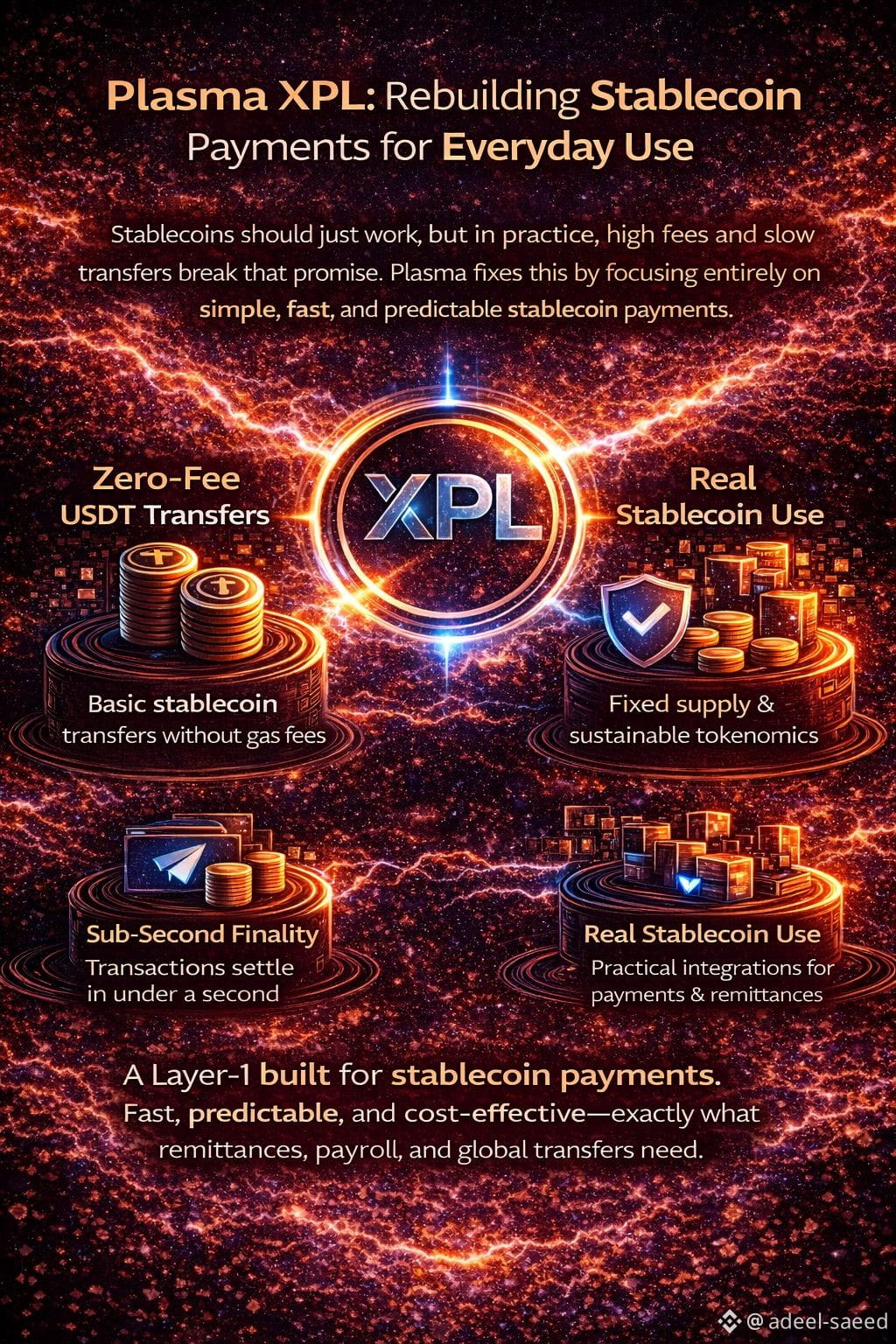

Stablecoins were supposed to make crypto simple digital dollars that move fast, cost almost nothing, and just work. In practice, fees spike, transfers slow, and users hesitate. Plasma was built to fix that gap, not by chasing every use case, but by focusing entirely on stablecoin payments.

@Plasma is a Layer-1 designed to make sending stablecoins feel normal again. Transactions finalize in under a second, the network handles high throughput, and core transfers like USDT can move with zero fees. XPL, the native token, works quietly in the background to secure the system rather than dominate attention.

The network’s design removes common friction points: no gas anxiety, predictable costs, and simple user flows. Its tokenomics are structured for longevity, with a fixed 10B supply, gradual unlocks, and modest inflation that tapers over time. Fees are often burned, balancing issuance as usage grows, while staking stays accessible through delegation.

#plasma partnerships and integrations reflect its payment-first mindset. Support from stablecoin leaders, EVM compatibility, and faster cross-chain settlement position it closer to financial infrastructure than hype-driven crypto. TVL near $200M and strong USDT balances point to steady, real usage.

Plasma isn’t trying to reinvent money. It’s focused on making digital dollars reliable, fast, and predictable. If stablecoins are going to be used every day for remittances, payroll, or global transfers chains built like Plasma are likely to matter most, precisely because they work quietly when it counts.$XPL