When I think about Dusk in 2026, I don’t think about it primarily as “another privacy chain.” I think about it as an infrastructure designed for a kind of user who usually gets overlooked in blockchain narratives: people and organizations that already live under regulatory obligations and want technology that helps them meet those obligations without reinventing how they work. That framing matters because it forces me to look at the project not through the lens of hype or excitement, but through the lens of everyday reliability.

I’ve watched blockchains claim innovation for years, and I’ve learned that real utility doesn’t come from flashy announcements. It comes from consistency and clarity about who the technology serves. For Dusk, the foundational premise is that financial infrastructure should handle confidentiality and compliance as first-class concerns. In practice, this means designing a system where confidentiality isn’t a gimmick, and compliance isn’t tacked on as an afterthought. These aren’t easy conditions to satisfy together, and observing how the project’s architecture reflects this reveals a lot about its intent.

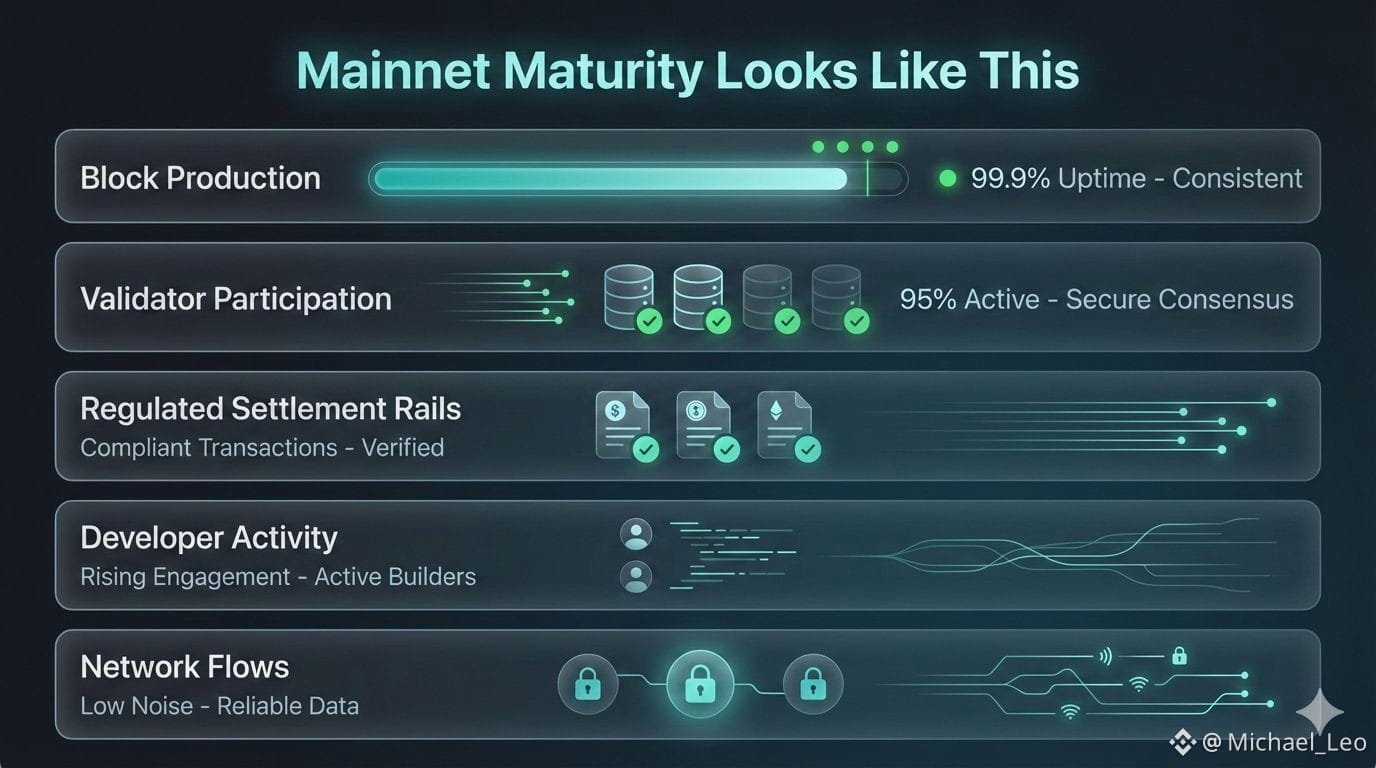

In early 2026, the network reached what is arguably the most important milestone in its history: the mainnet launch in January 2026. This transition from research and testnets to a live Layer-1 blockchain is far from trivial. It signals that the project has moved past theoretical capability and into operational reality. You don’t judge infrastructure by promise; you judge it by whether it stands up under use. The launch enabled confidential smart contracts and opened the door for real applications to be deployed on the network in ways that align with its architectural assumptions.

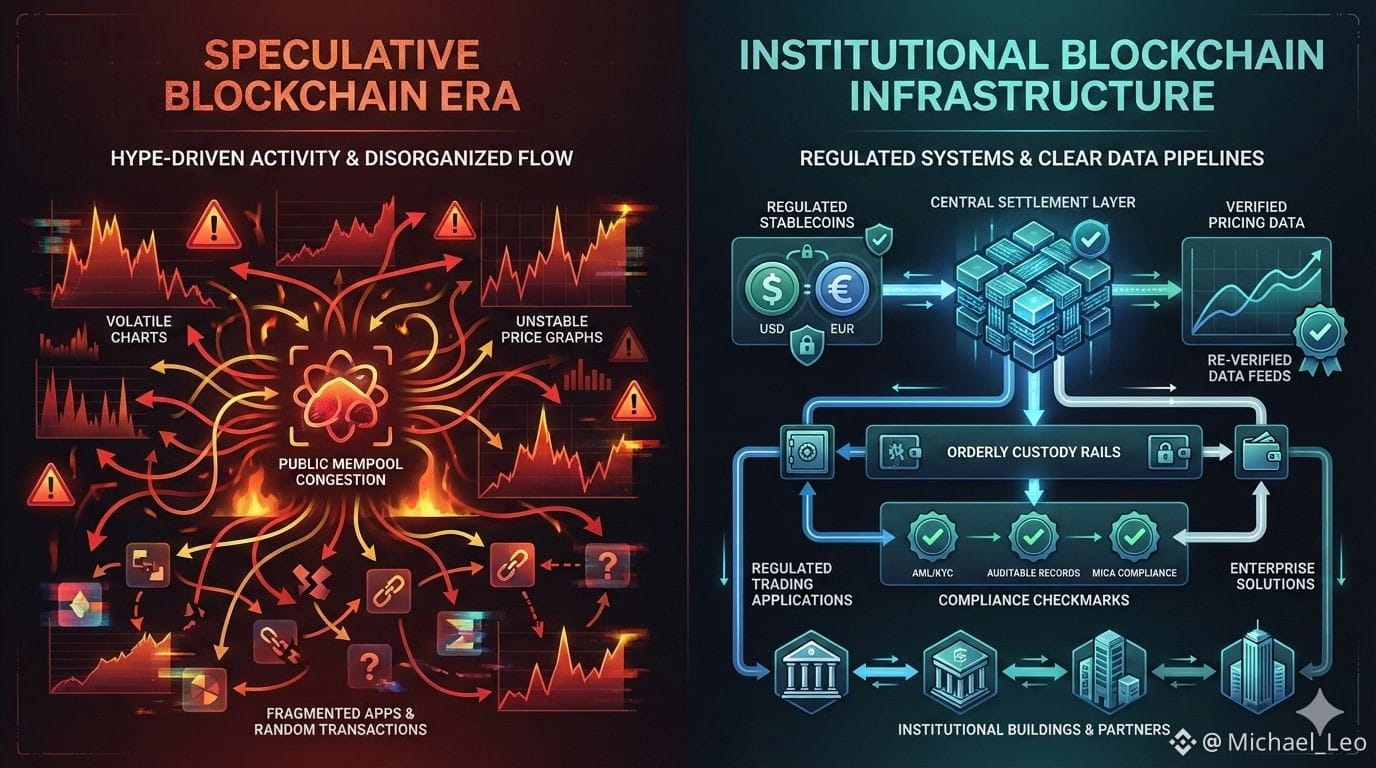

When I look at how people actually interact with the system today, I see a pattern that reinforces the project’s design philosophy. Usage isn’t driven by speculative traders. Instead, it is anchored in workflows oriented toward tokenizing real-world assets, compliant issuance, and integration with regulated financial systems. Dusk’s modular architecture where privacy protocols, settlement mechanics, and compliance hooks operate as distinct but connected layers reflects a practical decision to make complexity manageable. For the people ultimately relying on this infrastructure developers building financial applications, compliance officers validating on-chain events, and participants engaging with tokenized assets the underlying technology needs to behave predictably and transparently. They need certainty that the rules they already follow in traditional systems aren’t invalidated when they go on-chain.

I find that one of the quietest but most revealing trade-offs in Dusk is its emphasis on confidentiality with auditability. Many projects have pitched privacy as an end in itself, but Dusk’s approach is different. It treats confidentiality as a tool to protect sensitive information while still enabling auditors, regulators, or authorized participants to verify what’s necessary. That reflects a core reality of regulated finance: you don’t want everything hidden, and you don’t want everything exposed either. You want the right information to be available to the right parties under the right conditions. Building that into the protocol rather than layering it on later is an intentional design choice that says something important about the project’s understanding of real user needs.

I find that one of the quietest but most revealing trade-offs in Dusk is its emphasis on confidentiality with auditability. Many projects have pitched privacy as an end in itself, but Dusk’s approach is different. It treats confidentiality as a tool to protect sensitive information while still enabling auditors, regulators, or authorized participants to verify what’s necessary. That reflects a core reality of regulated finance: you don’t want everything hidden, and you don’t want everything exposed either. You want the right information to be available to the right parties under the right conditions. Building that into the protocol rather than layering it on later is an intentional design choice that says something important about the project’s understanding of real user needs.

This is also reflected in how the network handles onboarding. Most everyday users never think about consensus algorithms or cryptographic proofs, and they shouldn’t have to. What they care about is whether the system does what they need: can it execute a confidential transaction for a tokenized security? Can it record a compliant trade in a way that regulators accept? Does the wallet interaction feel familiar and not like a sandbox experiment? These questions shape how tools and services around the core protocol are built. Dusk’s recent upgrades prior to mainnet incremental improvements to performance, settlement, and APIs show an awareness that developers need stability and clear interfaces more than flashy features.

One of the aspects I find compelling, even if cautiously optimistic about its challenges, is the way the project is extending beyond basic transaction privacy toward broader financial tooling. The roadmap for 2026 includes components like Dusk Pay, a MiCA-compliant payment solution intended for enterprise usage, and the deployment of regulated trading applications such as those built with licensed partners like NPEX. These components are not abstract experiments. They tie directly into how financial services are delivered: payments that need both privacy and auditability, markets that need clear settlement records, and interoperability components that link on-chain assets with traditional financial markets.

I approach these ambitious building blocks with cautious curiosity because every new layer introduces complexity and dependencies. Integrating a compliant payment network, for example, is not just a technical challenge. It’s a governance, legal, and operational challenge that goes beyond code. The fact that the roadmap includes these elements, rather than an endless parade of speculative features, suggests a seriousness about the infrastructure’s role in real financial workflows. What matters, to me, is not whether these components are eventually profitable or fashionable, but whether they function reliably under the kinds of scrutiny and constraints that regulated services demand.

In early 2026, I also look at how the system manages real applications as stress tests rather than marketing examples. Tokenized securities trading, stablecoin payments, and compliance-oriented workflows aren’t forgiving. They expose latencies, governance questions, and integration gaps quickly. For infrastructure to be useful, it has to absorb these pressures without frequent disruptions. Designing for this reality is inherently different from designing for novelty. It requires humility and a focus on long-term stability over short-term attention.

Another point that I find particularly pragmatic is the way the token is framed within daily operations. In Dusk’s design, the token exists to support the functioning of the network to facilitate settlement, validate participation, and coordinate among stakeholders. It isn’t positioned as an object of speculation in the infrastructure context. That doesn’t mean people don’t trade it on exchanges, nor does it mean there isn’t liquidity or price movement around it. But in terms of everyday utility, its role is tied to making the network operate, not to driving narratives about growth or capture. This aligns with how real systems embed units of account or settlement mechanisms in ways that are functional rather than symbolic.

Another point that I find particularly pragmatic is the way the token is framed within daily operations. In Dusk’s design, the token exists to support the functioning of the network to facilitate settlement, validate participation, and coordinate among stakeholders. It isn’t positioned as an object of speculation in the infrastructure context. That doesn’t mean people don’t trade it on exchanges, nor does it mean there isn’t liquidity or price movement around it. But in terms of everyday utility, its role is tied to making the network operate, not to driving narratives about growth or capture. This aligns with how real systems embed units of account or settlement mechanisms in ways that are functional rather than symbolic.

As I step back and consider what all of this signals about blockchain infrastructure’s trajectory, it reinforces a simple but often forgotten lesson: infrastructure earns trust through consistency, clarity about its purpose, and an honest accounting of trade-offs. For everyday users developers, financial professionals, and participants who don’t want to think about blockchain mechanics what matters is that a system fits into their existing workflows without imposing new cognitive burdens. Dusk’s choices represent a design ethos grounded in that reality.

In a world where many projects chase the next technological spectacle, it is worth paying attention to systems that focus on doing one thing clearly and reliably. Dusk’s approach emphasizing compliance by design, confidentiality with auditability, and modular complexity that stays under the hood reflects an infrastructure-centric mindset I respect. It doesn’t seek to dazzle. It seeks to endure. And for the people who need systems that “just work,” that distinction makes all the difference.