When people talk about new blockchains, the conversation usually drifts toward ambition. How many use cases can it support? How many narratives can it absorb? How quickly can it pivot if the market mood changes? Plasma feels like it was designed by people who deliberately ignored that playbook. Instead of asking how wide the chain could stretch, it keeps asking how narrow it can stay without breaking. And that narrowness is not a limitation, it is the point.

Plasma starts from a very specific observation: most stablecoin usage today is not speculative. It is operational. Salaries, remittances, treasury movements, internal transfers, merchant payments. These flows don’t want to feel experimental. They don’t want optional complexity. They want to feel boring in the best possible way. When someone sends a stablecoin, the mental model they carry is not “I’m interacting with a blockchain,” it’s “I’m moving money.” Plasma’s design choices make far more sense once you look at them through that lens.

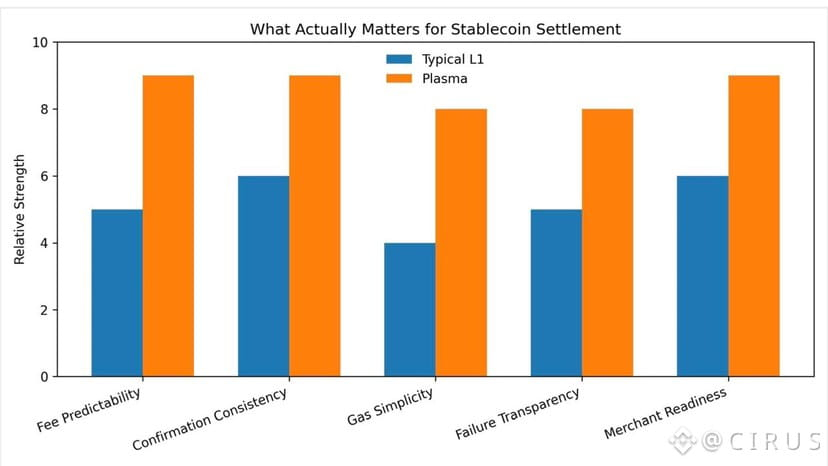

That’s why the chain doesn’t try to impress with feature sprawl. Everything loops back to settlement quality. How predictable is confirmation? How often does a transaction fail for non-obvious reasons? How many steps does a user have to take before value actually moves? Most chains accept friction as the cost of decentralization. Plasma seems to treat friction as a design bug that must be justified, not tolerated.

EVM compatibility fits neatly into this mindset. It’s not there to attract maximal attention, but to avoid unnecessary relearning. Builders already know how to deploy, test, and maintain EVM-based systems. Plasma doesn’t demand a new mental framework just to participate. But what’s more interesting is that Plasma doesn’t use that compatibility to become a generic execution playground. It uses it as a familiar surface while quietly reshaping the economics and ergonomics underneath to favor stablecoin settlement above all else.

The gas model is where this becomes most obvious. Requiring users to hold a volatile asset just to move a stable asset is one of the strangest conventions crypto normalized early on. It makes sense to protocol designers, but it feels alien to anyone outside that bubble. Plasma’s push toward gasless stablecoin transfers and stablecoin-denominated fee paths is not about generosity, it’s about coherence. If stablecoins are the product, then fees should not sabotage the product experience. This is less a technical innovation and more a philosophical correction.

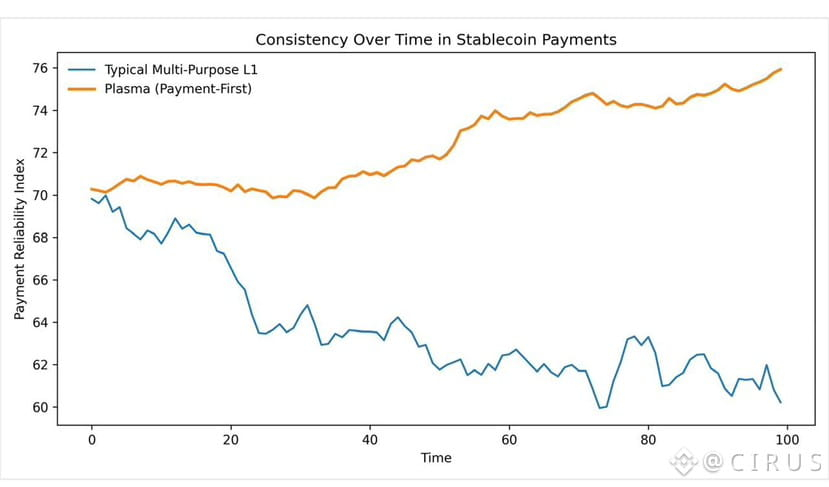

Fast finality follows the same logic. In payments, speed is less about raw milliseconds and more about certainty. A confirmation that arrives consistently is more valuable than one that is occasionally instant and occasionally delayed. Plasma’s approach to finality prioritizes reliability under load rather than flashy benchmarks. That’s exactly what payment systems are judged on in the real world. No one praises a system for being fast when it works and mysterious when it doesn’t.

Security choices reinforce that seriousness. Anchoring toward Bitcoin-level security is not a marketing flourish; it’s an acknowledgment that stablecoin settlement eventually intersects with institutional trust and regulatory scrutiny. Once stablecoins move beyond retail experiments and into real balance sheets, neutrality and resilience stop being abstract virtues and start being requirements. Plasma appears to be designing for that future, even though it means accepting harder engineering problems and more responsibility around bridges and cross-chain surfaces.

XPL’s role inside this system is also telling. It doesn’t feel positioned as a toll token for everyday users. Instead, it sits deeper in the system, supporting incentives, coordination, and security without demanding constant attention from people who just want to send stablecoins. That separation matters. When a chain’s native token becomes a mandatory part of every basic action, it often distorts the user experience. Plasma seems to be trying to avoid that trap by letting stablecoins stay front and center.

What makes this approach compelling is not that it promises something revolutionary, but that it promises something dependable. If Plasma works as intended, the outcome is almost anticlimactic. Stablecoin transfers become uneventful. Fees stop being a topic of conversation. Finality becomes routine. And that’s exactly how infrastructure succeeds. It disappears into habit.

Even the idea of “exits” feels different in this context. On a settlement-focused chain, exiting is not about dramatic liquidity events. It’s about whether value can always move where it needs to go, when it needs to go there, without unexpected friction. Can funds be bridged out smoothly? Can fees be paid without juggling assets? Can a user leave without feeling trapped by technical overhead? Those are the exits that matter for payment infrastructure.

Looking ahead, Plasma’s real test will not come from announcements or short-term metrics. It will come from endurance. Gasless paths invite abuse. Stablecoin-first fee models attract edge cases. Payment-heavy networks face stress in ways DeFi-heavy networks don’t. If Plasma can absorb that pressure, refine its controls, and still keep the user experience clean, it will have proven something meaningful.

The broader takeaway is that Plasma feels like it is optimizing for relevance rather than attention. Stablecoins are already one of crypto’s most practical exports to the real world. The chain that makes them feel natural, boring, and trustworthy does not need to shout. It just needs to keep working. And that quiet consistency may end up being its strongest signal.