When I first looked at Dusk Network, what stood out wasn’t what it was building, but what it was quietly refusing to build. This was during a cycle when every serious blockchain roadmap felt obligated to promise infinite DeFi composability, permissionless liquidity, and incentives stacked on top of incentives. Dusk was present in that era, funded, capable, technically fluent. And still, it stepped sideways.

That decision felt strange at the time. It still does, in a market that rewards speed and spectacle. But the longer I’ve watched how things unfolded, the more that early restraint feels intentional rather than cautious.

Most DeFi-first chains began with a simple belief.

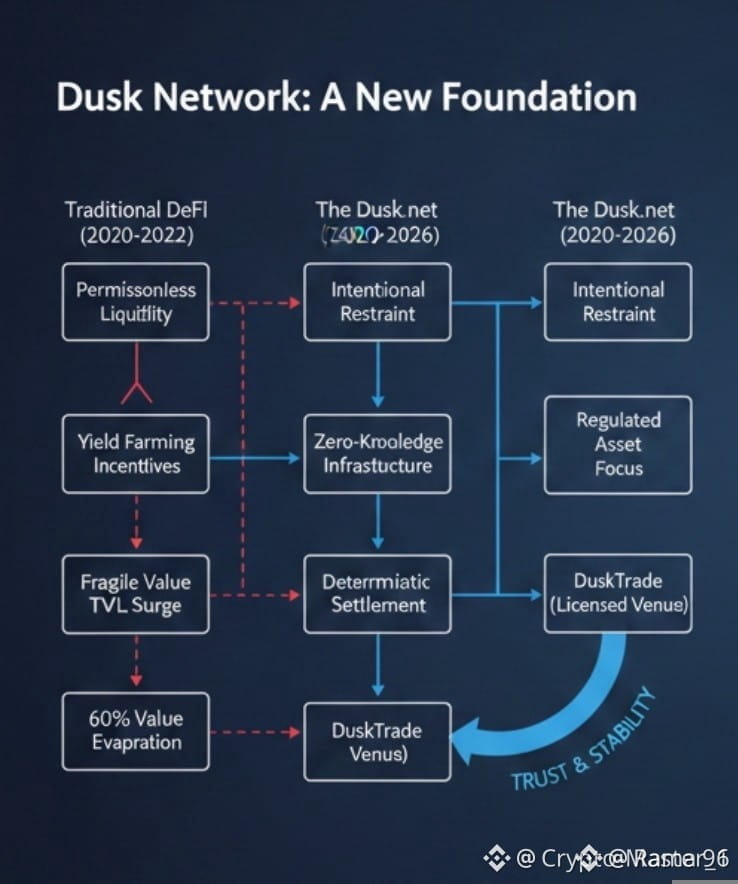

If you make financial infrastructure open enough, liquidity will self-organize, trust will emerge from transparency, and scale will take care of itself. In practice, we got something else. By late 2021, over $180 billion in total value was locked across DeFi protocols, a number that looked impressive until it wasn’t. Within a year, more than 60 percent of that value evaporated, not because blockchains stopped working, but because the markets built on top of them were fragile by design.Liquidity followed the rewards while they were there. When the rewards ran out, it didn’t hesitate to leave. Trust vanished overnight.

Dusk watched this unfold from the outside, and instead of reacting, it kept building underneath. What struck me was that it never framed DeFi as a technical problem. It treated it as a market structure problem. Transparency alone does not create trust when the actors involved have asymmetric information, when front-running is structural, and when compliance is treated as an afterthought rather than a constraint.

That understanding creates another effect. If you assume regulated finance is eventually coming on-chain, then designing for total permissionlessness becomes a liability, not an advantage. Institutions do not fear blockchains because they dislike innovation. They fear unpredictability. They need privacy that is selective, auditable, and enforceable. They need settlement guarantees. They need clear accountability when something breaks.

This is where Dusk’s rejection of DeFi maximalism becomes clearer. Instead of launching dozens of yield products, it focused on zero-knowledge infrastructure designed specifically for regulated assets. On the surface, that looks like slower progress. Underneath, it’s a different foundation entirely.

Take privacy as an example. Most DeFi chains expose transaction flows by default. Anyone can reconstruct positions, strategies, even liquidation thresholds. Dusk’s use of zero-knowledge proofs hides transaction details while still allowing compliance checks when required. That balance matters. In Europe alone, new regulatory frameworks like MiCA are pushing digital asset platforms toward stricter reporting and auditability. Early signs suggest that chains unable to support selective disclosure will be boxed out of these markets entirely.

Meanwhile, Dusk built consensus around economic finality rather than raw throughput. Its proof-of-stake design emphasizes deterministic settlement, which is less exciting than headline TPS numbers, but far more relevant when real assets are involved. In traditional finance, a settlement failure rate above even a fraction of a percent is unacceptable. By contrast, many DeFi protocols implicitly accept downtime, reorgs, and rollbacks as part of experimentation.

Understanding that helps explain DuskTrade.

Instead of treating tokenization as a demo, Dusk is building a licensed trading venue where assets are not just represented on-chain but actually cleared and settled within regulatory boundaries. As of early 2026, the European tokenized securities market is still small, under €10 billion in live issuance, but it’s growing steadily rather than explosively. That steady growth tells you something. Institutions move when the rails feel solid, not flashy.

Critics argue that this approach sacrifices composability. They’re not wrong. Dusk does not optimize for permissionless remixing. But that constraint is intentional. In regulated markets, unrestricted composability can increase systemic risk. The 2008 financial crisis didn’t happen because instruments were opaque. It happened because they were too interconnected without oversight. Dusk’s architecture limits that by design, trading some flexibility for stability.

There’s also the question of network effects. DeFi maximalists point out that liquidity attracts liquidity, and that building for institutions risks missing grassroots adoption. That risk is real. Dusk’s ecosystem is smaller than many DeFi-native chains, and growth is slower. Validator participation remains more concentrated, and application diversity is narrower. If retail interest never returns to infrastructure-level narratives, that could matter.

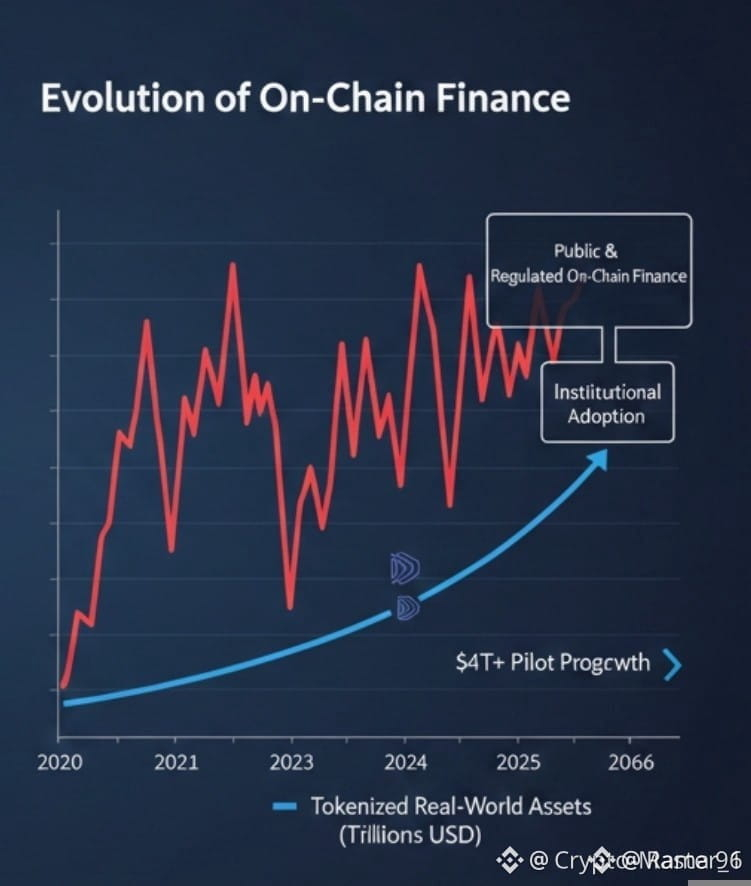

But the market context is shifting. In 2024 alone, over $4 trillion worth of traditional financial assets were tokenized in pilot programs, mostly off-chain or on permissioned ledgers. Only a small fraction touched public blockchains. That gap is not due to lack of demand. It’s due to lack of suitable infrastructure. Dusk is positioning itself in that gap, betting that public and regulated do not have to be opposites.

Another layer worth mentioning is governance. DeFi governance often looks democratic on paper but concentrates power through token incentives. Dusk’s governance model evolves more slowly, with explicit roles for validators and oversight mechanisms that resemble financial infrastructure rather than social networks. It’s less expressive, but also less vulnerable to capture by short-term interests.

What this reveals is a different reading of time. Most DeFi chains optimize for cycles. Dusk seems to optimize for decades. That doesn’t guarantee success. Regulatory landscapes change.

Institutions may choose private chains instead. Or they may demand features that public networks still struggle to offer. All of that remains to be seen.

Still, the quiet part matters. While much of crypto chased maximum permissionlessness, Dusk treated constraint as a design input rather than a failure. It assumed that finance does not become trustworthy by being loud. It becomes trustworthy by being boring, predictable, and earned.

If this holds, we may look back and realize that rejecting DeFi maximalism wasn’t a retreat at all. It was a bet that the future of on-chain finance would belong not to the fastest builders, but to the ones willing to build foundations that regulators, institutions, and markets could stand on without flinching.