Dusk Network did not begin like most crypto projects. There was no loud token price obsession no constant trending hashtags no wild promises. It started almost in silence, like a collaborative research effort that slowly turned into something real. By early 2026, Dusk was no longer an experiment sitting in documents. It became a living network with rules code upgrades and responsibility.

Most blockchains start by selling a dream. Dusk started by building plumbing. That already tells you who it is trying to serve.

also read: Dusk And The Missing Ingredient Of Fair Markets

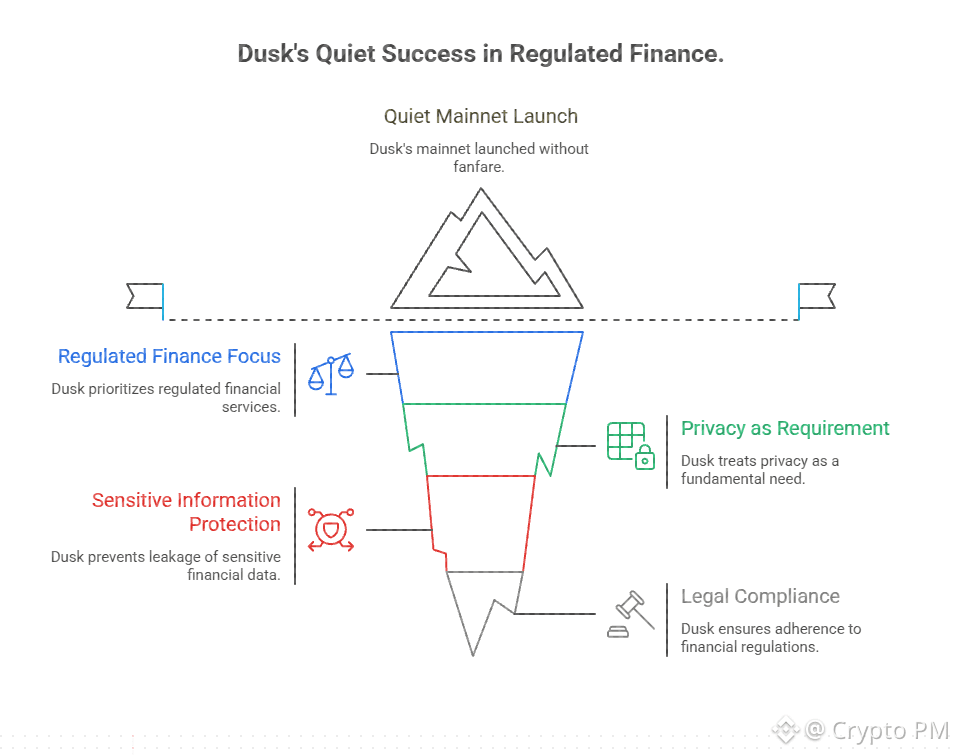

Built For Regulated Finance Not For Attention

From the beginning Dusk focused on regulated financial services and real world assets. The real problem they wanted to solve was uncomfortable. How do you put serious financial activity on a public blockchain without leaking sensitive information and without breaking laws.

Public mempools open trade disclosures and transparent balances work fine for speculation. They fail for institutions. Dusk treats privacy not as rebellion but as requirement. Large trades asset transfers identity linked flows simply cannot be exposed by default.

When Dusk mainnet went live in January 2026 it was not celebrated with fireworks. It quietly worked. That itself was a signal.

Why Boring Mainnet Activity Builds Trust

By late January 2026 the Dusk network felt calm. Blocks produced nodes stayed online developers shipped quietly. No chaos no drama. Some people mistake that for lack of excitement. Institutions read it as reliability.

Finance does not want surprises. Predictability matters more than vibes. The way Dusk rolled out updates slowly carefully and without breaking things shows a mindset shift from startup mode to infrastructure mode.

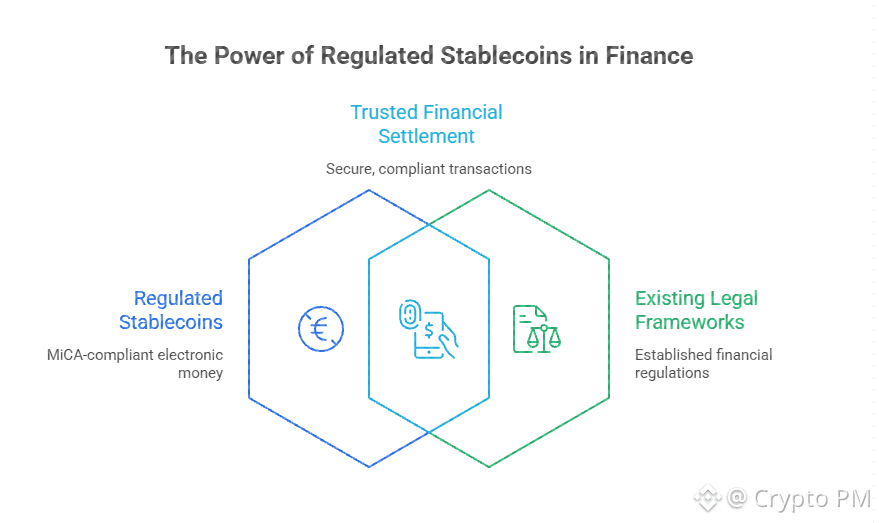

Regulated Stablecoins Are Not A Detail

One major milestone was the support of regulated stablecoins like EURQ from Quantoz. This is not just another euro token. It is MiCA compliant electronic money token aligned with European law.

This matters because it shows Dusk is not experimenting with imaginary assets. It is building settlement rails that fit inside existing legal frameworks. That is hard and slow and very few chains bother.

Software Upgrades That Prepare The Ground

Before EVM expansion Dusk focused on its base layer DuskDS. Data availability speed and predictable finality were improved mid 2025. These are not headline features but they are prerequisites.

Without this foundation DuskEVM would not make sense. Institutional developers need predictable settlement. Random reorgs and delays are unacceptable.

Beyond Privacy There Is Data Integrity

One thing rarely discussed is market data. In regulated markets price feeds are not guesses. They are authoritative inputs.

Dusk integrates verified exchange data using Chainlink and DataLink services. This allows settlement margin accounting and compliance checks to rely on audited sources.

This shifts Dusk from app platform to market infrastructure. Institutions require this. DeFi narratives often ignore it.

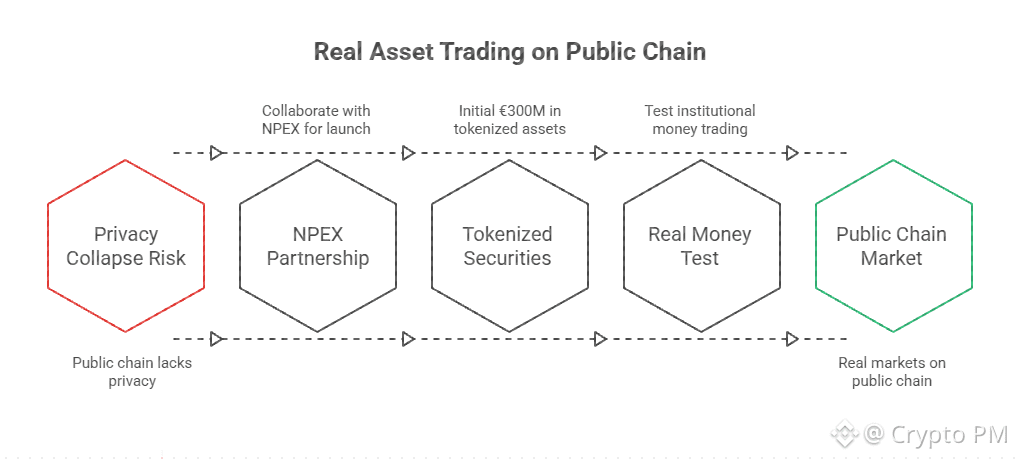

NPEX And Real Asset Trading On Chain

In Q1 2026 Dusk plans to launch a regulated trading dApp with NPEX. Over 300 million euros worth of tokenized securities are expected initially.

This is not a demo. This is a test. Can real institutional money trade settle and be audited on a public chain without privacy collapse.

If it works Dusk proves something few have. That public blockchains can host real markets when designed correctly.

EVM Compatibility Is A Strategic Bridge

DuskEVM coming in 2026 connects Ethereum developers to Dusk privacy and compliance stack. Developers do not need to relearn everything.

This lowers adoption cost massively. Instead of forcing new paradigms Dusk adds new capabilities to familiar workflows. That is how institutions adopt technology.

Market Signals Are Slowly Appearing

Despite being infrastructure heavy the market noticed. Early 2026 saw increased DUSK token activity and volume. This was not random.

It reflects a broader shift. Investors start paying attention to utility and infrastructure not just narratives.

Institutions Care About Details Not Narratives

Regulated stablecoins identity tooling custody options audit trails. These are signals institutions read. Dusk seems to understand that language.

Privacy here is not absolute secrecy. It is selective accountable and provable. That is what regulated markets require.

The Road Is Still Hard

Adoption will not be fast. Institutions move slowly. Liquidity must appear. Real assets must issue and trade. NPEX launch will be critical.

Infrastructure success is measured in years not weeks. Volatility noise can distract but execution decides everything.

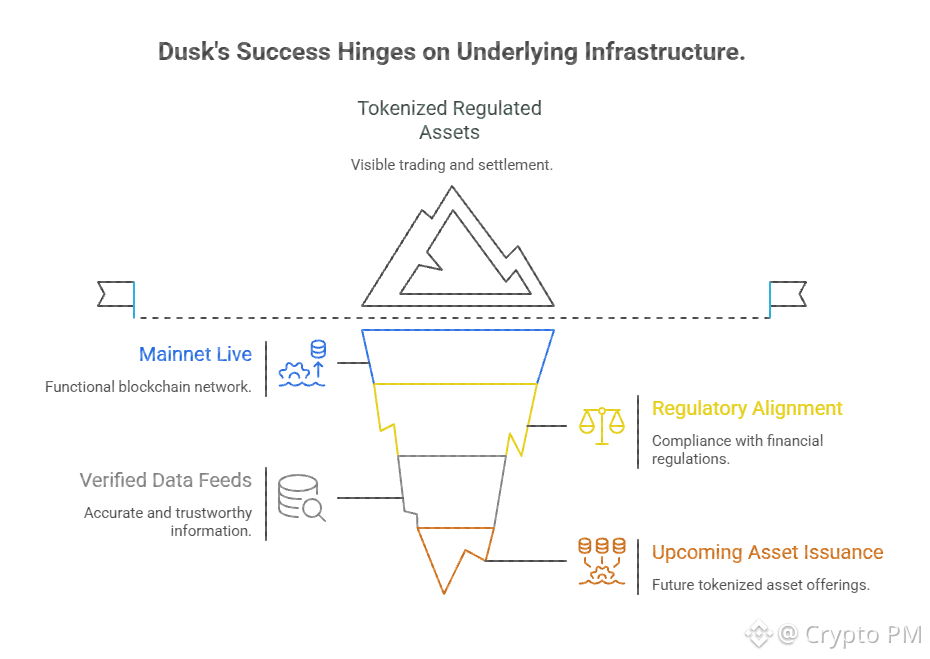

Infrastructure Over Hype

Dusk in 2026 stands apart because it is building something real. Mainnet live regulatory alignment verified data feeds upcoming asset issuance.

If Dusk proves tokenized regulated assets can trade settle and be audited on chain without turning markets into public spectacles then it does more than innovate crypto. It changes how markets operate.

my take

I honestly think Dusk is doing the least attractive thing in crypto. Building slow regulated boring infrastructure. That is also why it might last. The risks are huge. Adoption is slow liquidity is hard and markets are impatient. But if Dusk succeeds it will not just be another privacy project. It becomes financial infrastructure. And those systems rarely trend but they shape everything quietly.