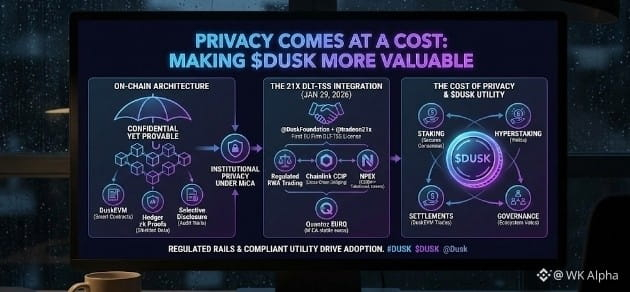

When I search about that the Coffee's barely warm after closing that position at midnight—quiet room, just the keyboard and Dusk's steady grind on my mind. Privacy in finance isn't free; it demands architecture that balances secrecy with proof, and Dusk pays that price in deliberate design—making $DUSK the scarce utility that powers it all. On-chain, DuskEVM handles EVM contracts, Hedger zk proofs shield data while selective disclosure provides audit trails—confidential yet provable, institutional privacy under MiCA, not anonymous exposure.

The 21x dlt-tss license integration that sealed it

checked the feed earlier: on january 29, 2026, at 14:05 UTC (post id 2016875408210481649), @DuskFoundation announced onboarding as trade participant with @tradeon21x—first EU firm with DLT-TSS license for fully tokenized securities market. no visible staking/liquidity param change on explorer (pools ~38% supply locked, address snippet 0xb2bd0749...), but it activates regulated RWA trading on Dusk rails, Chainlink CCIP bridging cross-chain without leaks, NPEX's €300m+ tokenized assets flowing compliantly via Quantoz EURQ for MiCA-stable euros.

The cost of privacy that actually pays off

this hits different late at night: dusk's dna charges for privacy through compliance—provable zk for verifiable reveals, no shortcuts that regulators hate. NPEX's licensed MTF/broker infrastructure tokenizes real securities on-chain, CCIP standards enable secure interoperability, Quantoz's EURQ anchors euro liquidity. $DUSK bears the load: staking secures consensus and hyperstaking yields, settlements execute DuskEVM trades, governance votes shape ecosystem like reward tweaks. the cost—rigorous design—creates scarcity and value as institutions seek these exact rails, recent 21x move proving the demand.

as the mug sits empty, dusk shows how privacy's price becomes an asset—regulated rails that cost effort to build but deliver the trust tradfi needs, fitting blockchain's evolution where compliant utility drives lasting adoption.