Most financial systems survive on memory.

A permission granted once gets reused indefinitely.

A role assigned years ago still passes checks today.

A balance that cleared yesterday is assumed safe to move again tomorrow.

Nothing about that feels fragile—until scale arrives.

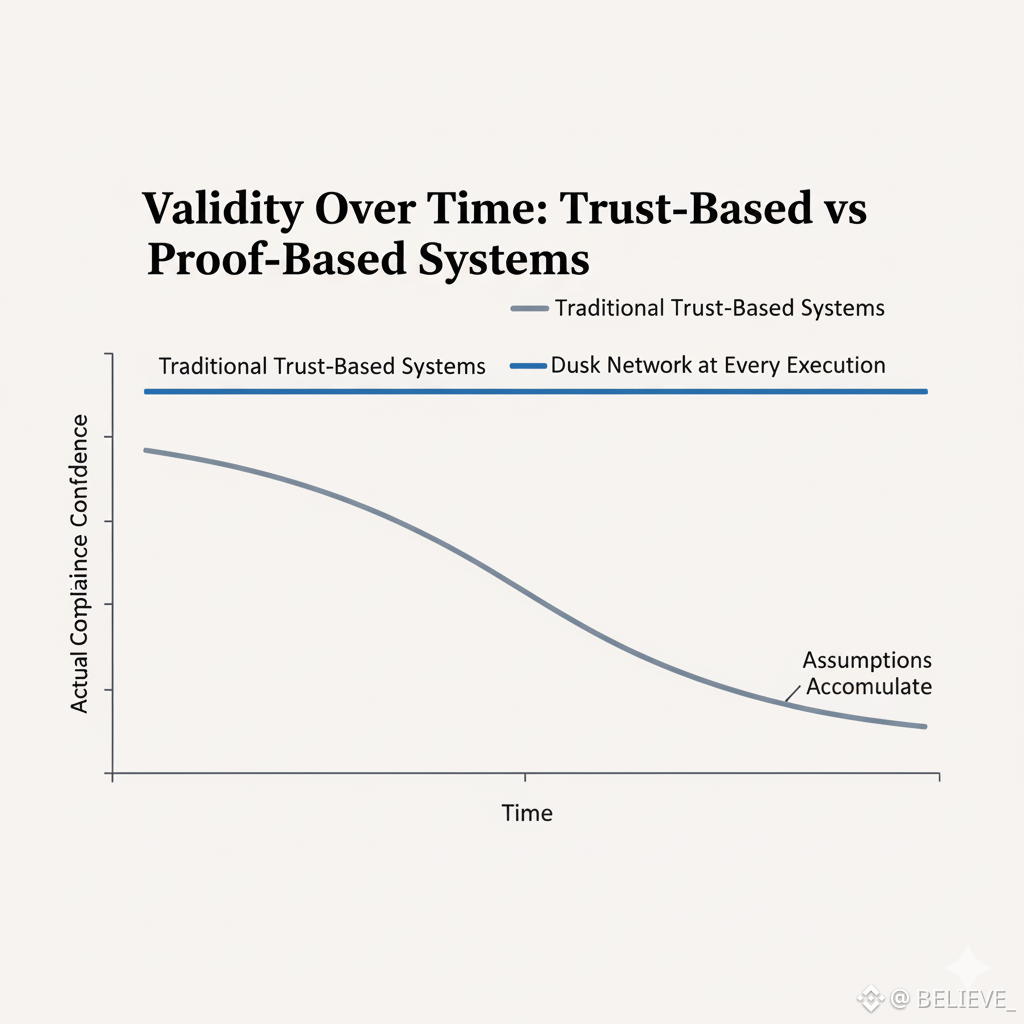

What Dusk does differently is almost uncomfortable in how little it relies on memory. It doesn’t care what cleared last week. It doesn’t inherit confidence from earlier approvals. Every meaningful state transition is treated as a fresh question, asked again, in the moment, with no shortcuts. That design choice sounds minor. In practice, it changes who can safely use the system.

On Dusk Network, progress is not something that accumulates. It’s something that must be continuously justified.

This matters because the real world doesn’t fail loudly. It fails quietly, through assumptions that stop being checked. In traditional finance, compliance breaches rarely happen because someone intentionally breaks a rule. They happen because a rule was followed once, then carried forward out of habit. A spreadsheet keeps clearing. An internal control never re-triggers. The system keeps moving because nothing explicitly says stop.

Dusk is built to say stop—without drama.

A transfer that doesn’t advance on Dusk doesn’t throw an exception. There’s no red banner. No exploit headline. The system simply refuses to move state forward if the proof presented no longer satisfies the rules right now. That refusal is invisible unless you’re watching closely. But it’s precisely what regulated environments need.

The core insight is that compliance is temporal. Approval is not a permanent property. Identity is not a static attribute. Eligibility decays unless it’s re-established. Dusk encodes this idea at the protocol level rather than outsourcing it to off-chain governance or manual audits.

This is where zero-knowledge stops being a privacy feature and becomes a control mechanism.

Instead of exposing transaction details and hoping oversight catches problems later, Dusk requires participants to prove—cryptographically—that conditions are met at the moment of execution. The network doesn’t know who you are in human terms. It knows whether the statement you submitted is valid under the current ruleset. That separation is subtle but critical. It allows privacy to coexist with enforcement without turning either into theater.

The result is a system that doesn’t accumulate technical debt in the form of outdated permissions. If something is no longer allowed, it simply doesn’t happen. No rollback required. No retroactive fixes. No narrative damage control.

Consensus follows the same philosophy.

Many chains optimize for responsiveness under stress. Dusk optimizes for correctness under repetition. Blocks don’t just land quickly; they land conclusively. Once finalized, a decision doesn’t linger as a probability. It becomes history. That kind of finality feels boring—until you’re settling assets that regulators expect to be final, not “final unless conditions change.”

This is why Dusk’s consensus cadence feels conservative compared to hype-driven networks. It’s not designed for spectacle. It’s designed for environments where a delayed confirmation is preferable to a reversible one.

The implications for real-world assets are obvious once you stop looking at RWA as a narrative and start treating it as operations.

Institutions don’t need chains that are expressive. They need chains that are predictable. They don’t need optional privacy. They need guaranteed confidentiality paired with provable compliance. And they don’t need systems that trust them implicitly. They need systems that check them consistently—without public exposure.

Dusk’s architecture reflects an uncomfortable truth: most financial failures come from trust being extended longer than it should have been. By removing the concept of “grandfathered” validity, Dusk forces systems to behave like auditors that never sleep.

This also changes participant behavior. When every action must be re-proven, laziness disappears. Roles aren’t ceremonial. Committee participation isn’t symbolic. Reliability becomes visible—not socially, but mathematically. The network doesn’t remember intentions. It remembers outcomes.

That persistence is what makes the system feel heavy to casual users and reassuring to serious ones.

There are tradeoffs. Systems like this don’t forgive misconfiguration. They don’t smooth over operational gaps. If your setup drifts, the chain doesn’t compensate. It waits. That’s uncomfortable in ecosystems used to soft failures and flexible interpretations.

But finance doesn’t reward flexibility. It rewards systems that fail safely.

Dusk isn’t trying to replace existing financial rails overnight. It’s doing something more patient. It’s building a settlement layer that behaves the way institutions already expect systems to behave—without requiring them to surrender privacy or decentralization to get there.

Nothing about this approach will trend easily. There are no dramatic metrics to screenshot. No viral spikes. Just a network that keeps asking the same question, over and over again:

Is this still valid now?

If the future of Web3 is less about spectacle and more about endurance, that question may end up being the most valuable feature of all.