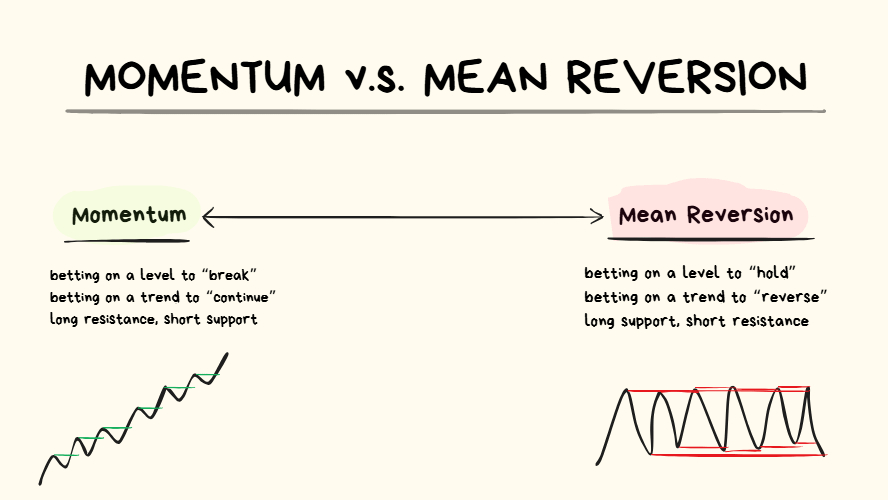

When price approaches any support/resistance level you have 3 types of decisions:

1️⃣→ Bet on a breakout (Momentum).

2️⃣→ Bet on a bounce (Mean reversion).

3️⃣→ Take no trade.

As a Trader you have to get used to picking Option 3... a lot.

Before jumping into a trade it can be quite helpful to have a little bit of context.

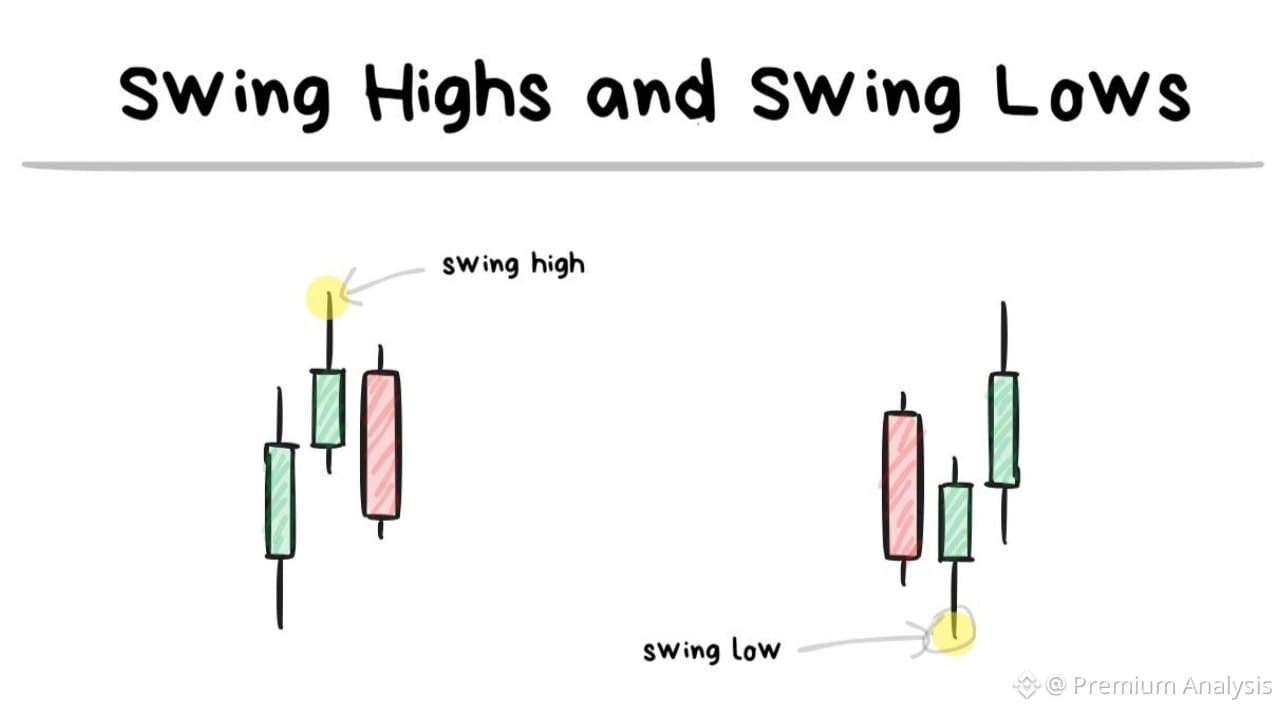

Looking at the current Market Structure is a good place to start.

🐂Bullish Market Structure: higher highs and higher lows.

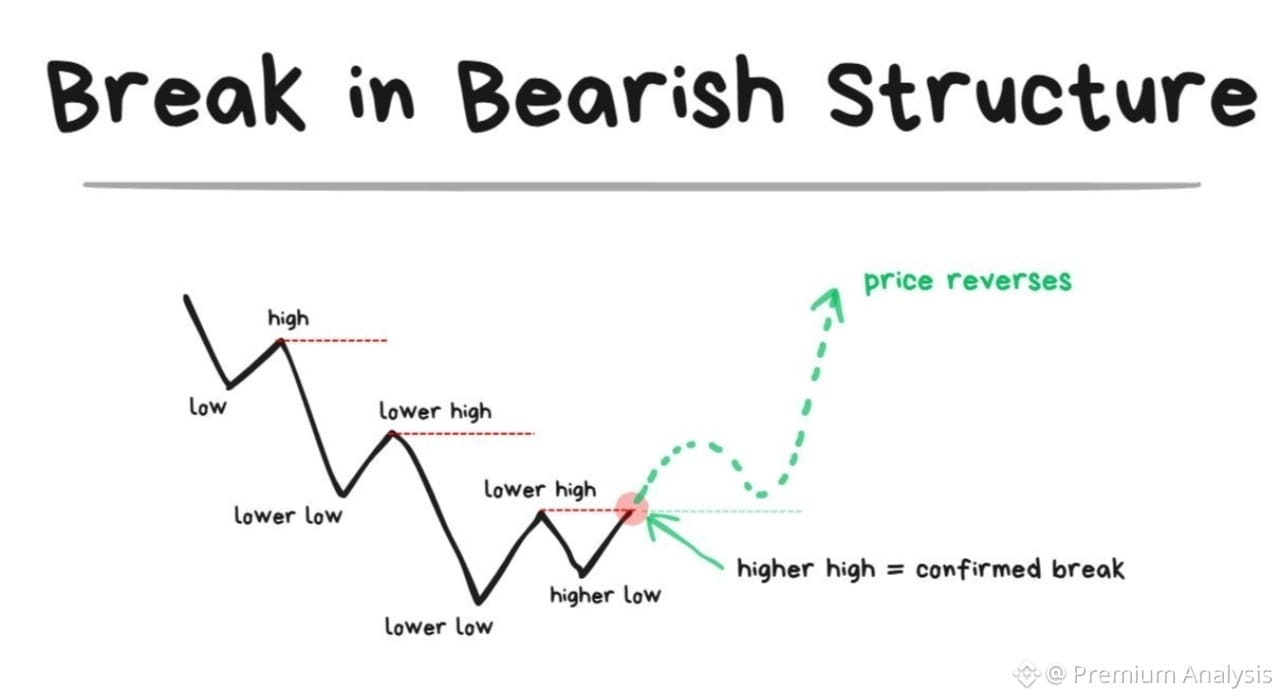

🐻Bearish Market Structure: lower lows and lower highs.

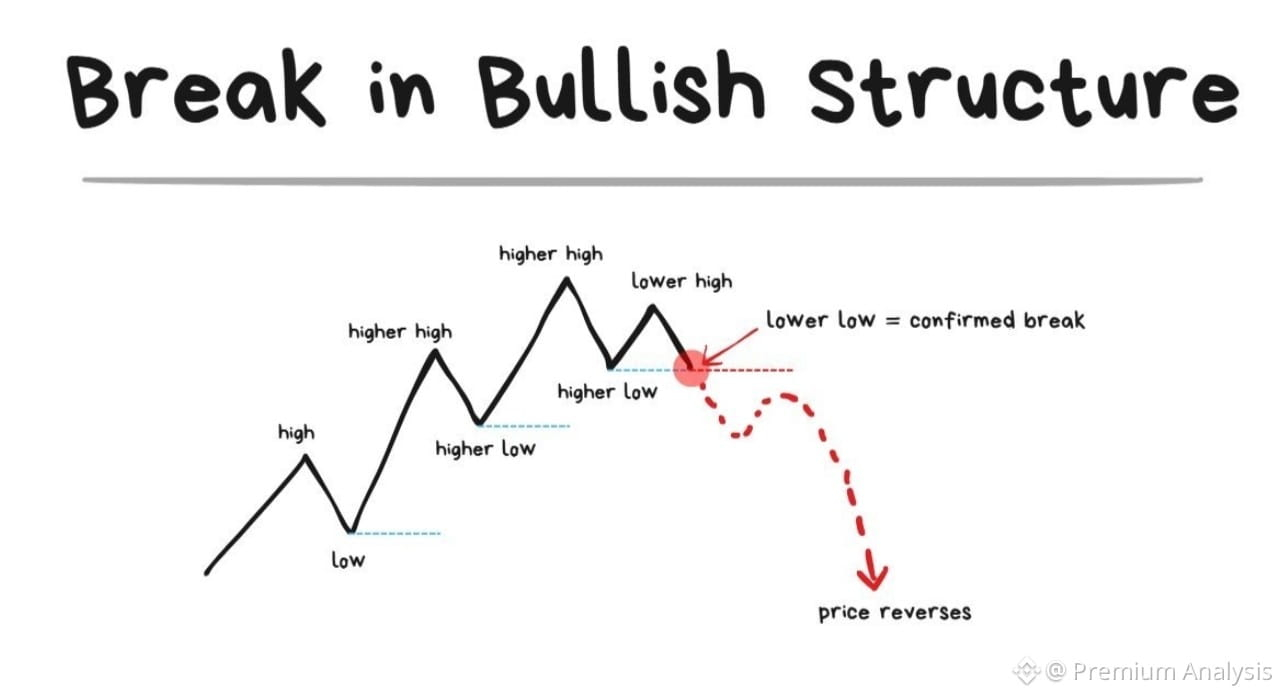

Break in Market Structure

Just because price currently has Bullish Structure doesn't mean that it will just go up forever.

There are going to be times where the structure "breaks" and price can potentially turn around and start moving in another direction.

Just because a Lower High comes in does NOT mean the structure has broken yet

The structure is only broken when the Lower Low comes in.

A Lower Low = the break of the most recent swing low that was formed.

Just because a Higher Low comes in does NOT mean the structure has broken yet.

The structure is only broken when the Higher High comes in.

A Higher High = the breach of the most recent swing high that was formed.

Mean-Reverting Markets (ranging)

When the direction of price isn't clear because it just keeps reversing from the same highs/lows over and over again, this is a Mean Reverting Environment.

This type of environment is:

✅the BEST for trading reversals

❌the WORST for trading breakouts

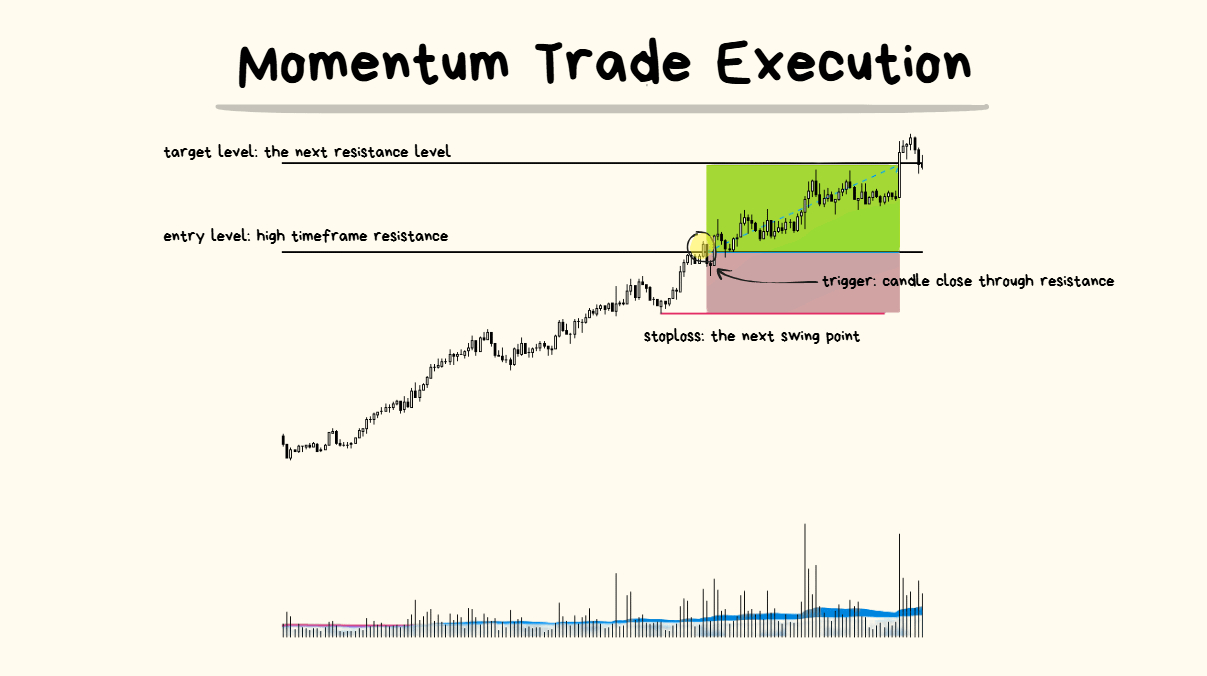

Momentum Markets (trending)

When the Market Structure of a move appears to be Bullish or Bearish for a consistently long duration, then you're looking at Trending Price Action.

Common characteristic of strong Trending Price Action:

Price hits a resistance and then effortlessly breaks through it, drifting to the next resistance.

Then when it reaches the next level, it breaks through that again and the cycle continues.

This type of environment is:

✅the BEST for trading breakouts

❌the WORST for trading reversals

📝Summary Lesson :

Every trade fits one of three decisions:

1️⃣→ Bet on a breakout (momentum).

2️⃣→ Bet on a bounce (mean reversion).

3️⃣→ Take no trade.

Your job as a Trader: identify the environment and choose the option

1. Market Structure

Bullish: higher highs + higher lows

Bearish: lower lows + lower highs

Break of structure: confirmed only when price breaches the most recent swing high/low.

2. Market Environments

A. Momentum (Trending)

Price consistently breaks through levels and continues in one direction.

✅ Best for breakouts

❌ Worst for reversals

B. Mean-Reverting (Ranging)

Price repeatedly bounces between similar highs/lows.

✅ Best for reversals

❌ Worst for breakouts#btc #bitcoin