Crypto traders have a love hate relationship with privacy. We want markets that are liquid and frictionless, but we also know the “anything goes” phase is over. Since 2024, the mood has shifted fast: regulators tightened the screws, exchanges got pickier, and the old idea that privacy has to mean “untraceable” started losing ground. In that context, DUSK’s vision privacy that still plays by the rules doesn’t feel like a niche narrative anymore. It reads like a strategy memo for where Binance wants to be in five years.

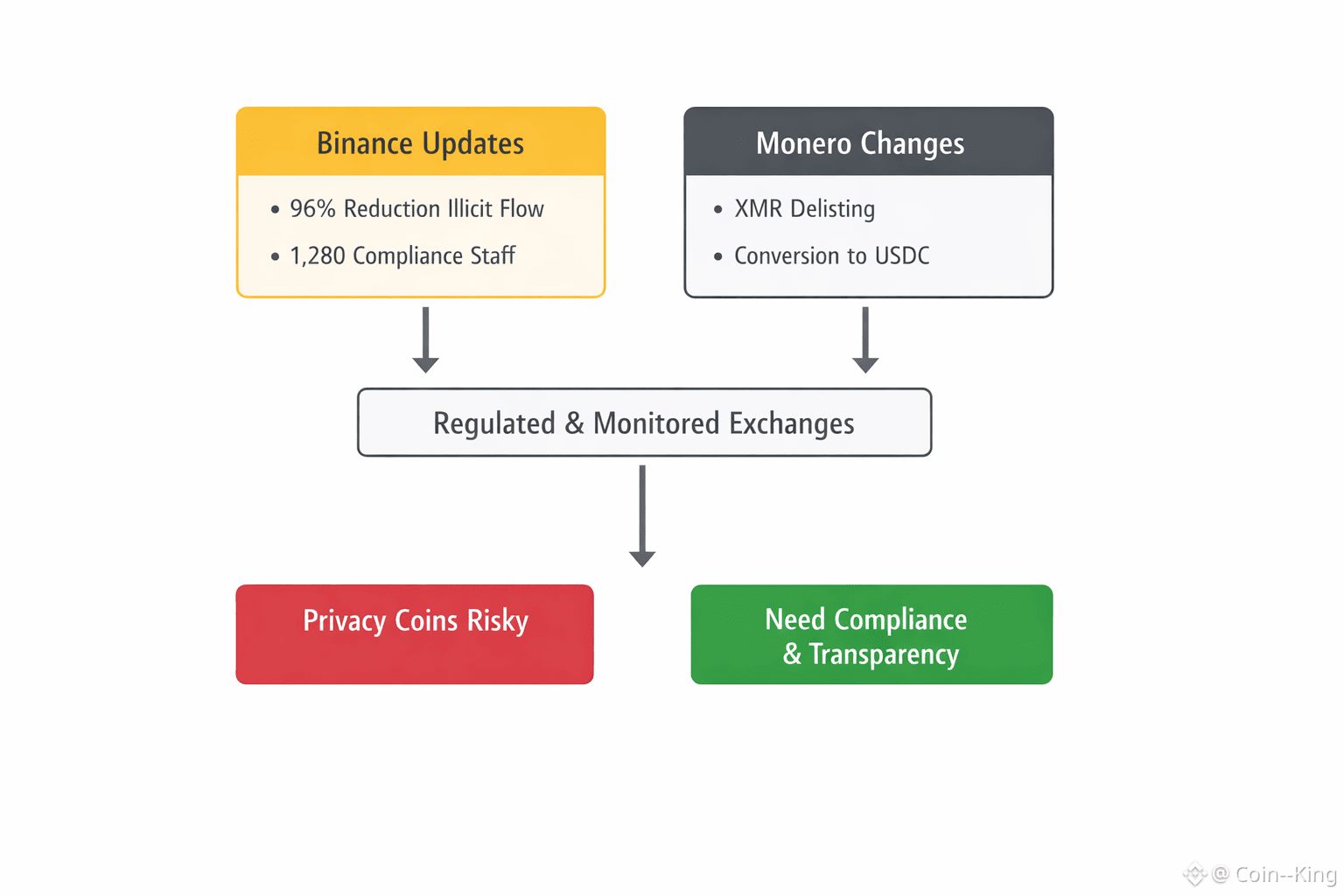

To see why, look at what Binance has been signaling with actions, not slogans. In a compliance update published recently, Binance said it reduced its direct exposure to major illicit-flow categories by 96% from January 2023 to June 2025, and noted a compliance workforce of 1,280 people supporting a platform serving 300+ million users. That kind of operational footprint changes what you can list, what you can support, and what kinds of privacy narratives you can tolerate. “Privacy coin” used to be a marketing label; now it’s a risk label unless the design can coexist with monitoring, reporting, and law enforcement cooperation.

The Monero chapter is the clearest example of the new reality. Binance’s delisting process included a conversion plan where it would start converting remaining XMR balances to USDC on September 2, 2024, based on an average rate through March 1, 2025. Whether you love or hate that decision, it’s a reminder: exchanges aren’t just matching buyers and sellers anymore they’re running regulated, surveilled financial infrastructure, and they’ll cut anything that can’t be defended to banking partners and regulators.

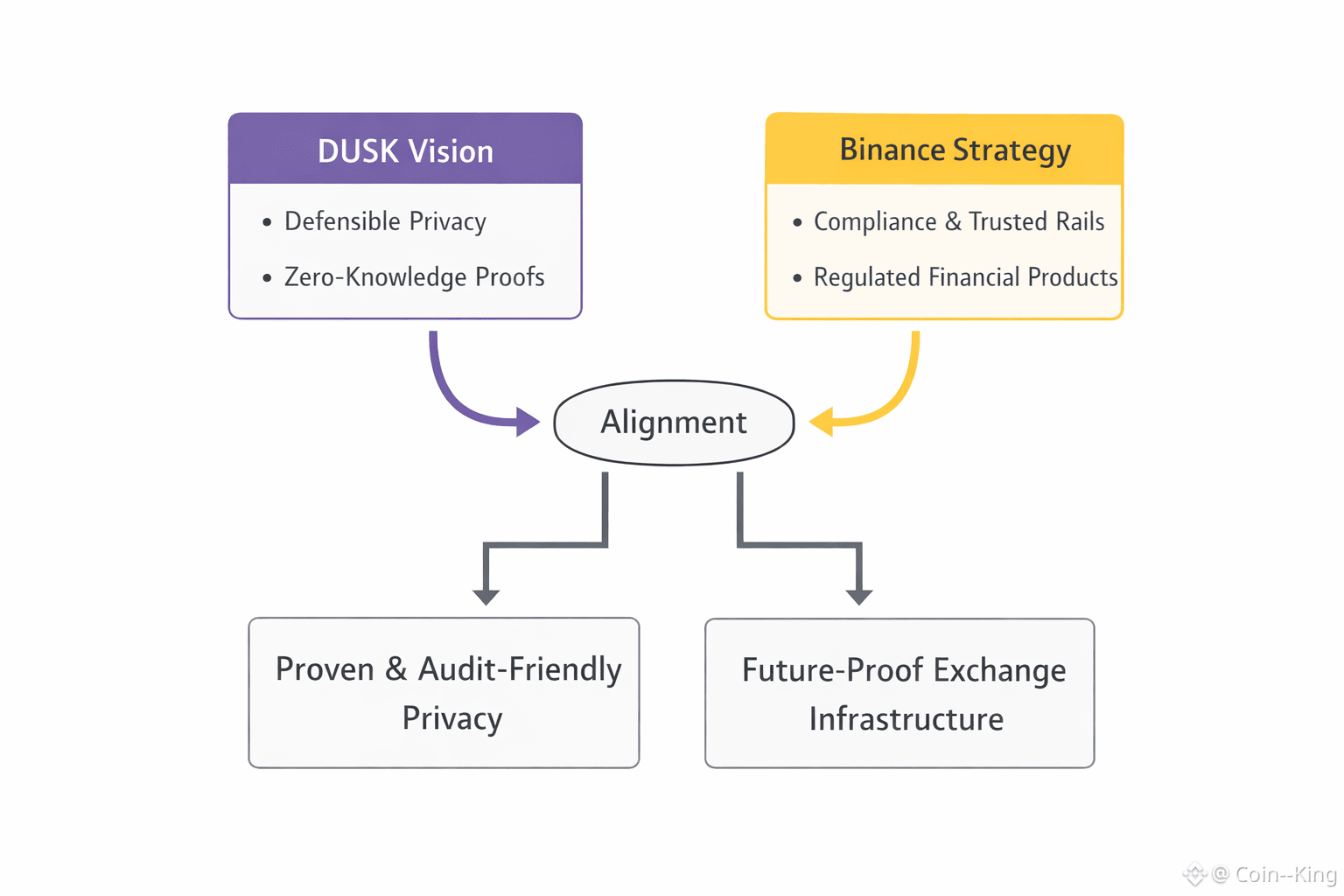

Here’s where DUSK becomes interesting, and why the timing matters. Dusk’s mainnet went live on January 7, 2025, after years of building toward “privacy for financial applications,” not privacy for its own sake. The technical trick, put simply, is using zero-knowledge proofs: cryptography that lets you prove a statement is true without revealing the underlying data. In practice, that means you can prove you passed certain checks (think KYC/AML rules, limits, eligibility) without broadcasting your identity or the sensitive details of a transaction to the whole world.

Traders are noticing because DUSK’s story is lining up with real market plumbing. On October 22, 2025, DUSK was listed on Binance US with the DUSK/USDT pair, and Dusk explicitly framed it around “regulated, privacy-preserving finance.” The same announcement pointed to a pipeline that includes tokenizing assets with NPEX and referenced €300M in assets under management as part of that plan numbers that grab attention because they imply a bridge to regulated capital, not just another DeFi loop.

Progress since then hasn’t been just talk. Dusk has been evolving toward a multi-layer architecture where DuskDS handles staking/governance/settlement, while other layers handle EVM style apps and full privacy applications basically, separating “heavy execution” from the base settlement layer so the chain can stay efficient as usage grows. And leading into 2026, industry trackers and exchange chatter have been focusing on the DuskDS Layer-1 upgrade activated around December 10, 2025, positioned as a stability and performance step ahead of broader application-layer expansion.

So why does this align with Binance’s long-term strategy instead of fighting it? Because Binance is increasingly selling “trusted rails” as much as it sells spot volume. The Financial Times reported in April 2025 that Binance had begun advising governments on crypto regulation and even discussions around national digital asset reserves work you simply don’t get asked to do if your posture is “move fast and ignore compliance.” In that world, privacy isn’t banned it has to be redesigned. DUSK is trending because it represents that redesign: confidentiality that can be selectively proven, audited, and integrated into real financial products, instead of privacy that forces exchanges into an all-or-nothing choice.

My trader takeaway is pretty practical. The market is starting to price a new premium: not “privacy,” but “defensible privacy.” If Binance is building for the next decade licenses, institutional flows, government relationships then infrastructure that can satisfy regulators while protecting user and business data is not a contradiction. It’s the only version of privacy that survives on major venues.