After following institutional interest in blockchain over the past few years, one pattern has become increasingly obvious to me: adoption is no longer blocked by technology but by risk. Institutions don’t hesitate because blockchains are slow or expensive. They hesitate because public, fully transparent systems break the way financial risk is traditionally measured and managed.

In traditional finance, information asymmetry is not a flaw it’s a feature. Trading strategies, balance sheet movements, liquidity positions and exposure levels are protected for a reason. When everything becomes fully transparent on a public ledger, institutions are forced into a risk environment they were never designed to operate in.

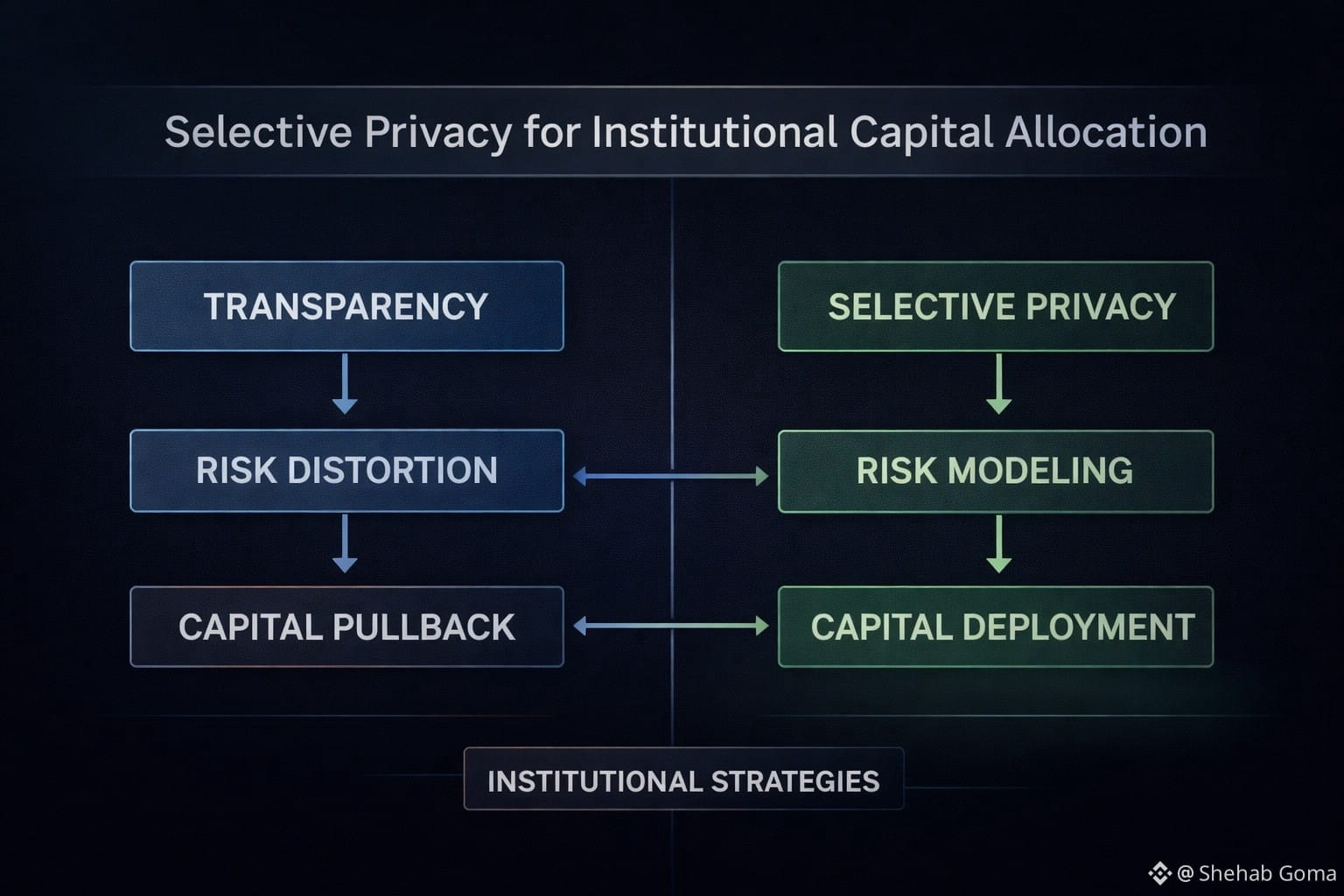

This is where selective privacy begins to matter.

Transparency Changes Risk Not Always for the Better

On fully transparent blockchains, every transaction is visible in real time. While this may sound ideal from a retail perspective, it introduces structural risk for institutional participants. Front-running, strategy leakage, signaling risk and forced exposure disclosure all distort how institutions assess downside and allocate capital.

In effect, transparency reshapes risk models in ways that make conservative capital behave defensively. When strategies can be reverse-engineered and positions tracked, institutions compensate by limiting exposure or staying out entirely.

From my perspective, this is one of the most under-discussed reasons institutional capital moves slowly on-chain.

Selective Privacy as a Risk Management Tool

Selective privacy changes the equation. Instead of hiding everything or exposing everything, it allows sensitive financial information to remain confidential while still enabling verification, auditability and compliance when required.

This matters because institutional risk models depend on predictability. When counterparties can protect strategic information without violating regulatory requirements, capital allocation becomes more rational. Risk premiums shrink. Exposure limits expand. Participation becomes sustainable rather than experimental.

In other words, selective privacy doesn’t reduce transparency it controls when and how transparency is applied.

Capital Allocation Follows Risk Clarity

Capital does not flow toward innovation alone. It flows toward environments where risk can be priced accurately. When institutions can model downside scenarios without worrying about adversarial visibility, they are more willing to commit capital long term.

This is especially relevant for tokenized real-world assets, compliant DeFi and regulated financial instruments. These markets require confidentiality at the strategy level and transparency at the regulatory level a balance that traditional public blockchains struggle to achieve.

Infrastructure designed with selective privacy in mind changes how institutions evaluate opportunity cost. Instead of treating blockchain exposure as speculative, it becomes allocatable alongside traditional asset classes.

Why This Shifts the Future of On-Chain Finance

From what I’ve observed, the next phase of blockchain adoption won’t be driven by retail excitement or technical breakthroughs. It will be driven by whether institutions can deploy capital without rewriting their entire risk framework.

This is where privacy-by-design financial infrastructure, such as that developed by Dusk Foundation, fits naturally into the broader evolution of on-chain finance. Not as a selling point but as a structural requirement for regulated markets.

The Bigger Takeaway

Public transparency helped bootstrap crypto. But institutional finance operates on different assumptions. If blockchains want to support meaningful capital allocation at scale, they must adapt to how risk is actually managed in the real world.

Selective privacy doesn’t hide risk it makes institutional risk measurable again. And capital only flows where risk can be understood.