Bitcoin, often hailed as "digital gold," has captivated the financial world with its meteoric rises and dramatic, albeit temporary, dips. These fluctuations aren't random; they often follow discernible patterns known as Bitcoin cycles. Understanding these cycles is key to appreciating Bitcoin's unique market dynamics.

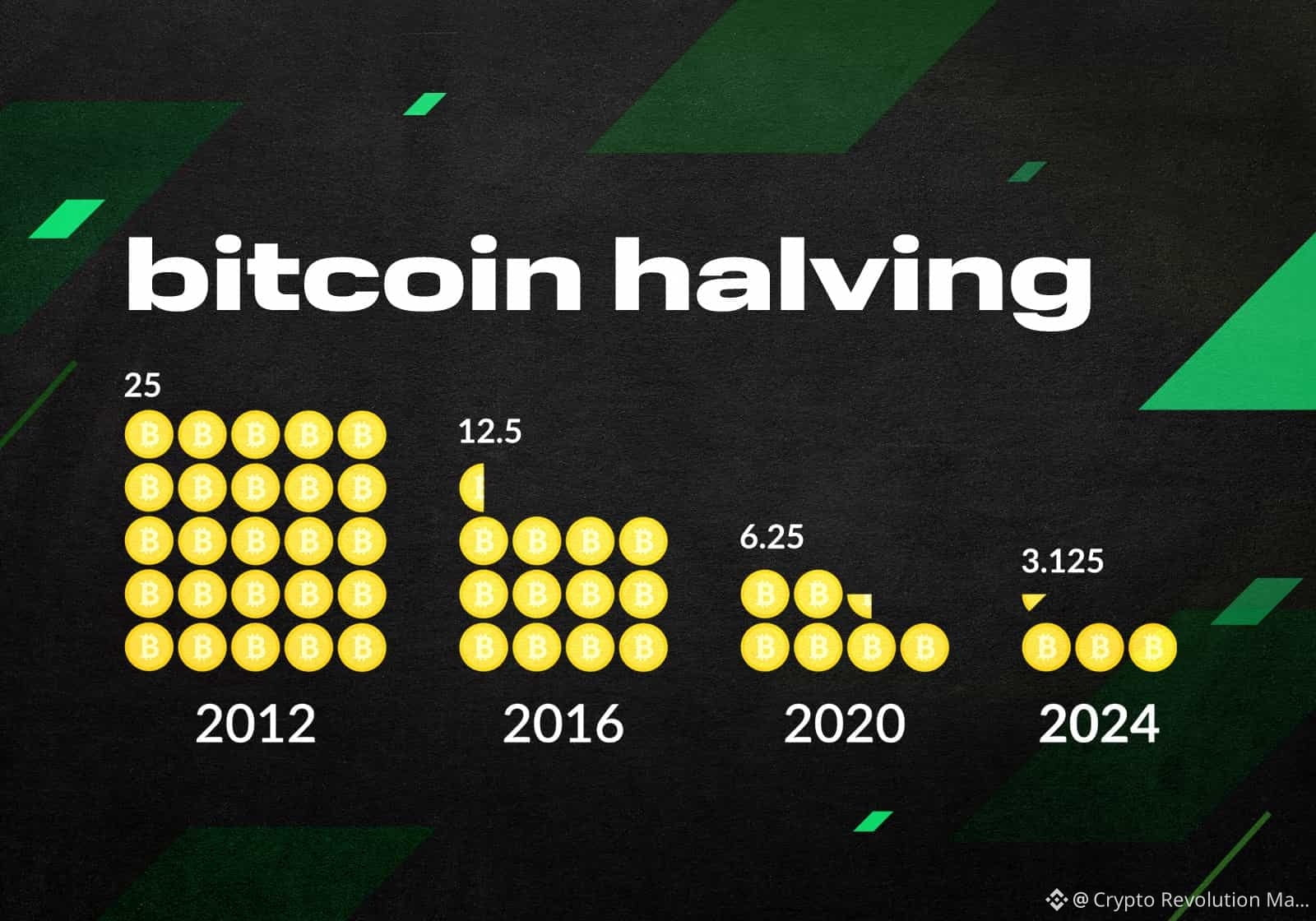

At the heart of Bitcoin's cyclical nature lies its ingenious design: scarcity. Unlike traditional currencies that can be printed at will, Bitcoin has a hard cap of 21 million coins. More importantly, the rate at which new Bitcoins are introduced into the system is halved approximately every four years. This event, known as the "halving," is a major catalyst for cycle formation.

The Halving and its Ripple Effect

Imagine a gold mine where, every four years, the amount of gold discovered is suddenly cut in half. That's essentially what a Bitcoin halving does. When the reward for mining a block of Bitcoin is reduced, the supply of new Bitcoins entering the market shrinks. Historically, this reduction in supply, while demand remains constant or increases, has been a powerful upward pressure on Bitcoin's price.

Phase 1: The Pre-Halving Accumulation

Leading up to a halving event, there's often a period of anticipation and accumulation. Savvy investors and institutions, understanding the historical significance of the halving, begin to increase their holdings. This quiet accumulation can slowly push the price upwards, setting the stage for what's to come.

Phase 2: The Post-Halving Bull Run

This is typically the most exciting phase. After the halving, the reduced supply begins to truly impact the market. As demand continues or grows, the price of Bitcoin starts to accelerate, often reaching new all-time highs. This period is characterized by increased media attention, growing public interest, and a sense of euphoria. Early adopters see significant gains, and new investors are drawn in by the promise of quick returns.

Phase 3: The Bear Market and Correction

What goes up must eventually come down, at least temporarily. After a significant bull run, a correction is inevitable. This period, often called a "bear market," sees prices decline substantially from their peak. This can be a painful time for those who bought at the top, leading to fear and capitulation. However, for long-term investors, bear markets can represent excellent opportunities to acquire Bitcoin at a discount. It's during these times that the weaker hands are shaken out, and the true believers often strengthen their positions.

Beyond the Halving: Other Influencers

While the halving is a dominant force, other factors also play a role in shaping Bitcoin cycles. Macroeconomic conditions, regulatory news, technological advancements, and shifts in public sentiment can all influence price movements. Institutional adoption, for example, has become an increasingly significant driver in recent cycles, bringing more capital and legitimacy to the asset class.

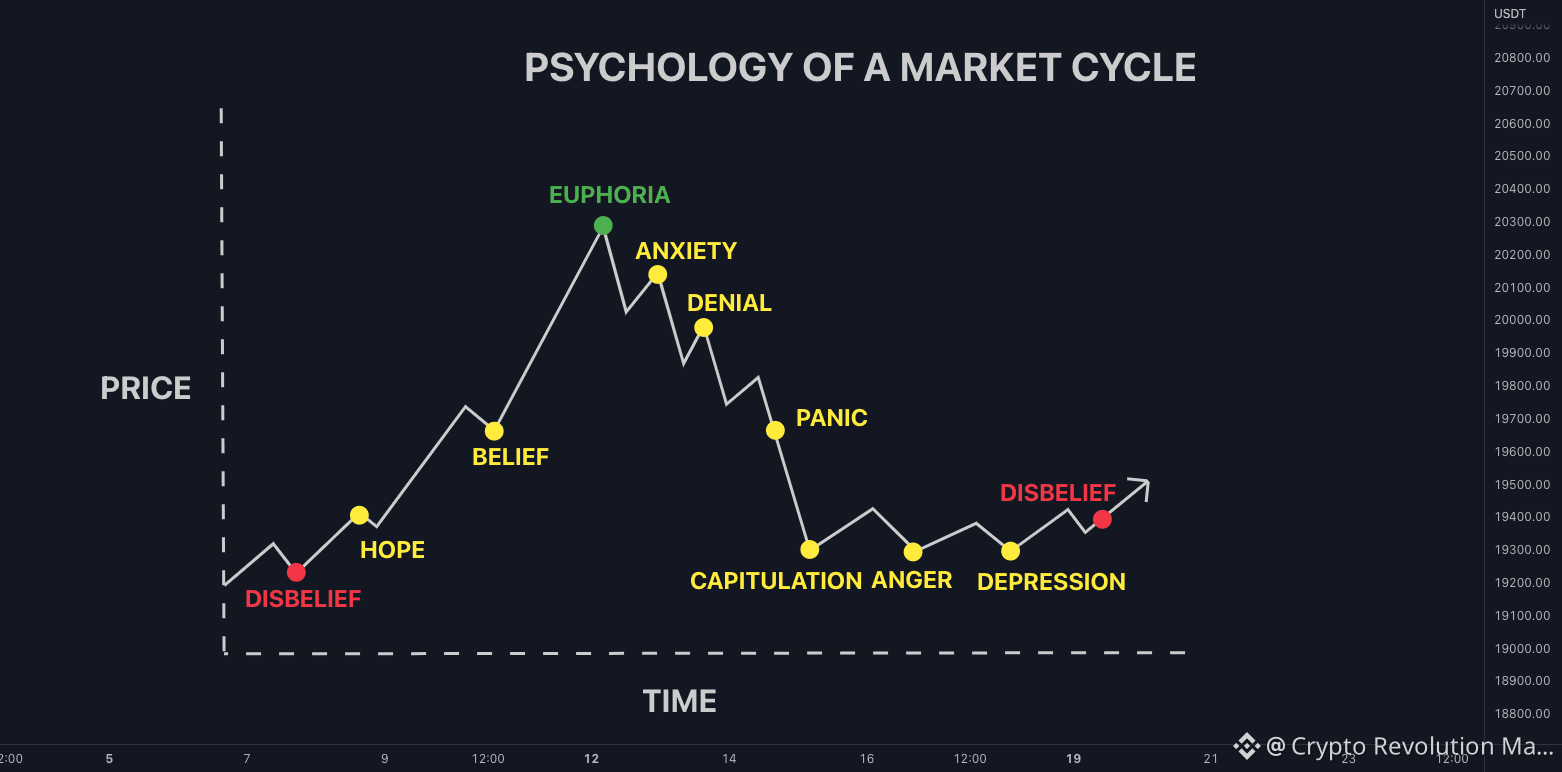

The Psychology of the Market

Human psychology is deeply intertwined with these cycles. The "Fear of Missing Out" (FOMO) often fuels the latter stages of a bull run, as people rush to buy in hopes of quick gains. Conversely, fear and panic can exacerbate bear market declines. Understanding these emotional extremes can help investors make more rational decisions, recognizing that market cycles are a natural part of Bitcoin's journey.

Looking Ahead

Bitcoin cycles are a testament to the interplay of scarcity, technology, and human behavior. While past performance is never a guarantee of future results, the historical patterns provide valuable insights into Bitcoin's unique market dynamics. As Bitcoin continues to mature and gain wider acceptance, its cycles may evolve, but the fundamental principles of supply and demand, driven by its inherent scarcity, are likely to remain foundational to its long-term trajectory.