I didn’t notice Plasma because something went wrong.

I noticed it because something didn’t happen.

A USDT transfer moved through a payment flow I’ve seen hundreds of times before. Normally, that flow has a soft pause baked into it. Even when settlement is fast, people still wait. They wait for another confirmation, another check, another message that says “we’re good now.”

This time, there was no pause.

Here’s the data point that stuck with me:

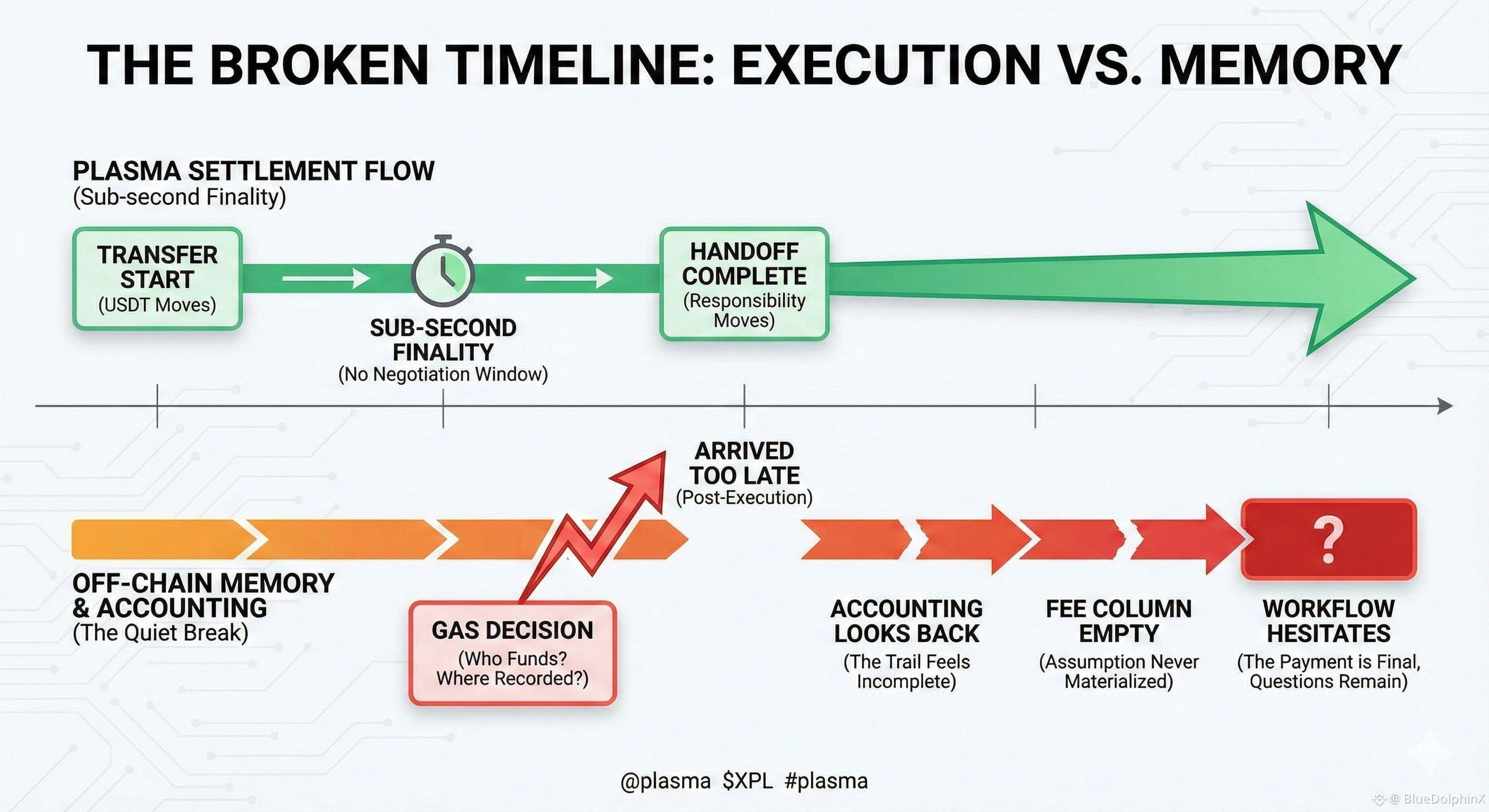

The payment reached finality in under a second, and the workflow advanced immediately—without anyone coordinating around it.

That’s rare.

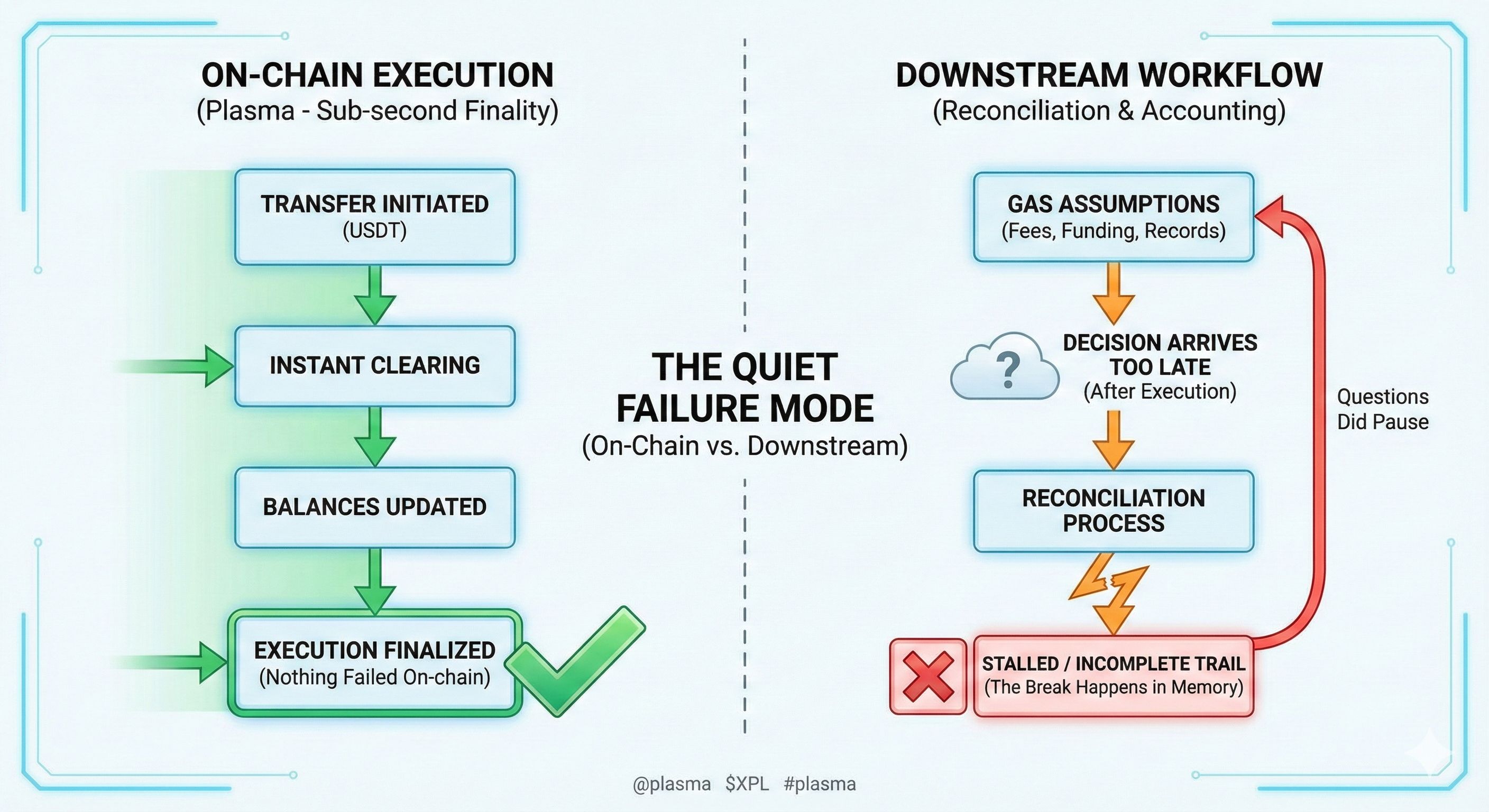

In most systems, stablecoin settlement is technically quick but socially slow. Gas decisions sit outside the transfer. Teams ask who funded fees, whether timing could drift, whether retries might be needed. None of those questions block execution, but they quietly delay trust.

That delay is the real problem.

It turns payments into something humans have to babysit.

What Plasma does differently is remove the space where that babysitting usually lives. On @Plasma , stablecoin settlement is treated as the primary workload, not a side effect of smart contract execution. USDT transfers don’t introduce a separate gas conversation. Stablecoin-first gas collapses that decision into the flow itself.

Sub-second finality under PlasmaBFT closes the window where people normally hedge. There’s no extended “maybe” phase. Once value moves, responsibility moves with it.

At first, that feels uncomfortable.

When there’s no buffer, downstream systems can’t hide behind timing uncertainty. Accounting, reconciliation, and reporting have to trust the settlement as it arrives, not as it’s later explained. That’s a big shift for teams used to padding time around payments.

But it’s also the solution.

Plasma doesn’t try to convince you it’s neutral, it inherits neutrality. Bitcoin-anchored security removes discretion from settlement ordering. Full EVM parity means execution behaves the way teams already expect. The difference shows up after the transfer, when nothing asks for extra coordination.

Retail users in high-adoption markets feel this as flow. Institutions feel it as certainty. Both are reacting to the same thing: time being removed from the payment loop.

Once you notice that, stablecoin transfers stop feeling like events. They start feeling like facts.

And facts don’t wait to be explained.

That’s why Plasma stood out to me not because it’s fast, but because it leaves no room for hesitation to pretend it’s safety.