Plasma ko samajhne ke liye pehle yeh samajhna zaroori hai ke crypto mein “fast” ka matlab aksar ghalat liya jata hai. Zyada tar blockchains speed ko sirf TPS, benchmarks aur charts ke zariye bechte hain. Lekin jab baat real paisay ki ho — salary transfers, merchant payments, ya stablecoin settlements — wahan speed se zyada reliability aur finality matter karti hai. Plasma isi gap ko fill karne ki koshish karta hai.

Plasma ek EVM-compatible Layer 1 hai, lekin iska focus sirf DeFi experiments ya flashy numbers nahi hain. Yeh chain asal mein stablecoin-native finance ke liye design ki ja rahi hai. Matlab yahan stablecoins koi side asset nahi, balkay core use case hain. Aur jab stablecoins core ho jayein, to sab se pehla sawal yeh hota hai: “Transaction final kab hoti hai?”

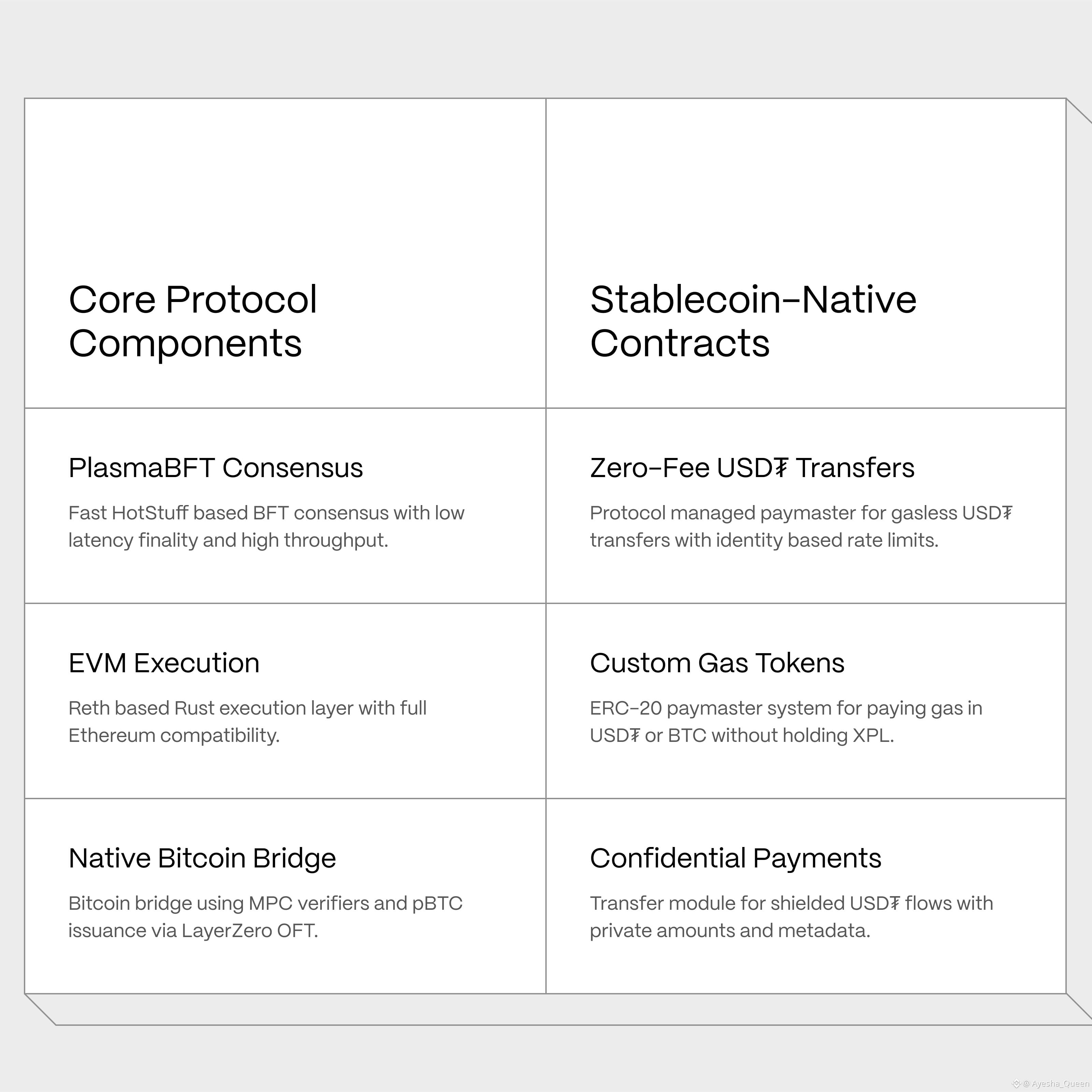

Isi jagah Plasma ka architecture interesting ho jata hai. Plasma Reth-based EVM client use karta hai, jo Ethereum ke saath compatibility ensure karta hai. Iska matlab developers apne existing Solidity contracts, tools aur workflows bina kisi headache ke deploy kar sakte hain. Koi naya ecosystem seekhne ki zarurat nahi, koi extra learning curve nahi. Yeh cheez developers ke liye bohat badi relief hoti hai, kyun ke time aur effort dono bach jate hain.

Lekin Plasma sirf compatibility pe nahi rukta. Yahan real differentiation PlasmaBFT consensus se aati hai. PlasmaBFT ka goal hai sub-second finality. Simple alfaaz mein: transaction bheji, aur almost foran confirm ho jati hai. Koi “wait and see” nahi, koi doubt nahi ke shayad block reorganize ho jaye. Payments ke liye yeh bohat critical hai, kyun ke business aur users dono ko certainty chahiye hoti hai.

Socho aap kisi ko USDT bhej rahe ho. Aap yeh nahi dekhna chahte ke “network busy hai” ya “fees spike ho gayi hain.” Aap sirf yeh chahte ho ke paisay foran pohanch jayein. Plasma ka stablecoin-first design isi expectation ko center mein rakhta hai. Fast finality, predictable execution aur consistent performance — yeh sab mil kar Plasma ko ek proper settlement layer banate hain.

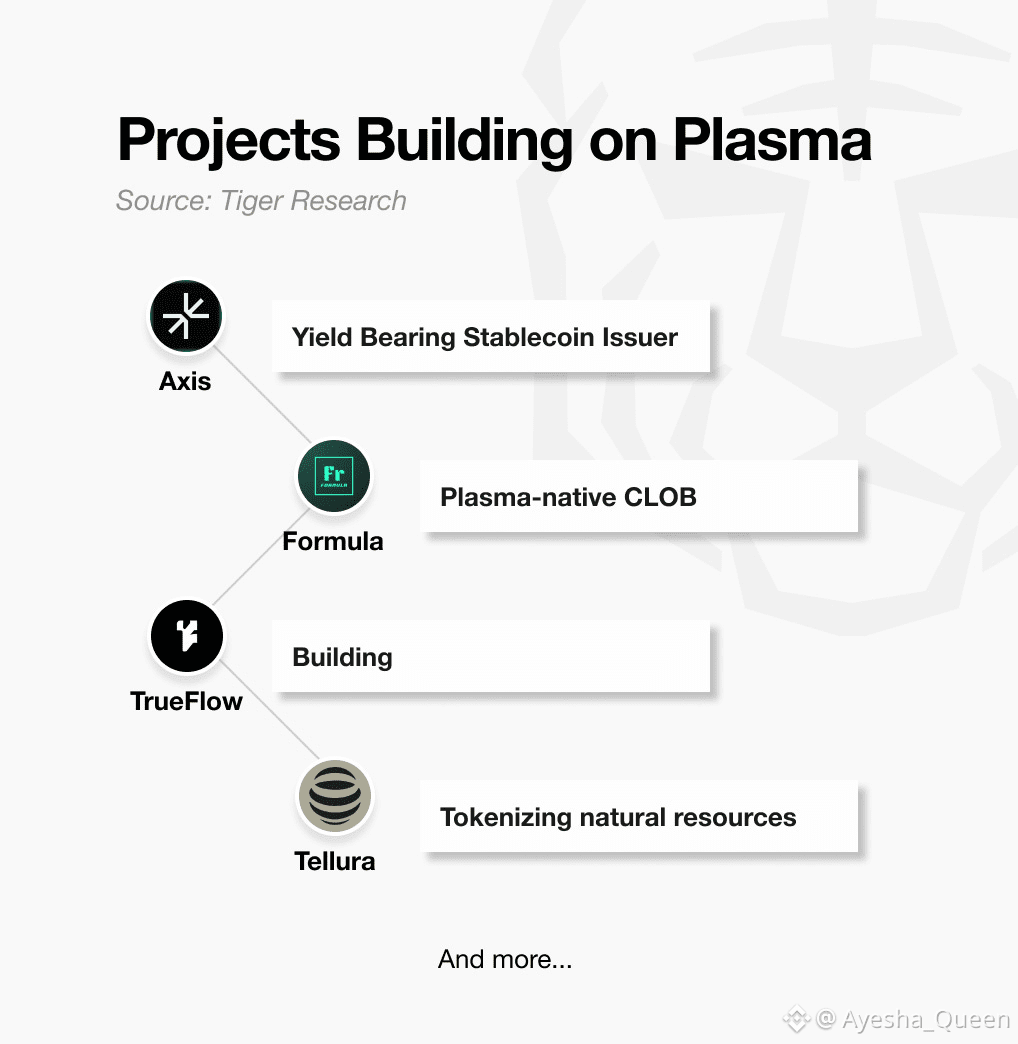

Yeh approach Plasma ko sirf ek aur smart contract platform banne se bachati hai. Yeh asal mein ek financial rail banne ki koshish hai. Jahan payments, treasury operations, cross-app liquidity aur even market-making jaisi cheezein bina friction ke chal sakti hain. Finance mein boring hona buri baat nahi hoti — balkay boring ka matlab hota hai reliable.

Jaise jaise crypto ecosystem mature ho raha hai, mujhe lagta hai ke sirf TPS race jeetna kaafi nahi hoga. Jo chains real world ke liye kaam karna chahti hain, unhein finality, reliability aur capital efficiency ko priority deni hogi. Plasma ka combination — EVM compatibility, sub-second finality aur stablecoin-centric design — isi direction ka signal deta hai.

Agar aap hype ke bajaye real usage, payments aur practical finance dekhte ho, to Plasma aur $XPL ecosystem ko seriously dekhna banta hai. Yeh chain shor machane ke bajaye quietly woh problems solve karne ki koshish kar rahi hai jo zyada tar log abhi define bhi nahi kar paaye.