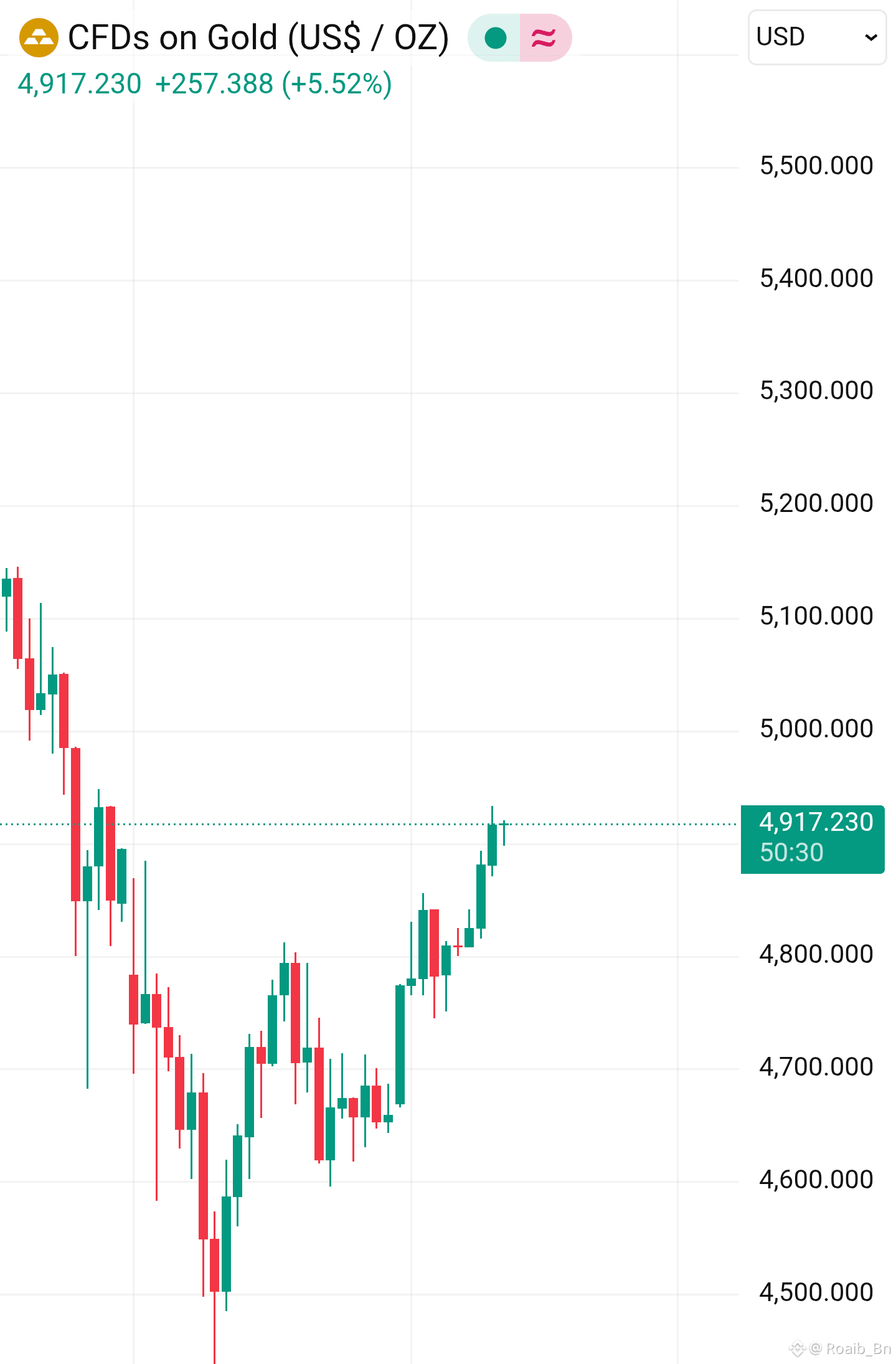

Gold and silver have swung violently in recent days, moving from historic sell offs to sharp rebounds that caught traders off guard. After one of the most aggressive corrections in decades, precious metals are attempting to stabilize and reclaim key levels.

Earlier this week, gold fell close to 9 percent in a single session, marking its steepest daily decline in more than forty years. Silver was hit even harder, dropping roughly 30 percent from recent highs as leverage unwound and margin calls forced liquidation across futures markets.

That kind of move doesn’t reflect a collapse in physical demand. It reflects stress in a paper driven market.

After the sell off, buyers stepped back in.

Gold rebounded more than 3 percent, trading back near the 4,800 dollar per ounce zone as dip buyers and short covering provided support.

Silver bounced strongly as well,

climbing around 5 to 6 percent and recovering into the 83 to 85 dollar per ounce range after briefly breaking below key support.

In regional markets, the rebound was just as visible. In India, silver futures reclaimed the 2.5 lakh rupees per kilogram level after three consecutive down sessions, while gold gained over 3 percent as value buyers returned.

So what is driving this rebound?

First, oversold conditions triggered aggressive value buying. Many traders who avoided the crash saw prices as temporarily disconnected from fundamentals and stepped in.

Second, short covering played a major role. As prices stabilized, traders who had positioned for further downside were forced to close positions, adding upward pressure.

Third, long term bullish narratives remain intact. Central bank gold accumulation has not slowed materially, and institutional forecasts still point to significantly higher prices over the medium term. Some major banks continue to project gold prices in the 6,000 to 6,300 dollar range by the end of 2026, while silver remains supported by industrial and investment demand despite its extreme volatility.

The key takeaway is this.

The crash was driven by leverage and forced selling, not a collapse in real world demand. The rebound confirms that buyers were waiting below the market, ready to absorb panic driven supply.

That does not guarantee a straight move higher from here. Volatility is still elevated, and both metals need to hold reclaimed support levels to confirm a sustained trend reversal.

But one thing is clear.

Gold and silver did not break because their long term role disappeared. They corrected because positioning became overcrowded. What we are seeing now is a classic reset.

Markets do not move to reward certainty. They move to punish excess.

Follow for more gold and silver market breakdowns, real price analysis, and macro driven insights.

Like, comment, and share to support quality market content on Binance Square.

#GoldSilverRebound #VitalikSells #StrategyBTCPurchase #AISocialNetworkMoltbook #USCryptoMarketStructureBill