Most blockchains don’t really care about privacy.

They say they do, but what they actually mean is transparency. Everything public. Everything traceable. Everything permanent.

That’s fine if you’re swapping tokens or playing around with DeFi. It stops being fine the moment real finance shows up. Salaries, securities, business transfers, compliance reporting. None of that is meant to be broadcast forever.

That’s the hole Dusk Network was built to fill.

Dusk isn’t trying to hide activity. It’s not trying to dodge regulation either. The whole idea is much simpler than that. Control who sees what. Prove things when proof is needed. Keep everything else private by default.

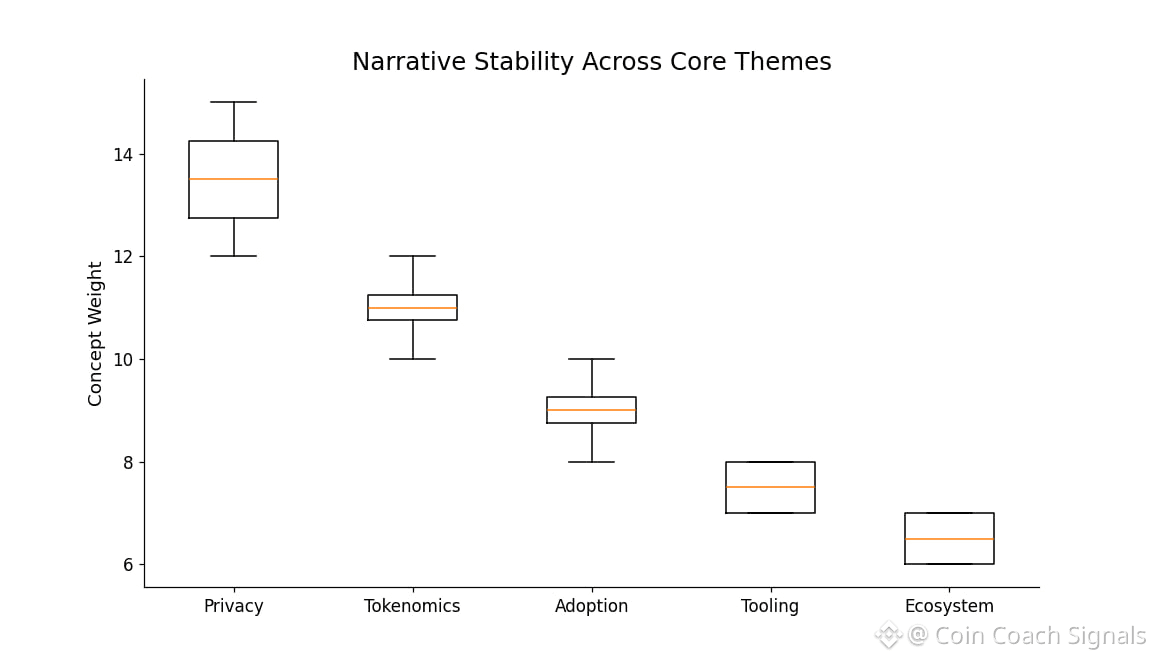

The project has been around since 2018, started by Emanuele Francioni and Jelle Pol, and it’s stayed unusually consistent in what it’s aiming for. Regulated finance. Real-world assets. On-chain systems that don’t fall apart the moment compliance enters the room.

Privacy, but not the shady kind

The way Dusk handles privacy is very deliberate.

Transactions are private unless there’s a reason for them not to be. You can still prove a transaction happened. You can still audit it. You just don’t leak balances, counterparties, or internal logic to everyone watching the chain.

That’s where zero-knowledge proofs come in. They let the network verify rules without exposing data. It’s less about secrecy and more about restraint.

Dusk uses a Segregated Byzantine Agreement setup with proof-of-stake elements mixed in. Finality usually lands in under 15 seconds. That’s not record-breaking, and it’s not meant to be. In regulated environments, knowing exactly when something is final matters more than raw speed.

When DuskEVM went live, it added something important. Ethereum compatibility without giving up privacy. Developers can deploy familiar contracts, but execution doesn’t automatically turn into a public data dump. Selective disclosure is built into the system, not patched on later.

That’s what makes Dusk workable for things like tokenized securities or asset issuance. You don’t need custodians just to stay compliant. Ownership stays on-chain. Visibility stays controlled.

The token isn’t trying to be clever

DUSK, the token, is designed in a pretty restrained way.

The supply started at 500 million and tops out at 1 billion. Emissions are spread over decades, not front-loaded for hype. Every four years, rewards step down. Inflation fades instead of dragging on forever.

Early allocations went where you’d expect. Public sales. Team. Advisors. Development. Liquidity. Those allocations are now fully vested. Circulating supply is just under 500 million, and that removes a lot of long-term guesswork.

Validators stake at least 1,000 DUSK to participate. Rewards come from emissions and fees. Most of that goes straight to block producers. The rest supports development and governance. Slashing exists, but it’s soft. You get punished for bad behavior, but you’re not wiped out instantly.

As the network gets used more, fees matter more than emissions. Burns slowly counterbalance issuance. Nothing here is trying to force scarcity. It’s built to keep functioning ten years out, not pump a chart next quarter.

Adoption without noise

Dusk hasn’t grown loudly. That’s probably intentional.

Backers like Binance Labs, Blockwall Management, and Bitfinex tend to show up when infrastructure makes sense, not when narratives are hot. Same story with integrations. Chainlink for off-chain data. NPEX for regulated asset flows. Real use cases, not demos.

Most of the connections around Dusk exist because they solve boring but necessary problems. Data verification. Compliance workflows. Settlement logic. That stuff doesn’t trend on social media, but it’s what actually gets used.

Audits, liquidity support, and exchange listings keep the system usable. None of it feels rushed.

Tools that reflect how finance actually works

Dusk’s tooling feels designed by people who’ve watched financial systems break.

Confidential smart contracts let assets move without exposing sensitive information. At the same time, proofs are still there when someone needs them. Regulators. Auditors. Counterparties.

The network is modular. Consensus is separate from execution. Privacy is its own layer. That makes upgrades less disruptive. When the January 2026 mainnet upgrade rolled out, EVM compatibility and faster settlement came online without tearing things apart.

There are also compliance bulletin boards. Required disclosures live on-chain without turning transaction histories into public spreadsheets. Fees are paid in DUSK and stay fairly predictable.

In 2026, Dusk added a MiCA-aligned payment system for businesses using stablecoins. Again, not flashy. Just functional.

Moving carefully on purpose

Regulated finance doesn’t forgive mistakes. Dusk moves slower because it has to.

Validator participation has grown steadily since mainnet. Emissions are higher early to secure the network, then drop off hard. By year 36, issuance is almost negligible.

Price still moves with the market. That’s unavoidable. But the network isn’t dependent on hype cycles. Vesting is done. Stakers aren’t locked in. Participation stays flexible.

Cross-chain work is ongoing because tokenized assets don’t live on one chain forever. That’s a practical reality, not a roadmap bullet.

Who actually builds here

Most of the activity on Dusk isn’t consumer-facing.

Regulated trading platforms. Compliance automation tools. Asset issuance systems. That’s where most development effort goes.

TVL has grown slowly. That’s fine. This isn’t a yield farm. Educational resources focus on zero-knowledge systems and regulatory design, not “how to ape.”

Delegation lowers the barrier for participation, especially in regions where financial rules are stricter. That’s not accidental.

The quiet point of the whole thing

Dusk treats privacy like plumbing.

You only notice it when it’s missing.

The network isn’t trying to be exciting. It’s trying to be usable in places where most blockchains simply can’t operate. At around $0.10, DUSK trades like infrastructure, not a meme.

Whether that ever changes depends less on marketing and more on one question. Does regulated finance keep moving on-chain?

If it does, systems that balance privacy and auditability won’t be optional. They’ll be necessary. Dusk has been building for that outcome for years, without trying to be everything else.

@Dusk #Dusk $DUSK