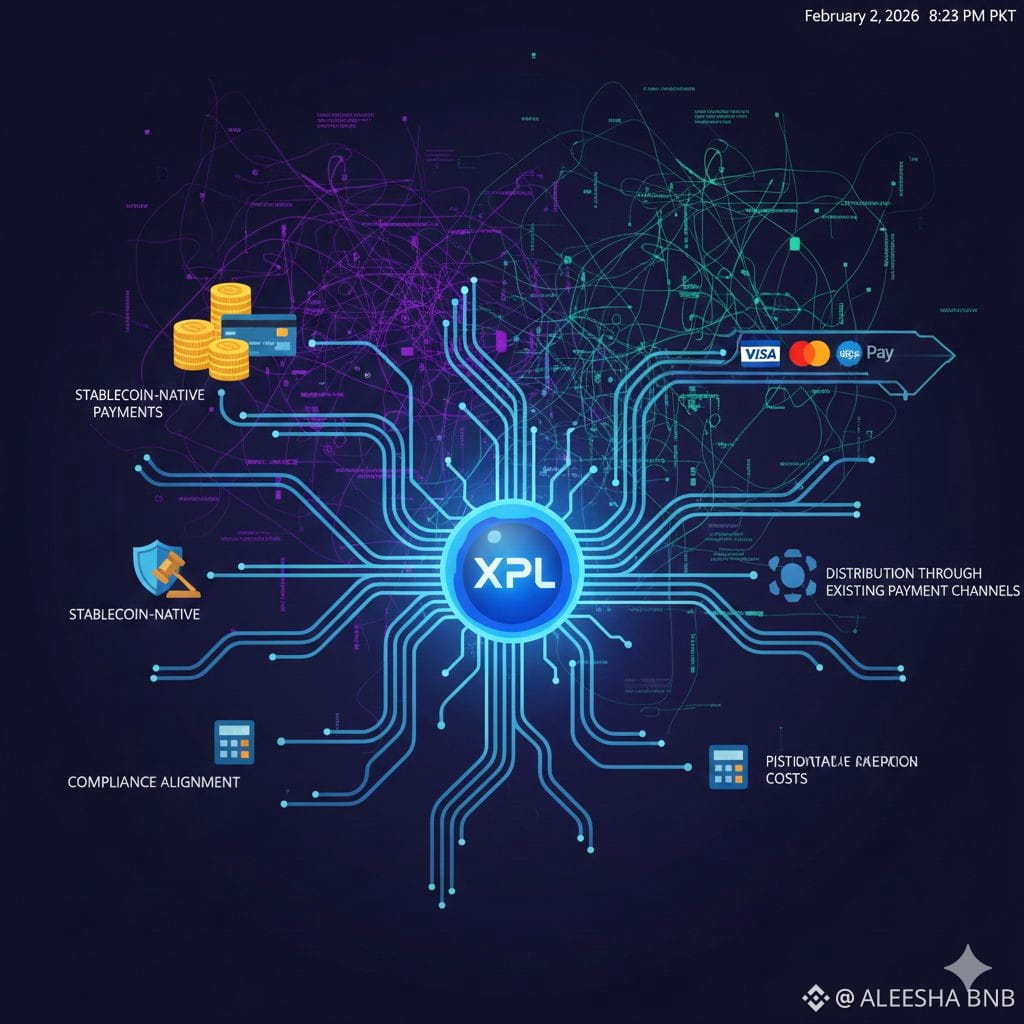

Plasma should be understood less as a general blockchain and more as a stablecoin-native payments infrastructure that happens to use blockchain primitives. Framing it as a Layer 1 obscures what it is trying to optimize for: user experience, compliance alignment, predictable costs, and distribution through existing payment channels. These are not the usual priorities of crypto networks, but they are the unavoidable priorities of payments.

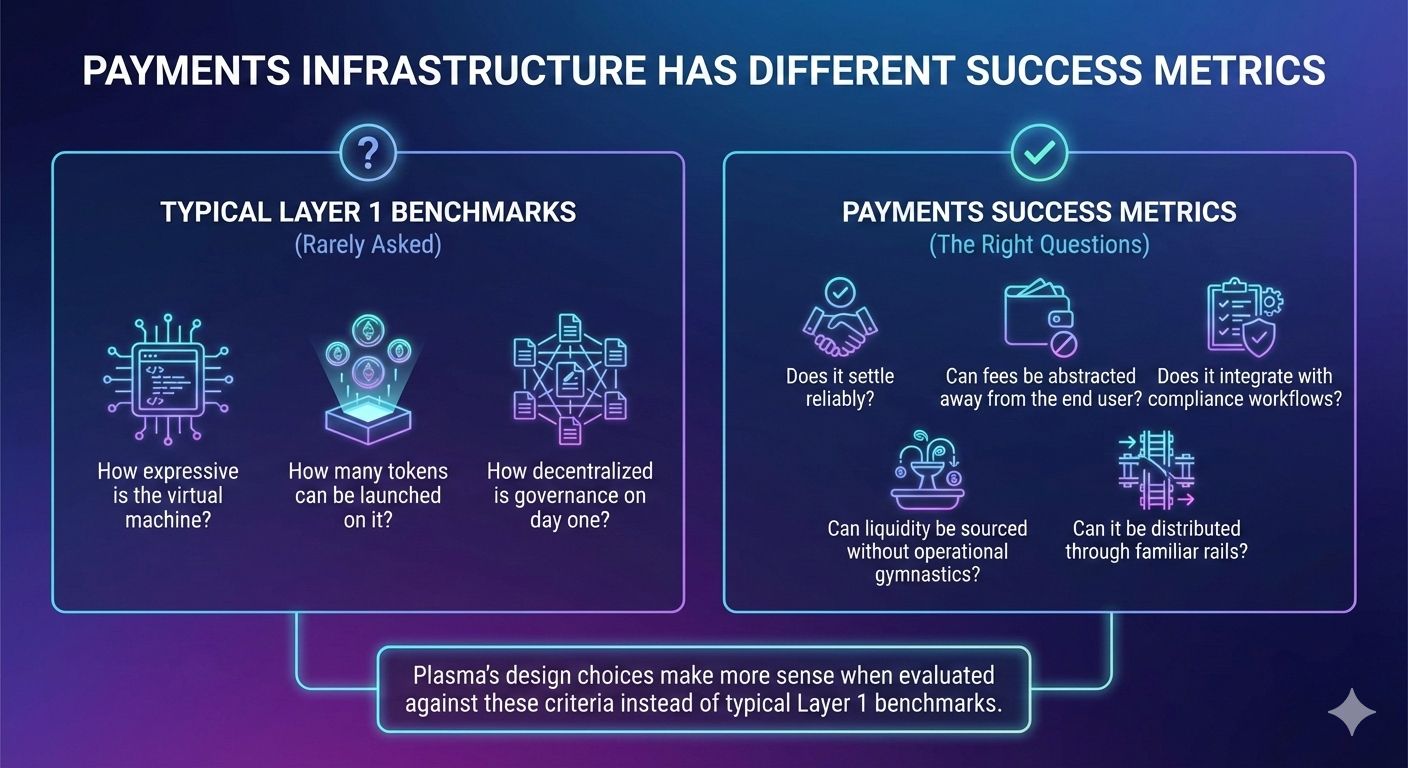

Payments Infrastructure Has Different Success Metrics

Payment professionals rarely ask:

How expressive is the virtual machine?

How many tokens can be launched on it?

How decentralized is governance on day one?

They ask:

Does it settle reliably?

Can fees be abstracted away from the end user?

Does it integrate with compliance workflows?

Can liquidity be sourced without operational gymnastics?

Can it be distributed through familiar rails?

Plasma’s design choices make more sense when evaluated against these criteria instead of typical Layer 1 benchmarks.

Stablecoins as the Core Product, Not a Use Case

On most blockchains, stablecoins are applications. On Plasma, they are the product.

This distinction matters. A general-purpose chain must remain neutral across thousands of use cases, which leads to trade-offs in fee markets, execution ordering, and UX. Plasma, by contrast, treats stablecoin transfer as the dominant—and often exclusive—transaction type. That focus enables tighter control over the entire transaction lifecycle.

For payments, predictability is more valuable than flexibility. Stablecoin issuers, PSPs, and merchants care less about on-chain innovation and more about whether balances move correctly, cheaply, and in compliance with regulations.

By constraining scope, Plasma can optimize for:

Deterministic transaction behavior

Fee structures aligned with payments, not speculation

Operational simplicity for integrators

This is not ideological minimalism; it is commercial pragmatism.

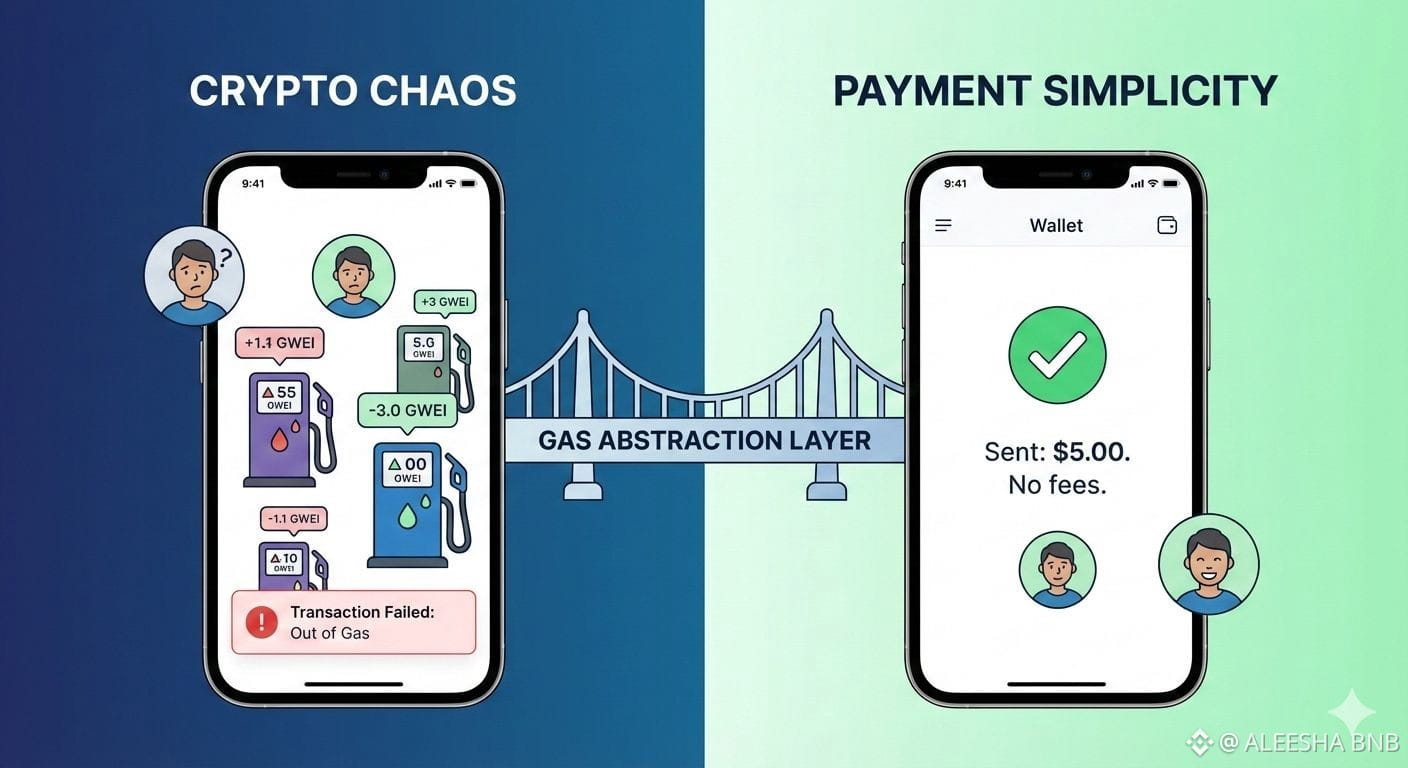

Gasless Transfers Are Not a Feature—They Are Table Stakes

In payments, asking users to manage gas is equivalent to asking cardholders to manage interchange. It is an implementation detail that should never surface.

Plasma’s emphasis on gasless or fee-abstracted transfers aligns it more closely with modern payment systems than with crypto networks. Someone—typically the platform, merchant, or issuer—absorbs and prices the cost of settlement upstream.

This enables:

Clear pricing for end users

Cleaner reconciliation for businesses

Fewer transaction failures caused by fee mismanagement

Gas abstraction also allows Plasma-based flows to resemble familiar experiences: wallets that “just send,” apps that show final amounts, and merchants that receive predictable settlements. This is boring by crypto standards—and essential by payments standards.

UX Is the Product

In traditional fintech, infrastructure that leaks complexity upstream does not scale. Plasma’s design appears to accept this reality.

A payments-oriented chain must support:

Stable addresses or identifiers

Fast confirmation semantics that feel final

Error handling that maps cleanly to user actions

Integration with custody, recovery, and compliance systems

None of these are glamorous. They are, however, what make payment products usable outside of crypto-native circles.

The absence of complex smart contract interactions also reduces UX risk. Fewer edge cases mean fewer support tickets, fewer failed payments, and fewer compliance escalations.

Compliance Is an Architectural Constraint, Not an Afterthought

Many Layer 1s treat compliance as something to be handled “at the edge” by applications. Payments infrastructure does not have that luxury.

Stablecoin flows intersect with:

Issuer controls (minting, burning, freezing)

Jurisdictional regulations

AML and sanctions screening

Reporting and audit requirements

Plasma’s value proposition is not that it eliminates these constraints, but that it accepts them as design inputs. For payment companies, this is not a compromise—it is a prerequisite.

A compliant-by-design rail reduces the need for brittle middleware and custom controls. It also makes it easier for regulated entities to participate without reinventing their risk stack.

Liquidity Is Operational, Not Speculative

In trading-oriented ecosystems, liquidity is measured by TVL, yield, and incentives. In payments, liquidity is about availability and redemption.

A stablecoin payments rail must ensure:

Reliable on- and off-ramps

Consistent settlement liquidity

Minimal slippage and fragmentation

Clear issuer backing and redemption paths

Plasma’s focus on stablecoins naturally centers liquidity around these operational needs rather than speculative DeFi constructs. That may limit upside narratives, but it significantly improves reliability.

For a merchant or PSP, the question is not “What is the APY?” but “Can I always convert this balance when I need to?”

Distribution Matters More Than Decentralization Theater

The hardest problem in payments is not technology—it is distribution.

Card networks succeeded not because of elegant protocols, but because they embedded themselves into banks, merchants, terminals, and consumer habits. Any stablecoin rail that ignores this lesson is unlikely to escape niche usage.

Plasma’s orientation toward integration with wallets, issuers, and payment providers suggests a recognition that adoption flows through institutions, not around them. This may frustrate decentralization purists, but it aligns with how money actually moves at scale.

Not a Layer 1, but a Settlement Utility

Calling Plasma a Layer 1 invites comparisons it does not need to win. It does not need to outperform general-purpose chains on developer flexibility or ecosystem breadth. It needs to be:

Reliable

Cheap

Predictable

Integrable

Regulatorily legible

In other words, it needs to function like payments infrastructure.

Why Stablecoin Rails Must Become Boring

The endgame for stablecoins is not excitement—it is invisibility.

When stablecoin rails succeed, users will stop talking about them. Transfers will feel like database updates. Fees will be bundled, compliance will be silent, and failures will be rare. The technology will recede behind products people already trust.

Plasma’s significance lies not in novelty, but in restraint. By optimizing for stablecoin payments rather than maximal expressiveness, it points toward a future where crypto infrastructure finally behaves like financial infrastructure.

And in payments, boring is not a failure mode—it is the goal.