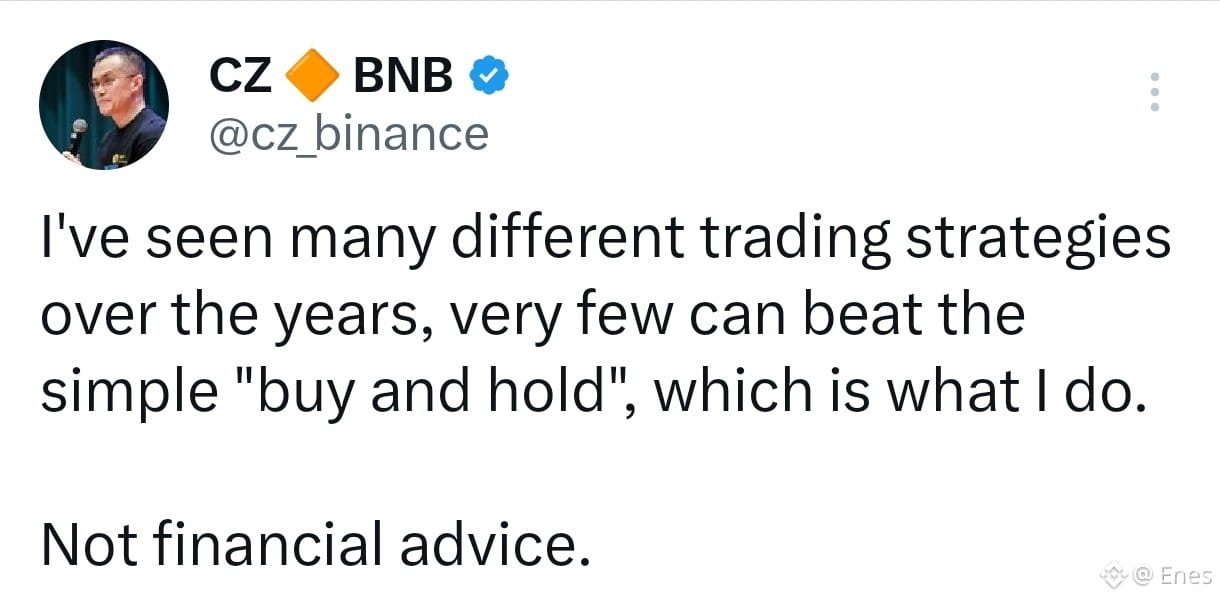

This philosophy isn’t unique to long-term investors — it’s also been consistently echoed by Changpeng Zhao (CZ), the former CEO of Binance.

Over the years, CZ has repeatedly emphasized that:

Most traders underperform because they overtrade

Emotional decisions destroy long-term returns

Holding quality assets through volatility beats chasing short-term moves

His core advice has remained unchanged across bull and bear markets:

“If you can’t hold, you won’t be rich.”

According to CZ, the biggest mistake investors make isn’t buying the wrong asset — it’s selling too early. Markets reward patience, discipline, and the ability to sit through drawdowns without panic.

In a space obsessed with constant action, doing nothing is often the most profitable strategy.

Not financial advice.