Bitcoin flushing to $74,680 looked violent on the surface. Underneath, the market told a very different story.

Yes, $1.8B in leveraged longs were liquidated. Yes, spot ETFs saw $3.2B in outflows. But structurally, this did not resemble a panic, a capitulation, or the start of a deep bear market. It looked like a reset.

1. Liquidations happened — panic didn’t

The drop to $74,680 was driven by futures liquidations, not broad-based selling. That distinction matters. After major bottoms, derivatives markets usually flip aggressively bearish: futures trade below spot, open interest collapses, and funding inverts.

None of that happened.

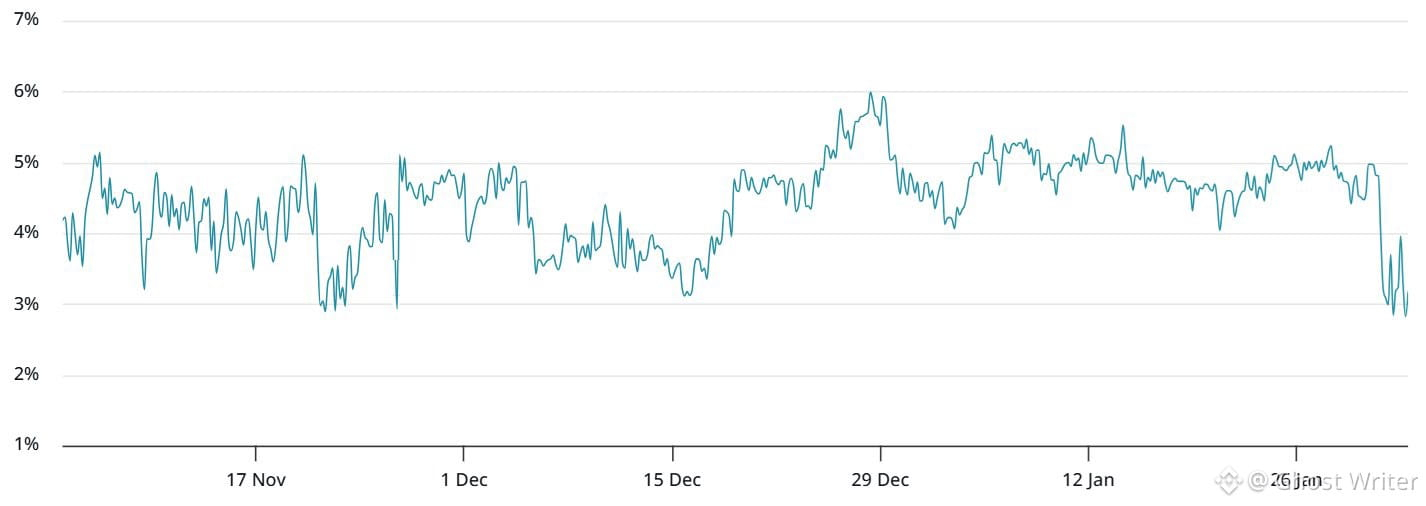

Bitcoin’s futures basis is low at ~3%, but still positive. Open interest sits near $40B, only ~10% off recent highs. Traders reduced leverage — they didn’t abandon the market.

That’s not fear. That’s risk management.

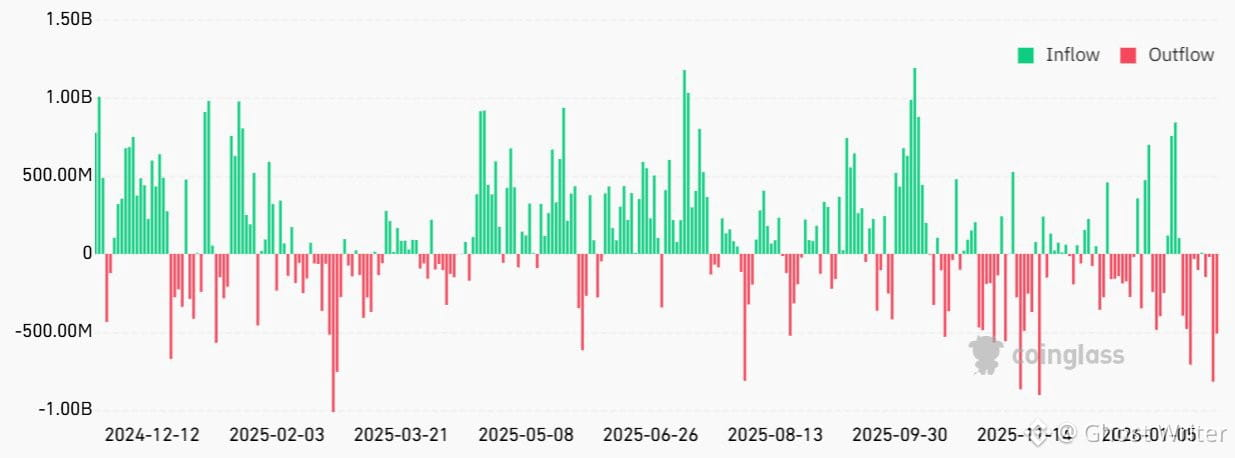

2. ETF outflows are large — but overstated

$3.2B in spot ETF outflows sounds dramatic until you put it in context. It represents less than 3% of total assets under management. This wasn’t an exodus — it was rebalancing during macro uncertainty.

More importantly, there’s no evidence of forced selling pressure from institutional holders. Even Strategy (MSTR), often blamed during drawdowns, holds ample cash reserves and faces no liquidation triggers tied to BTC price.

The selling narrative is louder than the data.

3. Macro stress failed to escalate

In true risk-off events, capital floods into short-term Treasuries and yields collapse. That didn’t happen.

The US 2-year yield held steady around 3.54%. The S&P 500 is still less than 1% off all-time highs. Markets are pricing resolution — not systemic stress — around US fiscal concerns.

Bitcoin sold off alongside silver’s historic crash, but macro indicators never confirmed a full-blown flight to safety.

4. Gold winning doesn’t mean Bitcoin loses

Gold’s $XAU market cap surged to $33T, reinforcing its role as the immediate hedge. That temporarily siphons attention from Bitcoin — but historically, this rotation has been short-lived.

When capital exhausts its move into traditional safe havens, it looks for asymmetric upside again. Bitcoin tends to benefit next, not suffer indefinitely.

The takeaway

Bitcoin can still consolidate. Volatility isn’t gone. But the ingredients of a deeper collapse simply aren’t present.

No derivatives stress.

No macro panic.

No forced sellers.

$75K wasn’t just a number — it was a stress test. And for now, Bitcoin passed.