I pay attention to what survives boredom.

After enough market cycles, you stop asking which network grows fastest and start asking which one still works when attention moves on. That question became louder in 2024, especially as traders reassessed long-term sustainability across infrastructure projects like Plasma.

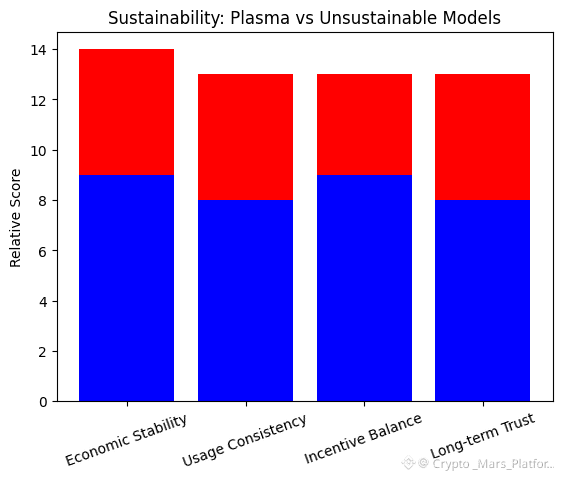

Sustainability in crypto isn’t a slogan. It’s economic behavior over time. It means a network can operate, secure itself, and attract participation without relying on constant incentives or narrative momentum. Plasma’s design seems aware of that reality. It doesn’t assume endless growth. It assumes repetition. Stable flows. Predictable use.

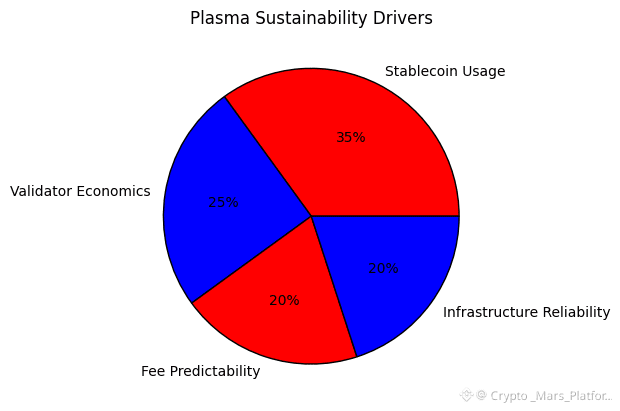

Let’s explain this simply. A sustainable network earns just enough to keep running well. Validators are compensated. Security costs are covered. Users aren’t subsidized into habits they won’t keep. Plasma’s stablecoin-first settlement model fits this logic. Real usage generates real demand. That demand supports the system quietly.

Why is this topic trending now? Because the market learned the cost of unsustainable economics. Between 2021 and 2023, many networks relied on high emissions and temporary rewards to attract users. When those incentives faded, activity vanished. By 2024, investors and traders became more cautious. They began tracking which networks functioned without constant stimulation.

Plasma positions itself differently. Its core workload revolves around stablecoin settlement, not speculative yield loops. Stablecoins dominated on-chain transfer volume again in 2024, with public data showing trillions in annual movement. This kind of usage is repetitive, not cyclical. That matters for sustainability. Repetition builds habits. Habits build demand that doesn’t depend on price excitement.

From a technical perspective, sustainability also means predictable costs. Plasma’s focus on fee predictability and gas abstraction reduces operational friction. Users aren’t surprised by changing conditions. Validators aren’t chasing volatile fee spikes. The system behaves more like infrastructure than an experiment.

Progress here hasn’t been loud. Throughout 2024, Plasma development emphasized refinement rather than expansion. Fewer pivots. Clearer assumptions. More attention to how the system behaves under normal conditions, not peak hype. That’s often how sustainable systems are built. They don’t announce maturity. They arrive there slowly.

There’s also a governance and incentive layer to sustainability. Plasma avoids extreme inflation to attract short-term participation. Instead, incentives appear tied to actual network usage and validator responsibility. This aligns cost with value. When incentives match behavior, systems last longer. When they don’t, systems churn.

From personal experience, I’ve learned that sustainable infrastructure feels uneventful. You don’t check it daily to see what changed. You assume it will work. In trading, that assumption is valuable. It reduces mental overhead. It lowers operational risk. Over time, those small advantages compound.

Philosophically, sustainability reflects restraint. It means accepting limits. Not every network needs to support every use case. Plasma seems comfortable narrowing its focus. Settlement reliability. Stable value movement. Predictable execution. By not chasing everything, it protects what it does well.

Why does this matter for investors? Because long-term value doesn’t come from constant reinvention. It comes from consistency. Sustainable networks survive market winters without emergency adjustments. They don’t depend on renewed narratives every quarter. They simply continue operating.

In 2024, as capital became more selective, sustainability quietly became a differentiator. Traders stopped asking which network promised the most features and started asking which one required the fewest assumptions. @Plasma ’s design choices suggest it aims to minimize assumptions rather than maximize ambition.

I’ve watched projects fail not because they lacked innovation, but because they couldn’t support themselves once attention faded. Sustainability isn’t about being exciting forever. It’s about being useful repeatedly. Plasma’s architecture appears aligned with that idea.

In the end, markets reward endurance. Cycles come and go. Narratives rise and fall. Infrastructure that survives those shifts earns trust slowly. Sustainability doesn’t trend. It accumulates.

That’s why I pay attention to systems built for normal days, not extraordinary ones. Plasma’s approach feels grounded in that mindset. And in crypto, grounded systems tend to outlast louder ones.