Most blockchains I’ve used feel like they’re trying to be everything at once. DeFi hub, #NFT playground, governance lab, experimental sandbox. Payments exist, sure, but they’re usually treated like a side quest. You can move stablecoins, but it never feels like the chain was actually built for that job.

Plasma feels different the moment you look at it through a user lens instead of a trader lens. It starts with one simple idea: stablecoins aren’t an add-on anymore, they’re the main workload. Once you accept that premise, a lot of Plasma’s design choices suddenly make sense.

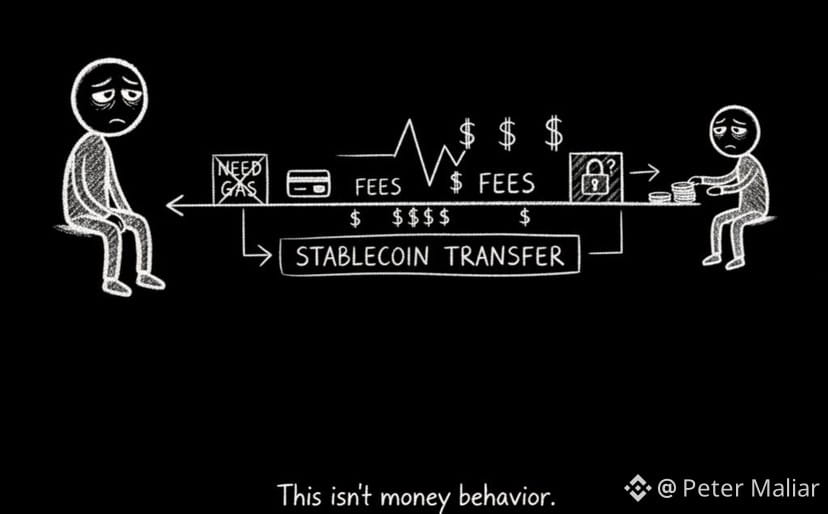

If you’ve ever tried to use #Stablecoins for real things, sending money to family, paying freelancers, moving funds between accounts, you know the pain points. Fees jump around for no clear reason. Networks slow down exactly when you need them most. And somehow you still need to hold a second token just to move the first one. From a payments perspective, that’s not “crypto growing pains,” that’s broken UX.

Plasma treats fee predictability as the product itself. Near-zero or zero-fee stablecoin transfers aren’t about hype, they’re about removing friction. When you stop thinking about gas, digital dollars start behaving like normal money again. You don’t plan around fees. You just send.

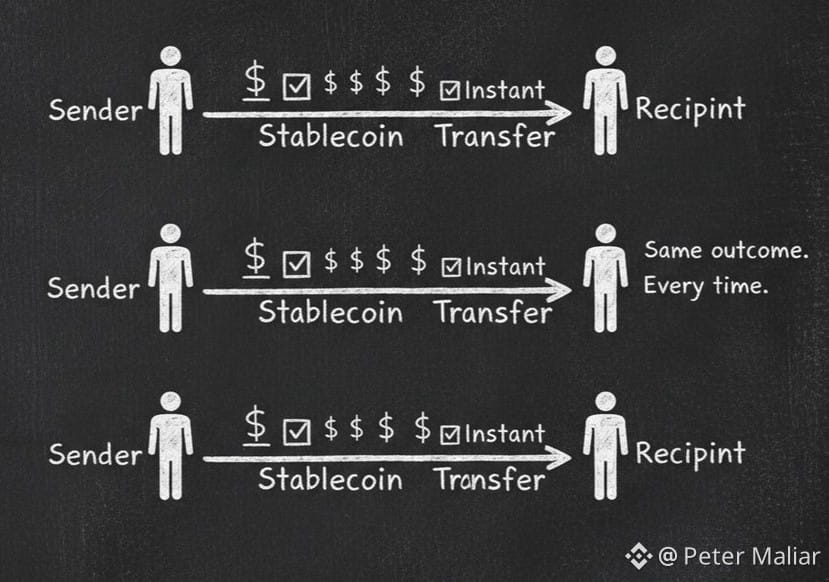

Performance on Plasma isn’t framed as a bragging contest either. It’s not about peak TPS screenshots. It’s about settling the same way every time. Payments are repetitive and time-sensitive. They don’t care about edge-case speed, they care about consistency. Plasma is clearly optimized for that kind of steady, boring reliability.

What also stood out to me is how Plasma approaches cross-chain movement. Instead of the usual lock-and-mint bridge complexity, it leans into shared liquidity and intent-based flows. In practice, that means less fragmentation and fewer points of failure when moving stablecoins across chains. For high-volume or institutional use, that simplicity matters a lot.

Then there’s the real-world angle. Stablecoins have always struggled with the last mile: actually spending them. Plasma’s integrations with payment rails and card solutions turn stablecoins into something you can use without explaining crypto to the cashier. No gas management, no extra steps, no headaches. That’s a big psychological unlock.

I also don’t see compliance treated as a necessary evil here. Plasma seems to accept a basic reality: if you want serious money and serious businesses, you need regulatory clarity. Instead of fighting that, it builds around it. For payments infrastructure, that’s not selling out, it’s growing up.

XPL fits into this picture as infrastructure fuel, not a meme narrative. It’s there to secure the network and keep things running long term. That’s not exciting, but payments infrastructure isn’t supposed to be.

My takeaway is simple. Plasma isn’t trying to change crypto culture. It’s trying to disappear into the background and just work. If it succeeds, people won’t talk about it much. They’ll just use it. And in payments, that’s kind of the highest compliment you can get.