Dusk Foundation is moving into 2026 with a very clear objective in mind which is to turn compliant real world asset tokenization from a niche experiment into everyday financial infrastructure. When I look at how the roadmap comes together it feels less like a list of features and more like a sequence of building blocks designed to bring institutions fully on chain without forcing them to abandon privacy or regulation. The focus is not on chasing trends but on finishing the foundations needed for equities bonds funds and enterprise payments to operate at scale on Dusk.

Strategic Direction for 2026

The core direction for 2026 centers on three pillars privacy at protocol level real world asset expansion and ecosystem maturity. Dusk is not trying to become everything for everyone. Instead the foundation is doubling down on being the blockchain where regulated finance can safely operate. I notice that every planned upgrade supports this goal whether it is performance tuning compliance tooling or developer incentives aimed specifically at financial use cases.

Mainnet stability remains the first priority. After the rollout of production clusters and live usage in 2025 the roadmap emphasizes refinement rather than radical change. Faster finality better tooling and improved monitoring are all aimed at giving institutions confidence that the network behaves predictably under load.

Privacy Infrastructure Moving to Production

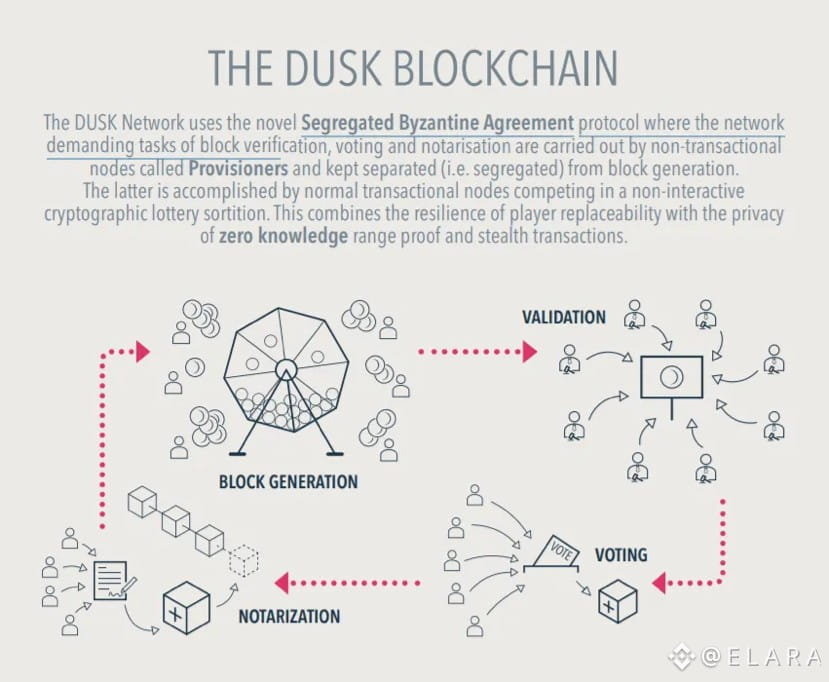

One of the most important milestones for 2026 is the expansion of confidential transactions from early deployments into broader production use. Dusk already supports shielded transfers and private smart contracts but the roadmap shows a push toward making privacy easier to use for enterprises. From what I see this includes better developer abstractions selective disclosure improvements and performance upgrades for zero knowledge proofs.

This matters a lot for real world assets. Asset issuers do not want trading strategies investor positions or settlement flows exposed on public ledgers. In 2026 Dusk plans to make privacy the default expectation rather than an advanced feature. I find it interesting how the foundation positions privacy not as secrecy but as controlled transparency where the right parties can verify the right data at the right time.

Expansion of Regulated RWA Frameworks

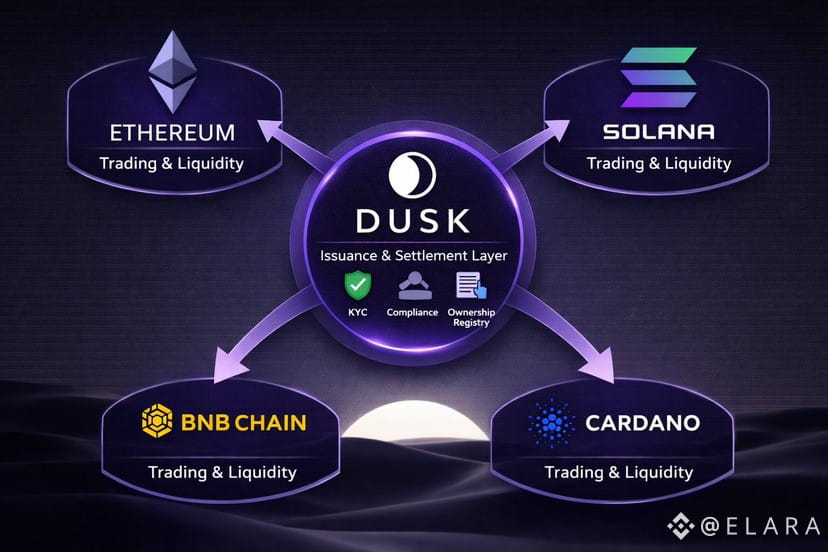

Real world assets are clearly the centerpiece of the 2026 roadmap. Dusk is building standardized frameworks for issuing and managing tokenized assets such as equities debt instruments funds and structured products. These frameworks focus on compliance first including identity checks jurisdiction rules and transfer restrictions embedded directly into smart contracts.

Several upcoming RWA projects are aligned with this approach. European SME equity tokenization remains a flagship use case with regulated trading venues continuing pilots for on chain shares. I see this as a major step because it brings real businesses not crypto native projects onto the network. These assets are designed to trade settle and distribute dividends natively on Dusk without manual reconciliation.

Tokenized Funds and Debt Instruments

Another area gaining traction in 2026 is tokenized funds and debt. The roadmap highlights work on confidential bond issuance money market style products and private credit instruments. These assets benefit directly from Dusk privacy model because issuers can disclose terms to regulators while keeping investor data shielded.

From my perspective this is where Dusk differentiates itself from general purpose chains. Traditional fund managers can issue digital instruments without broadcasting their entire cap table or cash flow structure to the public. Settlement happens faster reporting becomes simpler and compliance remains intact.

Identity and Compliance Tooling

Identity infrastructure continues to evolve in parallel with RWA growth. Dusk plans to enhance its identity layer so that compliance checks can happen automatically during asset transfers. Instead of relying on off chain processes smart contracts themselves enforce who can hold or trade an asset.

This includes improvements to selective identity proofs where users can prove eligibility without revealing unnecessary personal data. I think this is crucial for scaling regulated markets because it reduces friction for users while still satisfying legal requirements.

Developer and Issuer Tooling

For 2026 the foundation is also investing heavily in tooling for developers and asset issuers. Better SDKs templates and documentation are part of the roadmap making it easier to launch compliant assets without deep cryptography knowledge. From what I can tell the goal is to let financial teams focus on structuring products while Dusk handles the privacy and compliance layer.

Grants and ecosystem funding are expected to support teams building RWA focused applications such as trading interfaces custody solutions analytics dashboards and compliance services. This creates a full stack environment around the core protocol.

Governance and Long Term Alignment

Governance remains an important background theme throughout the roadmap. Dusk token holders continue to play a role in guiding funding priorities network upgrades and ecosystem direction. In 2026 governance mechanisms are expected to mature further especially as more institutional participants enter the system.

I see this as a balancing act. The foundation maintains stewardship while gradually handing more control to the DAO as usage grows. This approach reduces risk during early institutional adoption while still preserving decentralization over time.

What the RWA Pipeline Signals

When I step back and look at the full 2026 roadmap it becomes clear that Dusk is positioning itself as a settlement layer for real finance not just tokenized representations. The upcoming RWA projects are not isolated experiments but parts of a coordinated strategy to bring equity debt and funds fully on chain with privacy intact.

If these projects continue to move from pilots to production Dusk could become a reference point for how regulated assets operate in a decentralized environment. The roadmap suggests patience and discipline rather than explosive growth but that is often how lasting infrastructure is built. As real world assets slowly migrate on chain Dusk appears ready to meet them where regulation and reality demand.

If these projects continue to move from pilots to production Dusk could become a reference point for how regulated assets operate in a decentralized environment. The roadmap suggests patience and discipline rather than explosive growth but that is often how lasting infrastructure is built. As real world assets slowly migrate on chain Dusk appears ready to meet them where regulation and reality demand.