🧠 Short Intro

Morpho (MORPHO) is a decentralized finance (DeFi) lending protocol built primarily on the Ethereum Virtual Machine (EVM) that connects lenders and borrowers directly to improve capital efficiency. It’s designed to make crypto lending and borrowing more efficient, flexible, and accessible across decentralized markets.

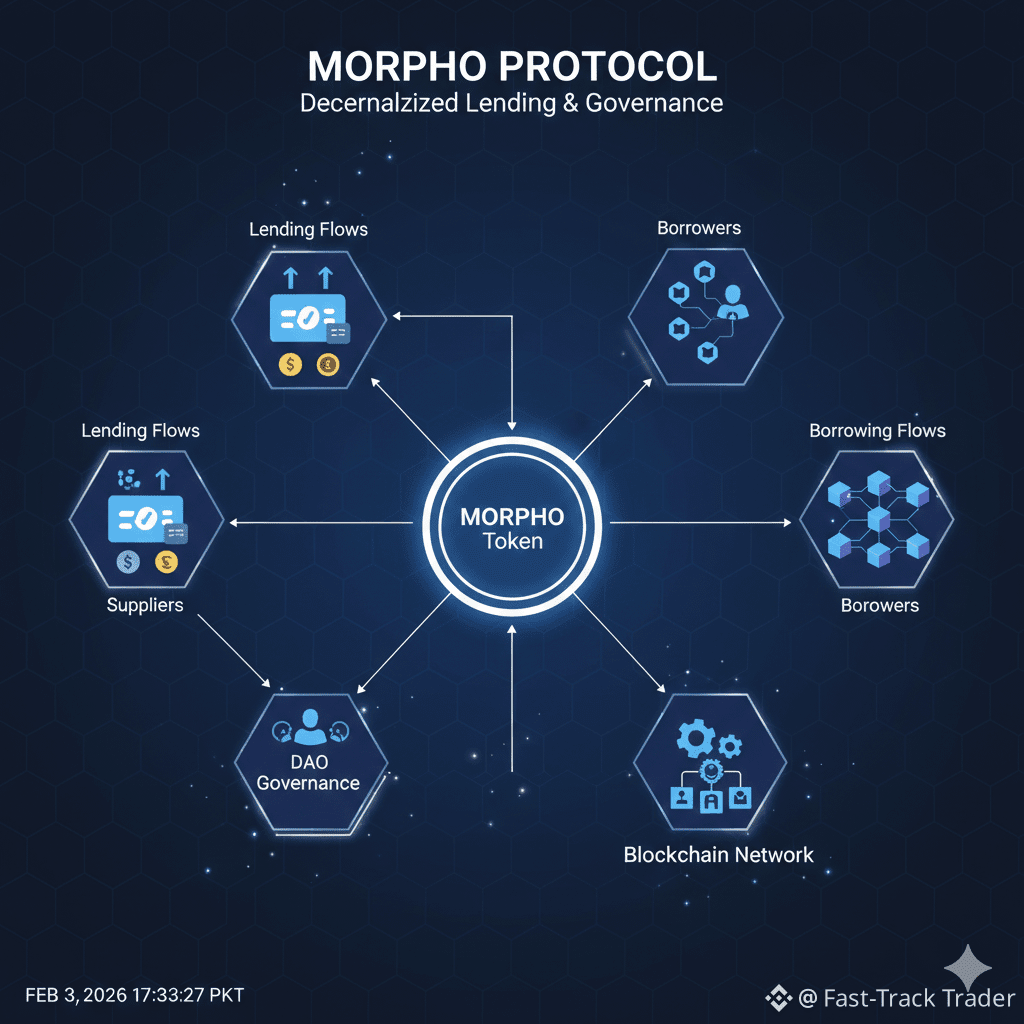

📌 What Morpho & MORPHO Are

Morpho is not just another crypto token — it’s the foundation of a DeFi lending infrastructure where users can earn yields or borrow crypto by interacting with smart contracts rather than centralized intermediaries. The protocol enhances traditional DeFi models by combining peer‑to‑peer matching with liquidity pools to help users capture better lending rates and optimized usage of capital.

The MORPHO token is the governance token for the Morpho ecosystem. With a maximum supply of 1 billion tokens, MORPHO holders can vote on important protocol decisions — such as parameter changes, fee structures, and ecosystem incentives — through the Morpho DAO.

📚 How Morpho Works — Beginner‑Friendly

1. Peer‑to‑Peer Lending Layer

Instead of relying only on pooled liquidity like many DeFi platforms, Morpho tries to match borrowers directly with lenders, reducing the gap between lending and borrowing rates and improving yield efficiency.

2. Integration with DeFi Ecosystem

If a perfect direct match isn’t available, Morpho uses integrated liquidity from established protocols (e.g., Aave, Compound) so that assets still earn yield or loans are filled.

3. Modular Architecture

Morpho’s system separates core lending logic from yield strategies, allowing institutions and developers to create customized markets with specific parameters (e.g., collateral types, interest models).

📊 Why MORPHO Matters

• DeFi infrastructure: Morpho acts as a base layer for building tailored lending markets and other financial products in decentralized ecosystems.

• Optimized capital use: Peer‑to‑peer matching can boost efficiency compared to classic pool systems.

• DAO governance: MORPHO token holders steer the protocol’s future through on‑chain voting.

• Institutional traction: Major players (e.g., Bitwise) are using Morpho‑powered vaults for regulated financial products, signaling broader adoption.

• Cross‑chain growth: Recent updates aim to expand beyond Ethereum into Layer‑2 networks like Base and OP Mainnet, improving interoperability.

⭐ Key Takeaways

• Morpho (MORPHO) is a decentralized lending protocol enabling efficient borrowing and lending on the blockchain.

• Its MORPHO token is primarily a governance token for the Morpho DAO with a 1 billion supply cap.

• Morpho’s peer‑to‑peer layer enhances capital efficiency compared with traditional DeFi models.

• The protocol rewards participation, supports customizable lending markets, and incentivizes community governance.

• Morpho is gaining traction with institutional integrations and cross‑chain lending capabilities.

#Morpho #DeFi #Lending #CryptoEducation #DAO $MORPHO