This is not hype.

This is not fear-mongering.

And this is definitely not politics.

Something very rare is happening behind the scenes — and smart money is already reacting.

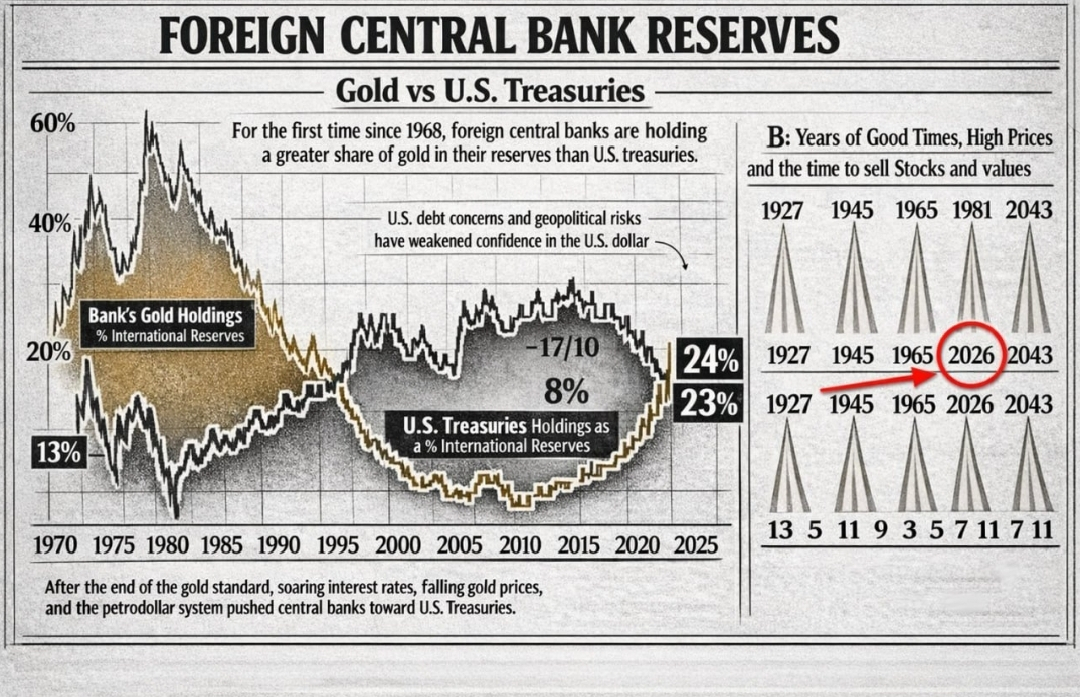

🟡 A Once-in-60-Years Signal Just Appeared

For the first time in over six decades, global central banks now hold more GOLD than U.S. Treasuries.

Let that sink in.

They didn’t panic. They didn’t chase risk. They quietly bought gold on dips while the public was told everything is “fine.”

That’s not coincidence — that’s preparation

🧠 What Central Banks Are REALLY Doing

While retail investors are pushed toward risk assets, central banks are doing the opposite. ❌ Reducing exposure to U.S. debt. ✅ Accumulating physical gold. ⚠️ Preparing for financial stress, not expansion

This is important because U.S. Treasuries are the foundation of the global financial system:

• Used as collateral • Anchor global liquidity • Support leverage across banks & funds When confidence in Treasuries weakens, everything built on top of them becomes unstable.

That’s how real crashes begin — quietly, not with headlines.

📉 History Never Warns Loudly — It Whispers Look at the pattern:

🔹 1971–1974 • Gold standard collapses • Inflation explodes • Stocks go nowhere for years

🔹 2008–2009 • Credit markets freeze • Forced liquidations everywhere • Gold protects purchasing power

🔹 2020 • Liquidity disappears overnight • Trillions are printed • Asset bubbles inflate. 👉 Today, we are entering the next phase —and this time, central banks moved FIRST.

🚨 Early Signs of Stress Are Already Here

• Rising sovereign debt risks

• Geopolitical uncertainty

• Tightening liquidity

• Growing demand for hard assets 🟡

Once bonds start cracking, the sequence is always the same ➡️ Credit tightens

➡️ Margin calls spread

➡️ Funds sell what they can, not what they want

➡️ Stocks & real estate follow lower

🏦 The Fed Has No Clean Exit There are only two paths — both painful: 1️⃣ Cut rates & print money • Dollar weakens 💵

• Gold reprices higher 📈

• Confidence erodes 2️⃣ Stay tight • Dollar defended

• Credit breaks

• Markets reprice violently 💥 Either way… something breaks. There is no painless solution.

🧠 Smart Money Is Already Positioned

Central banks are not speculators. They are risk managers. By the time this becomes obvious to the public, the positioning will already be done. Most people will react. A few will be prepared. The shift has already started.

gnore it if you want — just don’t say you weren’t warned ⚠️