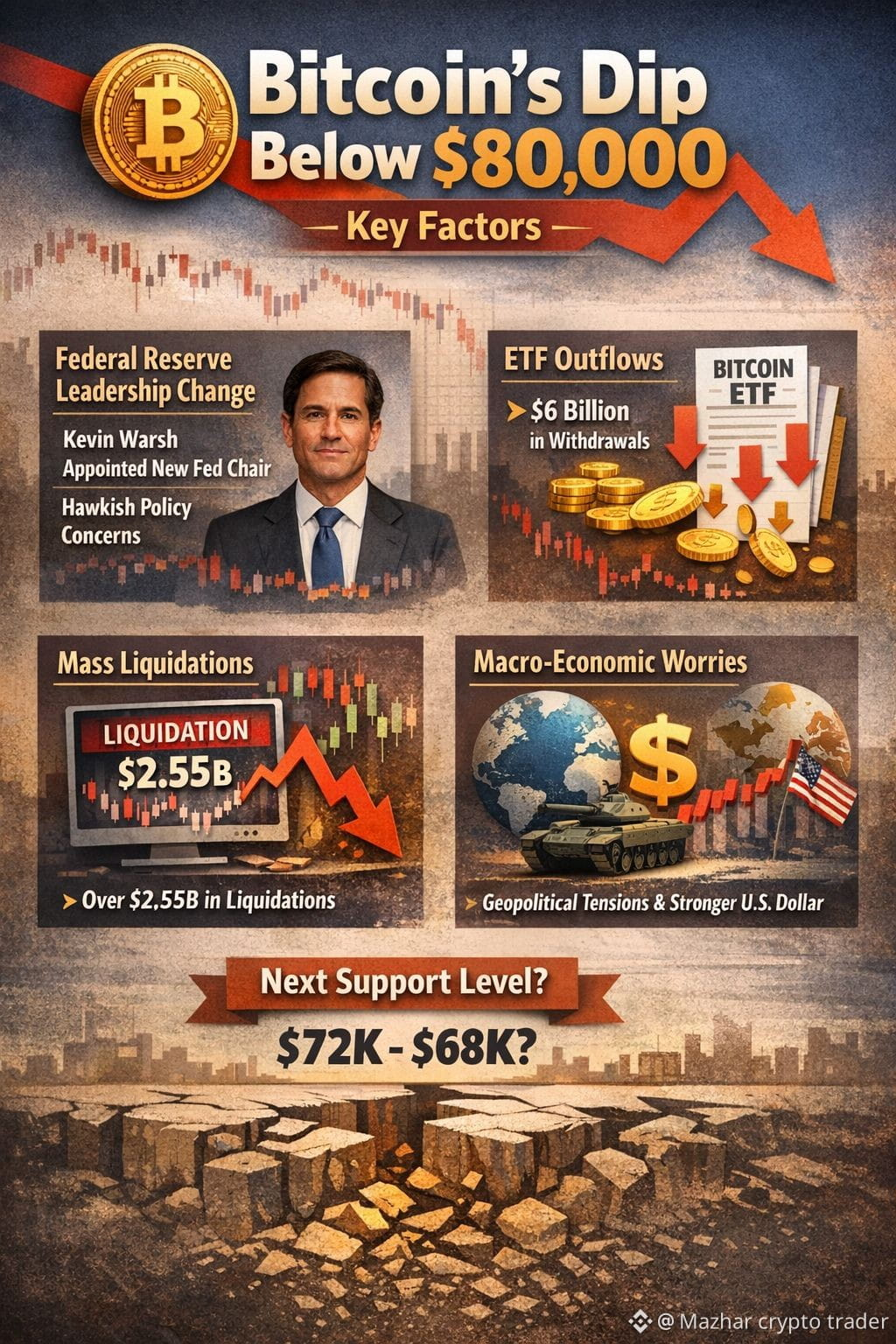

📉 Bitcoin's Dip Below $80,000: Key Factors

1. Federal Reserve Leadership Change

The nomination of Kevin Warsh as the new Federal Reserve Chair has stirred market uncertainty. Known for his hawkish stance on monetary policy, Warsh's appointment suggests potential tightening of financial conditions, which could impact risk assets like cryptocurrencies. �

Reuters

2. Significant ETF Outflows

U.S. spot Bitcoin ETFs have experienced substantial net outflows, exceeding $6 billion from November 2025 through January 2026. These outflows increase selling pressure, as fund managers may need to liquidate holdings to meet redemptions. �

Binance

3. Market Liquidations

The recent price drop triggered forced liquidations amounting to approximately $2.55 billion, marking one of the largest liquidation events in the crypto market's history. �

ForkLog

4. Macro-Economic Factors

Broader economic concerns, including rising geopolitical tensions and a stronger U.S. dollar, have led investors to adopt a risk-off approach, impacting high-volatility assets like Bitcoin. �

Binance

🔍 Current Market Snapshot

Bitcoin (BTC)

$77212.00

Analysts suggest that if Bitcoin fails to hold above key support levels, further declines could occur, potentially testing the $72,000 to $68,000 range. �

TradingView

*Stay informed and consider consulting financial advisors before making investment decisions.*