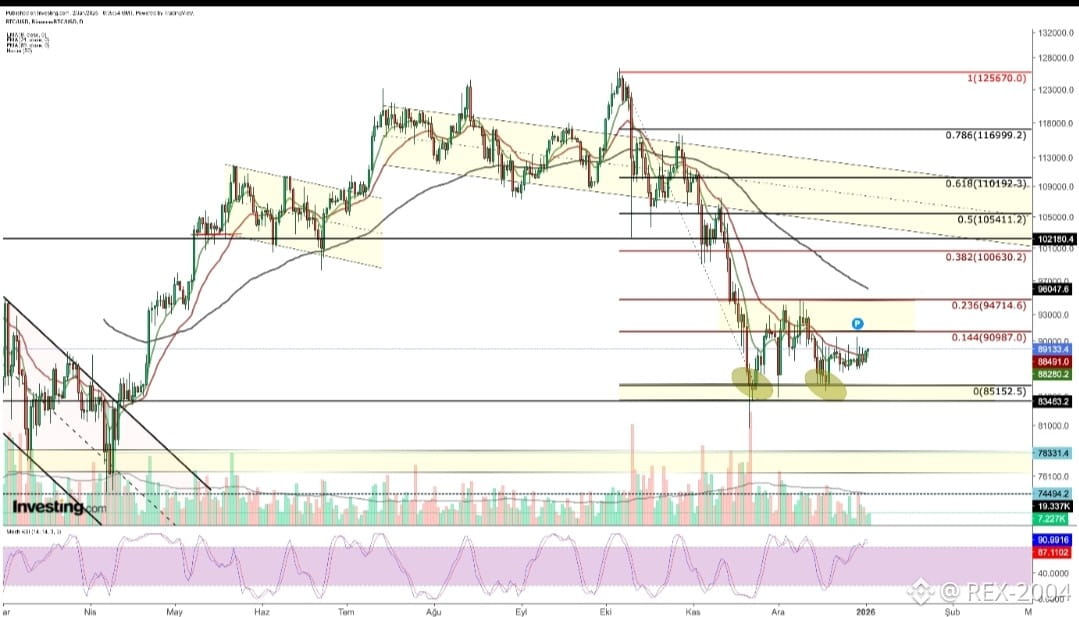

📊 $BTC Price & Market Sentiment (as of early Feb 2026)

Bitcoin has been trading lower recently, dipping below key levels around $75,000–$80,000 before attempting to recover. The market sentiment is cautious because of broader crypto sell‑offs and volatility. BTC is down from its 2025 peak and volatility remains high. �

Barron's +1

📉 Short‑Term Technical Analysis

Support Levels:

Around $87,000–$90,000 – charts show these as short‑term support zones.

If BTC breaks below major support, deeper pullbacks could occur. �

CoinCheckup

Resistance Levels:

Around $90,000–$95,000 is a key resistance zone — price needs to close above this to regain bullish momentum.

A stronger resistance zone historically is around $100,000+. �

CoinStats

Neutral Indicators:

RSI (momentum indicator) is neither strongly overbought nor oversold — this suggests sideways action and uncertainty in short‑term trend. �

CoinCheckup

🧠 Market Structure

Bitcoin is currently in a range‑bound or consolidation phase, where bulls and bears are balanced.

A clear breakout above resistance or breakdown below support would give a stronger trend signal.

📍 In technical trading, waiting for a confirmed breakout above resistance (with good volume) or a break below support often signals the next directional move.

📅 Medium‑to‑Long Term Views

Analysts’ longer‑term forecasts for Bitcoin vary:

Some see possible upside toward higher levels later in 2026 if institutional support and adoption continue.

Others warn that without macro catalysts and strong buying demand, BTC could stay range‑bound or correct further. �

Cointelegraph +1

📌 Summary (Easy Version)

BTC has been moving sideways or slightly down lately.

Important price zones:

Support ≈ $87k–$90k | Resistance ≈ $90k–$95k+.

A move above resistance could signal strength, while a break below support could lead to more downside.

Market is cautious with mixed signals.

#StrategyBTCPurchase #BitcoinETFWatch