Vanar Chain does not arrive screaming for attention. That alone already puts it in a different category.

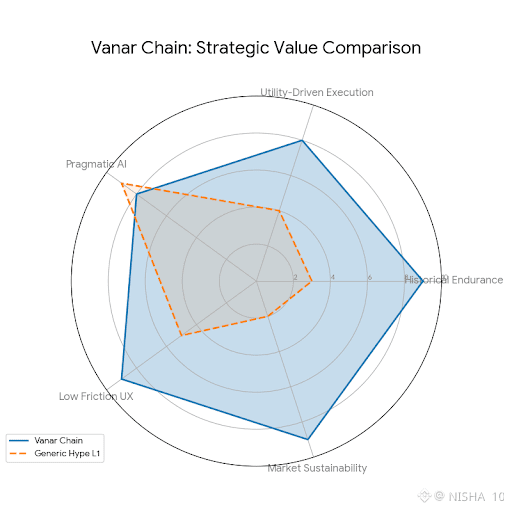

If you have traded long enough you know the pattern. Loud narratives pump fast and collapse faster. New L1s promise revolutions every cycle and most of them never make it past their first stress test. The market is brutal but fair over time. It rewards things that actually get used and forgets everything else. Vanar feels like it was built by people who understand that reality instead of fighting it.

What stands out first is not the tech specs or the branding refresh. It is the intent. Vanar is clearly not chasing crypto native applause. The architecture and product direction suggest a team that expects users who do not care about block times or consensus debates. Gamers brands entertainment platforms and AI driven experiences do not tolerate friction. If something feels clunky they leave. That constraint forces discipline and you can feel it baked into how Vanar is being shaped.

There is also history here. This is not a team spinning up a chain because L1s are fashionable again. Virtua existed before this cycle had a name. VGN was being built while most people were still arguing about whether gaming and crypto could even coexist. That matters because teams who survive bear markets build differently. They cut fantasies early. They focus on shipping. They learn what users actually do instead of what whitepapers say they will do.

Vanar as an L1 feels less like an experiment and more like infrastructure consolidation. It is the chain that ties together work that was already happening. That makes it harder to market but easier to sustain. Traders often underestimate how important that distinction is. Hype gets liquidity once. Utility keeps it coming back.

The AI angle is another place where this project could have easily gone wrong. We have all seen meaningless AI branding slapped onto roadmaps. Here it feels quieter and more pragmatic. Compression reasoning automation data handling. These are not flashy words but they are exactly the kind of boring problems that become extremely valuable once scale arrives. If AI on chain ever becomes more than a slogan it will be through systems like this rather than demo driven gimmicks.

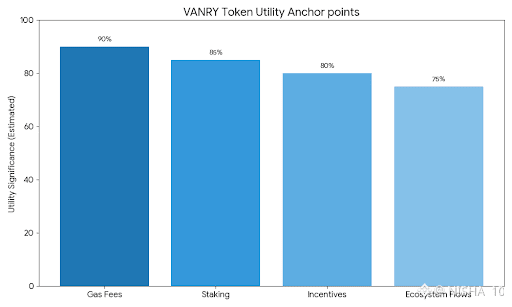

VANRY as a token sits in an interesting spot. It is not pretending to be a meme or a pure store of value. It is a working token tied to execution.Gas staking incentives ecosystem flows. That does not guarantee upside but it does anchor the token to activity rather than sentiment alone. In my experience that is the difference between charts that decay slowly and charts that completely vanish.

What really decides whether Vanar matters is not price or listings. It is whether the team continues to attract builders who want to deploy products that normal users touch without knowing they are on chain. That is the hardest thing to do in this industry. It is also where the largest upside hides because most traders stop paying attention before it becomes obvious.

This is not a project for people hunting instant narratives. It is for those who watch where real effort accumulates over time. Vanar feels like something designed to still be here after the noise moves on. In a market that constantly overestimates novelty and underestimates endurance that alone makes it worth taking seriously.

Personally, I pay attention to projects that are still building when the spotlight is elsewhere. Vanar gives me that quiet-builder energy that usually only shows its value late, not early. It’s not something I’d trade on emotion, but something I’d track through execution. If they keep shipping and attracting real products, the market will eventually notice — it always does. Until then, patience is the edge here.