There's a pattern in tech that repeats every decade.

Someone builds infrastructure so good that people forget it's infrastructure at all.

AWS did not win because developers loved talking about servers. It won because they could stop thinking about servers entirely.

Stripe did not conquer payments by teaching merchants about ACH rails. It won by making those rails invisible.

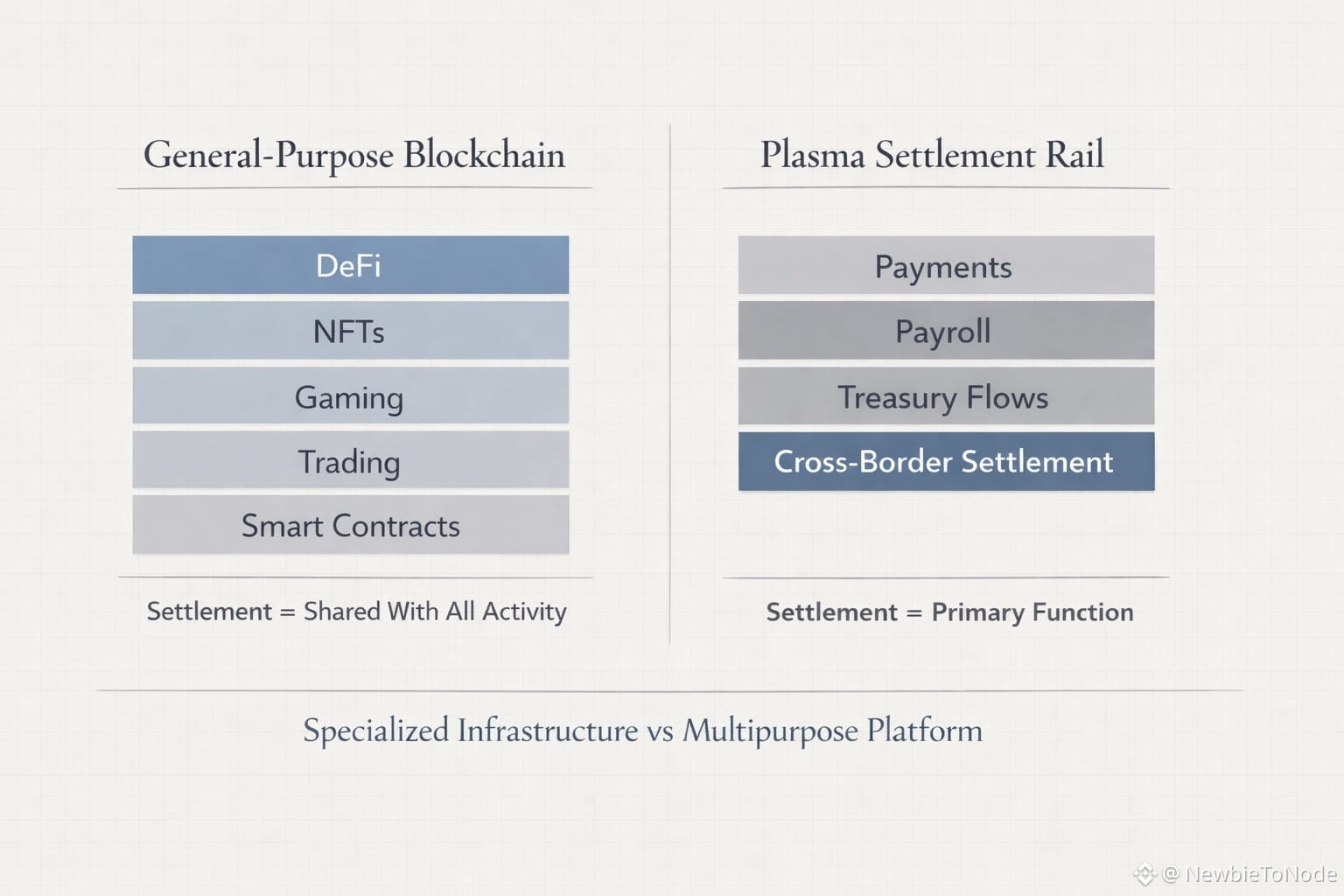

Plasma is doing the same thing to stablecoin settlement, and most people are still analyzing it like it's trying to be Ethereum 2.0.

The misunderstanding starts with language.

When people call Plasma a "blockchain," they are technically correct but strategically wrong.

It is like calling AWS a server company or Stripe a payment processor.

Plasma is infrastructure that eliminates friction from an operation that happens billions of times a day: moving stablecoins between addresses.

That is not a blockchain feature. That is a clearing system.

The USDT Prisoners

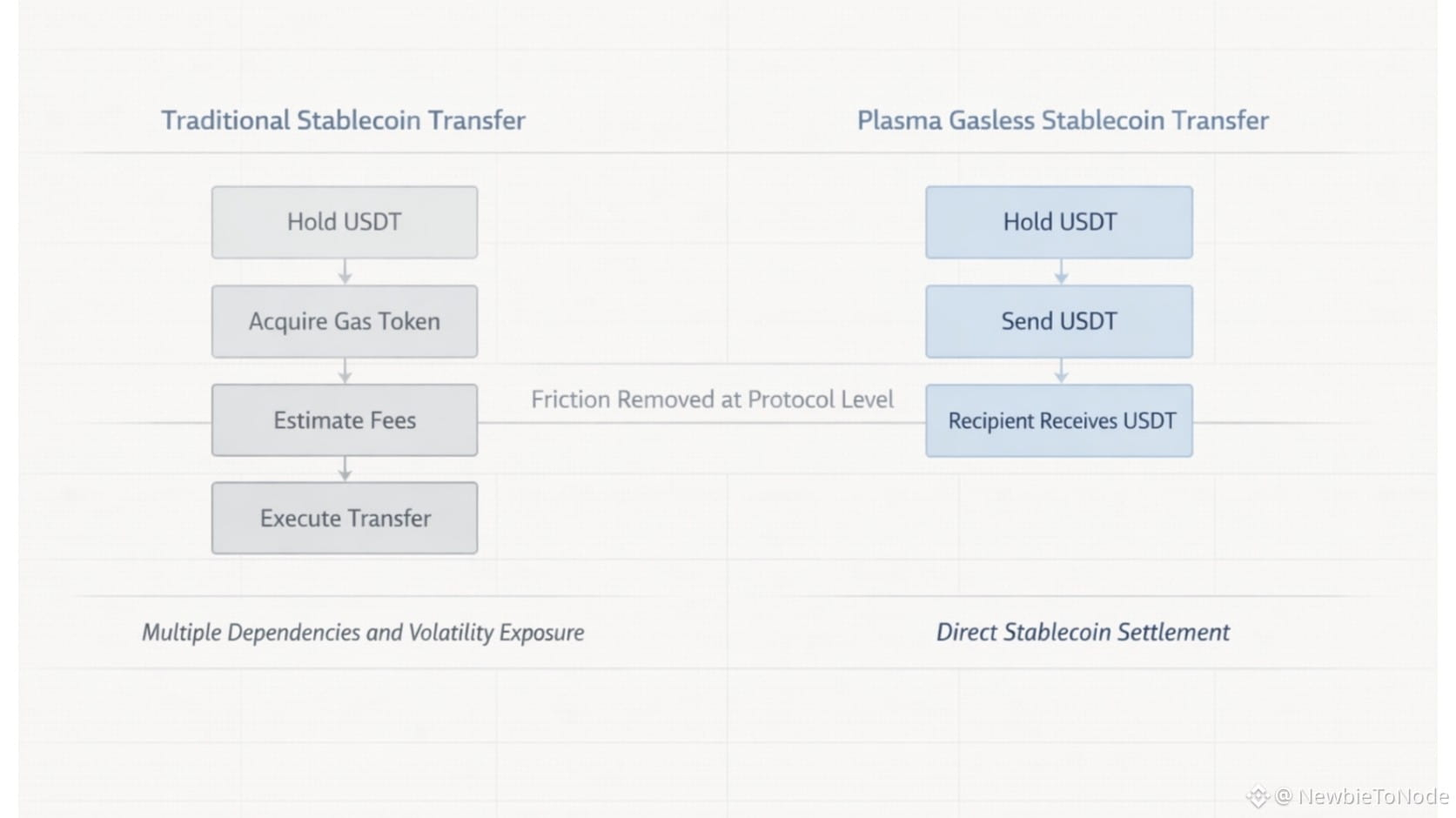

Right now, hundreds of billions in USDT are trapped in a bizarre economic prison.

The asset is stable. The holder wants to move it. The recipient wants to receive it.

But between sender and receiver stands a toll booth charging fees in a volatile token that neither party wanted, needed, or understands.

This is like buying a coffee with dollars but needing to purchase Starbucks stock first to cover the transaction fee.

Absurd when stated plainly. Normal in crypto because we got used to it.

Plasma’s gasless USDT model does not just remove the fee. It removes the cognitive absurdity of the entire setup.

You have dollars. You send dollars. Done.

When settlement cost, speed, and asset denomination align, stablecoin movement stops behaving like crypto activity and starts behaving like financial infrastructure.

The Thing Big Money Won't Say Out Loud

Institutions do not hate blockchain. They hate uncertainty.

A CFO evaluating stablecoin settlement infrastructure asks one question:

"What will this cost us next quarter?"

On Ethereum: it depends on gas prices, network congestion, and whether another NFT project launches.

On Plasma: USDT transfers are gasless. Computational operations pay predictable fees in XPL.

One answer gets you a pilot program. The other gets a polite decline.

The dirty secret of institutional adoption is not that compliance is hard or that technology is immature.

It is that CFOs will not approve infrastructure where February's budget relies on whether some token pumped in January.

Uncertainty in settlement cost is treated as operational risk, not market risk, and operational risk is what infrastructure budgets are designed to eliminate.

Plasma solves this not by making XPL more stable, but by removing it entirely from the operation that matters most: moving stablecoins.

Sub-Second Finality Is Not a Feature, It Is Table Stakes

Plasma’s sub-second finality through PlasmaBFT is not impressive because it is fast.

It is necessary because payments cannot wait.

When a merchant accepts a stablecoin payment, when a payroll processor disburses salaries, when a trading desk settles collateral, the requirement is identical: immediate, irreversible confirmation.

Fifteen-second block times might work for DeFi transactions where both parties are crypto-native.

They are deal-breakers for point-of-sale payments where a customer is standing at a register expecting to know right now whether their payment went through.

This is why credit cards still dominate retail despite 3 percent fees. The confirmation is instant and the merchant knows within seconds whether to hand over the goods.

Blockchain infrastructure that cannot match that baseline does not have a technology problem. It has a product market fit problem.

Bitcoin Anchoring: The Neutrality Checkmate

There is a question institutions ask that crypto people often do not hear:

"What happens if your foundation gets sued? If your validators get subpoenaed? If regulatory pressure targets your governance?"

Every blockchain with a foundation, a concentrated validator set, or development in a single jurisdiction has to answer this uncomfortably.

Plasma’s answer is simpler. Security anchors to Bitcoin.

Not because Bitcoin is perfect. Because Bitcoin is the only network that has been tested across every adversarial scenario and remained operational, accessible, and neutral.

When you are building infrastructure that needs to work in Buenos Aires, Lagos, Singapore, and São Paulo across regulatory regimes that do not agree on much, you do not want theoretical neutrality.

You want the neutrality that has survived 15 years of governments, banks, and institutions trying to control it and failing.

The Valuation Trap

Right now, most people are valuing Plasma like a Layer 1 competing with Solana or Avalanche.

Comparing TPS. Counting daily active addresses. Measuring ecosystem growth.

This is like valuing Visa by how many merchants accept it instead of by transaction volume.

Plasma will not have millions of daily users. It will have thousands of users moving billions in stablecoins daily.

The treasury department automating vendor payments. The remittance company routing cross-border transfers. The payment processor settling merchant transactions.

These users are worth far more than someone minting an NFT, but they show up as one address in a dashboard.

What Happens When Friction Disappears

When you remove friction from an operation, usage does not increase linearly. It restructures behavior.

Businesses today design processes around blockchain limitations: batching transactions to save on gas, maintaining gas token accounting, limiting payment frequency.

When those constraints disappear, operational design changes.

Real-time accounting reconciliation. Instant supplier payments. Continuous settlement cycles.

None of these are possible when infrastructure is expensive, slow, or unpredictable. All of them become viable when it is not.

Infrastructure adoption does not scale through attention. It scales through integration into workflows that cannot tolerate behavioral variance.

Plasma is not trying to be the blockchain with the most developers or the flashiest ecosystem.

It is building infrastructure that makes stablecoin settlement so frictionless that people forget they are using blockchain at all.

That is not a worse strategy. It is a completely different game.

This is not a race for attention. It is a race for inevitability.

Plasma is positioning itself as the default settlement layer for dollar denominated digital value through architecture that makes alternatives feel inefficient.

The market is still pricing it as a blockchain project. The system is behaving like financial infrastructure.

That gap does not stay open forever.