I used to believe “fast” was everything in crypto. Faster blocks, faster finality, faster dashboards — the usual race. But the more I’ve watched stablecoin payments being used in real life, the more one uncomfortable truth stands out:

payments don’t fail because a system is slow once — they fail because the system behaves differently at the worst possible moment.

And that’s exactly why Plasma keeps catching my attention.

Speed Isn’t the Real Metric — Consistency Is

If you’ve ever sent a payment that actually mattered — salary, merchant settlement, family remittance, a deadline-driven invoice — you already know this. In that moment, you don’t care about “10,000 TPS in perfect conditions.” You care about boring reliability.

Will it work the same way at 2pm and 2am?

On weekends?

During volatility?

When everyone else is rushing to move funds?

Most chains love to market their best day. Payments punish you for your worst day.

Plasma feels like it’s designed around that reality. It’s not trying to win benchmarks — it’s trying to disappear into the background and just behave.

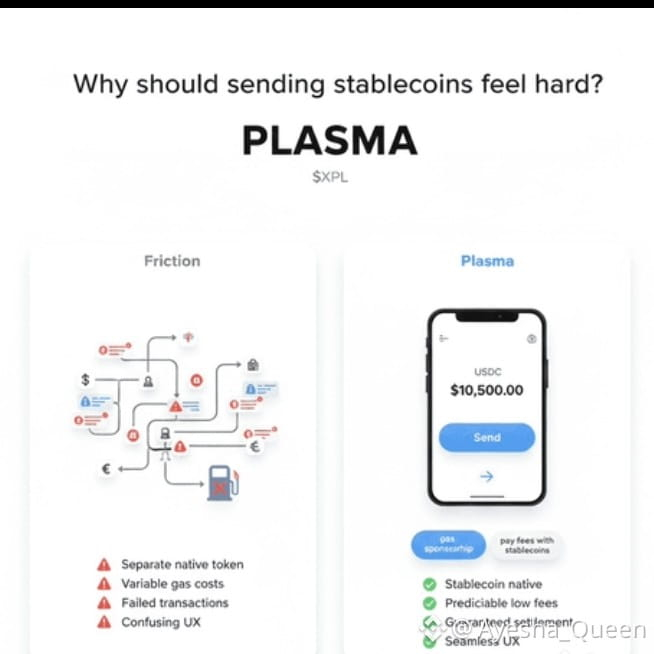

Why Stablecoins Expose Weak Infrastructure So Fast

Stablecoins aren’t a narrative anymore. They’re already how people actually move value on-chain. And once value is stable, expectations change. If the money doesn’t move, users blame the rail.

This is where many “fast” chains quietly break down. Fees are cheap… until they’re not. Confirmations are smooth… until congestion hits. Priority ordering turns into an auction at the worst time. Traders might tolerate that. Businesses don’t.

Plasma seems to be chasing a different promise: stablecoins should move like money, not like a crypto side-quest.

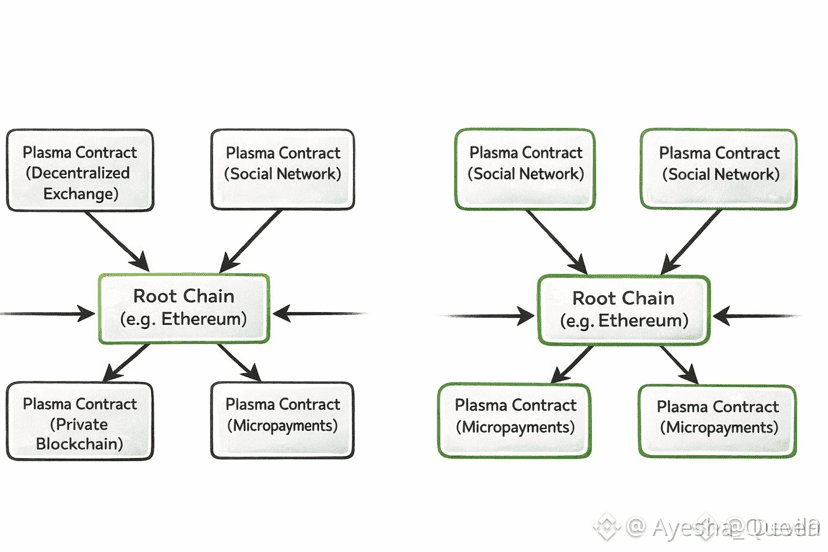

Focus as a Design Choice, Not a Limitation

What stands out is that Plasma doesn’t try to be everything. It’s not shouting, “Build every kind of app here.” It’s saying something much narrower and more disciplined: we’re optimizing stablecoin settlement first.

That’s a big deal, because stablecoin transfers are the most frequent, most sensitive, and most trust-dependent action in crypto. If you get that right, everything else becomes easier — payroll, subscriptions, merchant payments, cross-border settlement.

That kind of focus forces discipline. And discipline is rare in this space.

Zero-Fee Transfers Aren’t Marketing — They’re a Constraint

Gasless stablecoin transfers sound like a headline feature, but I see them as a self-imposed restriction. Once you remove fees from the most common action, you can’t rely on congestion spikes as an escape valve. You can’t just say “the market decided.”

Instead, the system has to stay predictable even when demand gets messy.

Plasma is basically choosing predictability over profiting from chaos — and that’s a harder path than it looks.

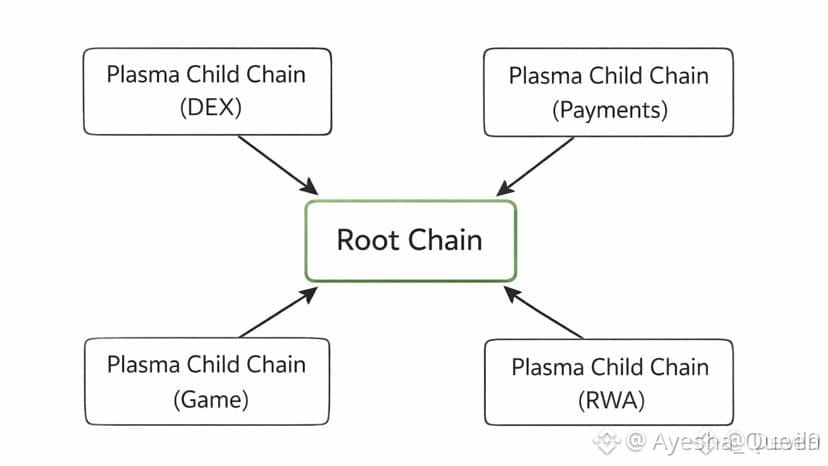

Why Payments and Speculation Shouldn’t Fight Each Other

This is the part crypto doesn’t like to say out loud: payments and speculation don’t belong on the same rails. A salary shouldn’t compete with leverage loops for blockspace. A merchant settlement shouldn’t get expensive because a meme coin is trending.

Plasma’s direction feels like it acknowledges that truth. Keep high-trust flows smooth, and don’t let hype cycles hold them hostage.

That kind of thinking doesn’t excite Twitter — but institutions and serious operators notice it, because operational unpredictability is where risk really starts.

Where $XPL Actually Makes Sense

I don’t buy into “token = number go up” stories. For Plasma, $XPL only matters if it works as coordination glue: aligning validators, securing uptime, and supporting an economy where stablecoin usage doesn’t punish users with friction.

If the network grows the way it’s intended, $XPL becomes tied to system health, not hype. If not, it stays a nice theory.

The Tradeoff Everyone Will Criticize

Yes, this approach sacrifices flexibility. You can’t monetize volatility as easily. You can’t treat every use case as equally important. You’re choosing sameness over creativity.

But that’s the point.

Payments don’t reward creativity. They reward trust. And trust is built by repetition without surprises.

What I Actually Watch (Not Price Charts)

When I look at a payments-first chain, I ignore the loud signals and watch the quiet ones:

Is usage becoming routine, not event-driven?

Do integrations feel normal, not crypto-native?

Does performance stay boring under stress?

Does the system feel easier over time, not harder?

If Plasma gets those right, everything else follows.

The Real Endgame: Invisibility

The best payment system is the one nobody brags about. It just works.

That’s what Plasma seems to be chasing — not hype, but quiet trust. And in a market obsessed with attention, a project choosing discipline over drama is exactly the kind of thing worth watching closely.