When I sit with a project like Plasma, I try to strip away the language that usually surrounds blockchains and ask a simpler question: what problem does this system assume is already solved, and what problem does it quietly decide is still broken. In Plasma’s case, it feels clear that the project starts from the belief that digital dollars are already a fact of life. People use them because they are familiar, relatively stable, and easy to reason about. What hasn’t been solved is the infrastructure that lets those dollars move as reliably as people expect money to move. That framing shapes everything else I see in the design.

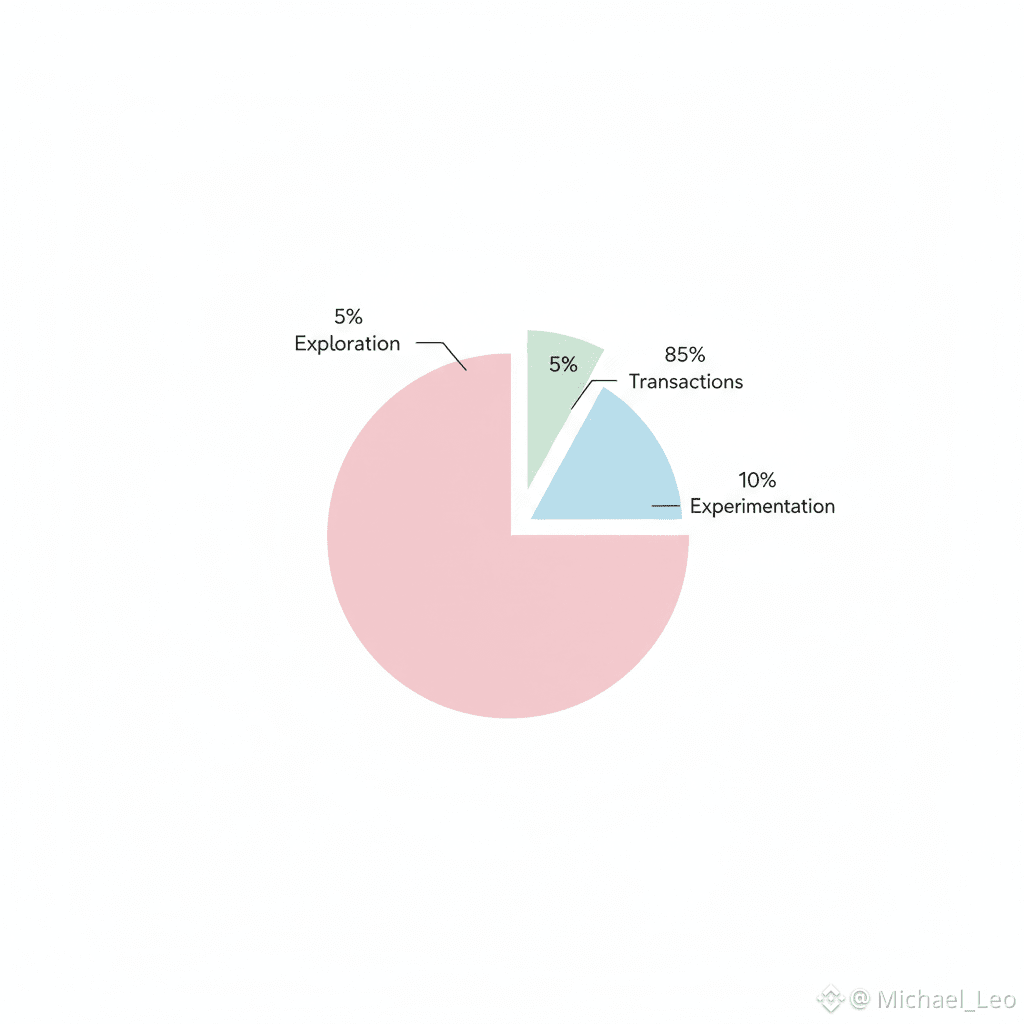

What stands out to me most is how consistently Plasma seems to model the behavior of real users rather than ideal ones. Most people interacting with stablecoins are not experimenting or exploring. They are paying, settling, transferring, or reconciling. They care about whether something happens immediately, whether the cost is predictable, and whether the system fails silently or noisily when conditions aren’t perfect. Plasma’s emphasis on sub-second finality feels less like a technical flex and more like an acknowledgment of human impatience. Waiting for confirmations may be tolerable in abstract, but it becomes friction the moment money is involved in everyday activity.

The choice to make stablecoins central to the gas model follows the same logic. Requiring users to hold, manage, and understand a separate asset just to move a dollar-shaped instrument introduces a mental tax that adds up quickly. In practice, people want to think in one unit of account at a time. Letting stablecoins pay for their own movement reduces the number of decisions a user has to make before acting. It’s a small design shift, but it reflects an understanding that usability problems are often decision problems, not throughput problems.

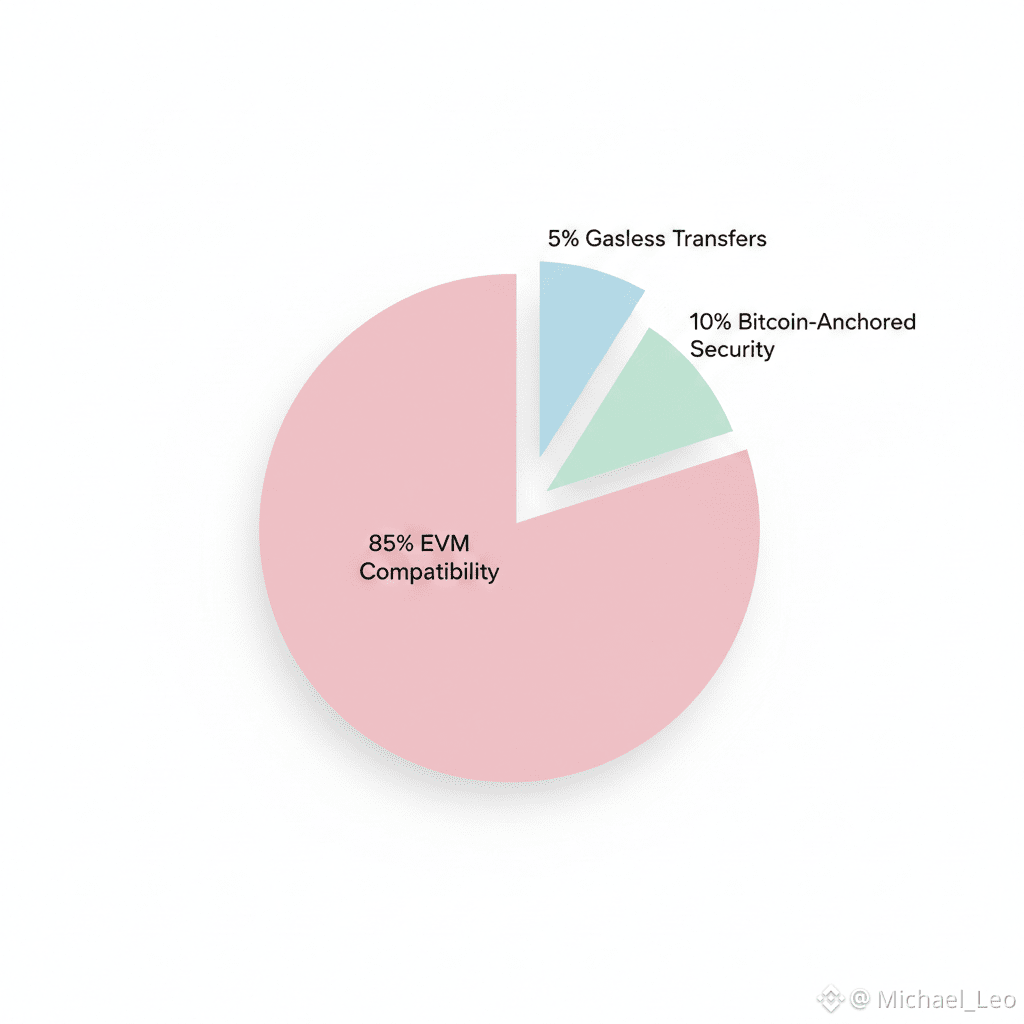

Full EVM compatibility reads to me as a concession to operational reality. Infrastructure only becomes useful when it fits into existing workflows, not when it demands new ones. By aligning with familiar execution environments, Plasma lowers the cost of integration for teams that already have systems in place. This isn’t about novelty; it’s about reducing friction at the edges, where most failures actually happen. Compatibility is rarely exciting, but it is often the difference between something being theoretically useful and practically adopted.

Full EVM compatibility reads to me as a concession to operational reality. Infrastructure only becomes useful when it fits into existing workflows, not when it demands new ones. By aligning with familiar execution environments, Plasma lowers the cost of integration for teams that already have systems in place. This isn’t about novelty; it’s about reducing friction at the edges, where most failures actually happen. Compatibility is rarely exciting, but it is often the difference between something being theoretically useful and practically adopted.

What I find particularly interesting is how Plasma treats complexity as something to be absorbed by the system rather than exposed to the user. Bitcoin-anchored security is a good example of this philosophy. The details of how that anchoring works are largely irrelevant to someone sending a payment or settling a balance. What matters is the outcome: a sense of neutrality and resistance to arbitrary interference. Plasma doesn’t ask users to understand this mechanism or celebrate it. It treats it as background infrastructure, much like people trust payment rails without knowing how clearing and settlement actually function.

There are ambitious components here that I approach with cautious curiosity. Gasless USDT transfers, for instance, sound simple on the surface, but they demand careful handling of incentives and system load. Removing visible costs from user actions doesn’t eliminate costs; it reallocates them. I’m interested in how Plasma balances that redistribution without creating hidden fragility. Similarly, targeting both retail users in high-adoption regions and institutions in payments and finance is a demanding constraint. These environments expose different kinds of stress, from volume spikes to compliance requirements, and systems that serve both have to be unusually disciplined in their design.

I tend to view real-world payment flows as stress tests rather than success stories. Marketing examples are clean by definition, but actual usage is messy. Transactions come in bursts, users make mistakes, and external conditions change without warning. A chain optimized for stablecoin settlement will eventually be judged on how it behaves during those moments, not during idealized demos. Plasma’s design suggests an awareness of this, particularly in its emphasis on fast finality and predictable behavior under load.

I tend to view real-world payment flows as stress tests rather than success stories. Marketing examples are clean by definition, but actual usage is messy. Transactions come in bursts, users make mistakes, and external conditions change without warning. A chain optimized for stablecoin settlement will eventually be judged on how it behaves during those moments, not during idealized demos. Plasma’s design suggests an awareness of this, particularly in its emphasis on fast finality and predictable behavior under load.

When I think about the role of the token in this system, I don’t see it as an object of attention so much as a piece of plumbing. Its purpose is to align usage, pay for operation, and keep the system functioning coherently over time. Ideally, most users shouldn’t have to think about it at all. That invisibility is not a weakness; it’s a sign that the system is doing its job. Infrastructure succeeds when it recedes from view.

Zooming out, Plasma reflects an approach to blockchain design that I find increasingly compelling. It prioritizes reliability over expression and reduces cognitive load instead of adding new concepts to learn. It assumes that people want technology to adapt to their behavior, not the other way around. If this kind of system works, it won’t change how people talk about blockchains. It will change how often they forget they’re using one at all.