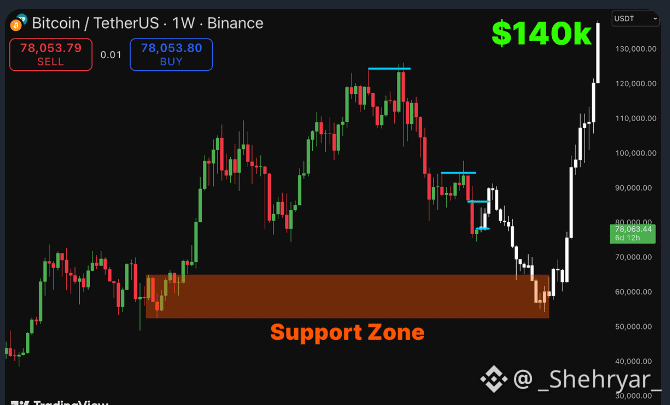

Bitcoin is approaching a decisive inflection point where volatility is not a threat — it’s a signal.

📈 Near-term:

Price action suggests a technical relief bounce toward the $83K region, driven by liquidity resting above current levels. This move should be treated as a structural reaction, not confirmation of trend continuation.

📉 Next phase:

Following that bounce, BTC is likely to enter a controlled corrective rotation into the $65K–$55K zone. This range historically acts as: • a leverage reset

• an emotional capitulation zone

• a strategic accumulation window

These conditions are typically required before any sustainable expansion can begin.

🧱 Key phase to watch:

A post-correction consolidation, likely lasting ~2 weeks, where volatility compresses and control quietly shifts back to stronger hands. This is where structure is rebuilt — not where headlines are made.

🚀 Expansion thesis:

If this cycle continues to rhyme with prior market behavior, a move toward $140K BTC transitions from speculation into a realistic upside scenario once accumulation is complete.

Short-term drawdowns test patience, not conviction.

Stay disciplined. Manage risk. Let the market do the heavy lifting.

📌 Bookmark this. Revisit it in August.

Clarity always follows volatility.

#BTC #BitcoinAnalysis #MarketStructure #RiskManagement #CryptoMacro