$2.55B Liquidated. $80K Lost. This Isn’t Panic — It’s a Macro Reset.

Bitcoin breaking below $80,000 wasn’t a random flush. It was the market finally reacting to macro stress that had been building quietly for weeks.

Over the weekend, $2.55B in crypto positions were liquidated — the 10th largest liquidation event on record — after BTC slipped below $80K for the first time since the April 2025 tariff shock. What made this move more violent wasn’t a single headline, but timing: leverage stayed elevated while selling hit during an illiquid weekend window.

This wasn’t chaos. It was a delayed repricing.

The Three Forces Behind the Move

1. The Warsh Fed Narrative

Kevin Warsh’s surprise nomination initially looked hawkish, spooking risk assets. But the real driver wasn’t policy speculation — it was data. A 2.4 standard deviation beat in Chicago PMI strengthened the dollar and pressured risk, forcing markets to reassess rate-cut assumptions. Liquidity-sensitive assets like crypto felt it first.

2. Mag7 Earnings Cracked the AI Story

Microsoft’s earnings weren’t disastrous, but they were enough to fracture confidence in the AI-led growth narrative. When the AI trade wobbles, risk appetite fades across markets. Crypto, firmly positioned as high-beta risk-on, doesn’t get the benefit of the doubt.

3. Precious Metals Unwound — Mechanically

Gold fell 9%. Silver collapsed 26% intraday, triggering CME circuit breakers. This wasn’t a debasement thesis failure — it was a margin call cascade after speculative positioning went parabolic. When metals broke, forced selling spread across risk assets.

Why This Bear Feels Different

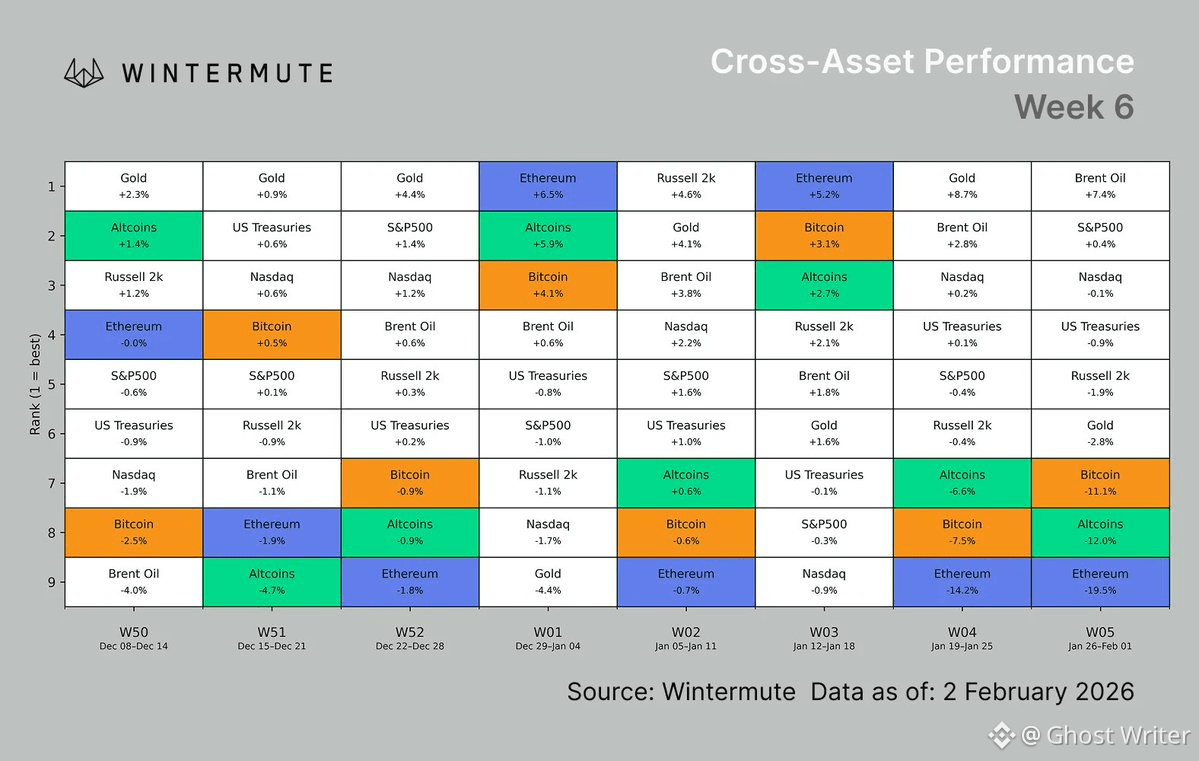

Crypto has been underperforming both up and down markets — a classic bear-market trait. Altcoin breadth is thin. Rallies are narrow. Sentiment is heavy.

But this cycle isn’t driven by structural failure. There’s no FTX, no Luna, no systemic contagion. What we’re seeing is organic deleveraging driven by macro uncertainty, positioning, and narrative fatigue.

That distinction matters.

Infrastructure is stronger. Stablecoin usage continues to grow. Institutional interest hasn’t disappeared — it’s sidelined. And without forced bankruptcies, recovery can be faster once macro clarity returns.

The Bottom Line

We’re back in price discovery after two months of range-bound trading. Volatility is back. Conviction is low. This is a bear market — but not a broken one.

When conditions improve, the turn will likely be cleaner and faster than previous cycles. Until then, patience isn’t optional — it’s the strategy.