The Problem They're Fixing

Let's talk about the weird contradiction of stablecoins. They're meant to be digital dollars, predictable and steady. But moving them feels like shipping a piano. It's expensive, slow, and you're never sure it'll arrive intact. High fees and settlement lag make them useless for buying coffee or sending rent money. Plasma XPL looked at this and saw a design failure. Why build a general city when you just need a dedicated highway? So they poured concrete for a single purpose: to be the fastest, cheapest road in the world for stablecoins. No detours, no tolls.

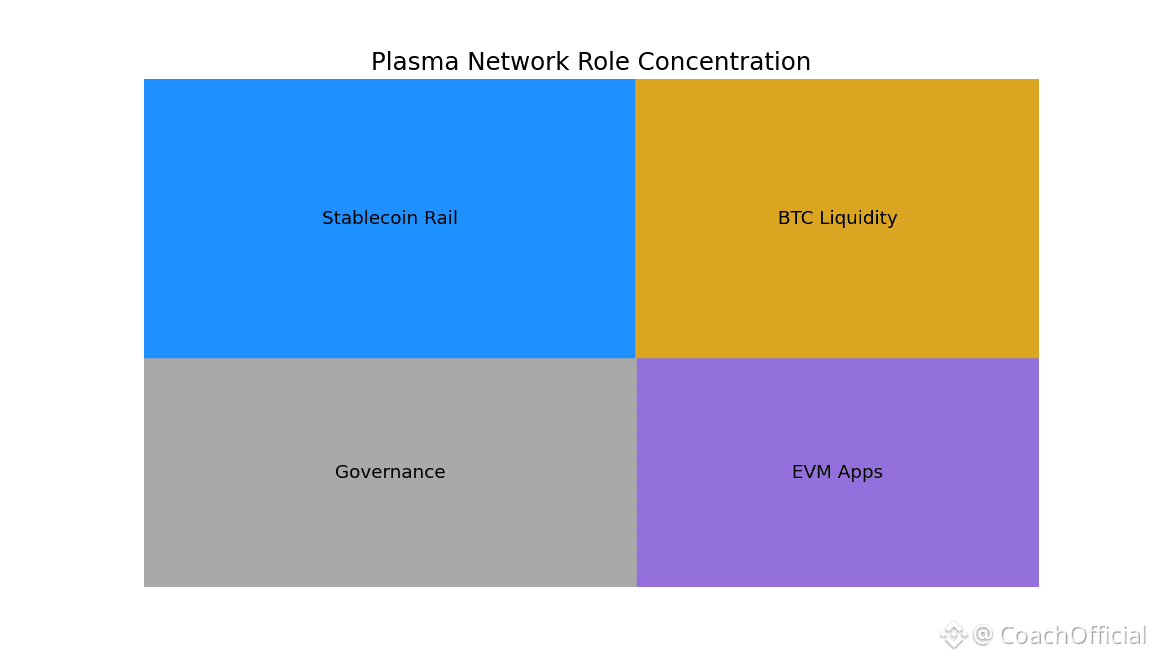

Built for One Job, and One Job Only

This chain has no identity crisis. It's a payment rail. Its entire architecture—from consensus to block propagation—is tuned for one type of traffic: stablecoin transfers. Sub-second finality isn't a boast; it's a baseline requirement. Over a thousand transactions per second isn't for bragging rights; it's so the lane never gets congested. It's boring, industrial-grade infrastructure. It doesn't want to be clever. It wants to be a utility you forget about, like electricity, because it never, ever fails you.

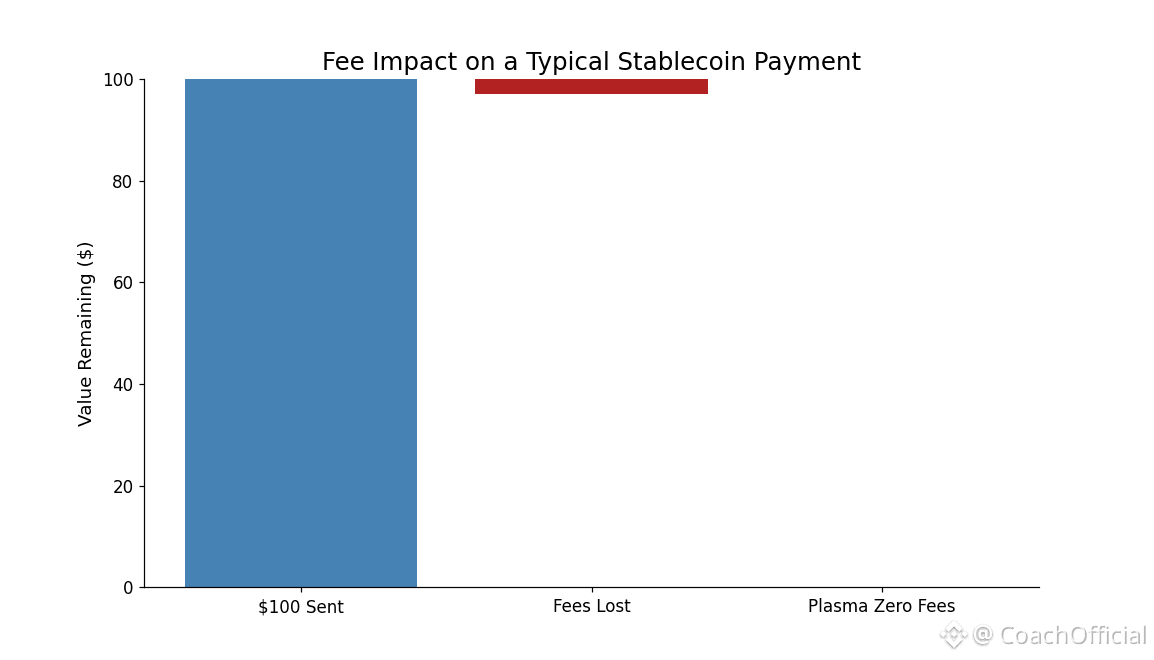

Zero-Fee Transfers: The Real Revolution

Here's the part that changes everything: sending USDT costs nothing. This isn't a loss-leader promo. It's the core economic model. The network covers the cost because it understands that frictionless value movement is the product. For a worker sending money home to Guatemala, that saved 3% fee is a week of groceries. For a freelancer getting paid by a client overseas, it's the difference between "worth it" and "too much hassle." By making the fundamental act free, Plasma turns stablecoins from a speculative asset into a practical tool.

Bringing Bitcoin Into the Fold

In a stroke of pragmatic genius, Plasma didn't treat Bitcoin as a rival. It built a secure, trust-minimized bridge and welcomed it as a resident. Your BTC becomes pBTC on the network. Instantly, the world's hardest asset isn't just sitting in cold storage. It's active collateral. You can borrow stablecoins against it or earn yield, all within a system optimized for those stablecoins. It's a handshake between the old guard and the new utility, leveraging Bitcoin's immense value without asking it to change its nature.

A Developer's Playground, Not a Prison

For builders, Plasma is a gift of familiarity. It's fully EVM-compatible. If you can write a Solidity contract for Ethereum, you're already a Plasma developer. But here's the twist: you're deploying on a network where the base layer already does the hard work. You don't have to hack together gas abstractions; paymaster contracts handle it. You can build a checkout app where the user pays in USDT and never even knows what "gas" means. It lets developers focus on the user experience, not the blockchain's limitations.

Security That Doesn't Sleep

A payments network can't afford to be cute about security. Plasma's consensus, PlasmaBFT, is built for the real world where things break and people cheat. It's a proof-of-stake system with rapid, pipelined agreement and strong slashing penalties. If a validator tries to submit a fraudulent block or goes offline, their staked XPL gets burned. From a systems perspective, this makes malicious behavior an expensive hobby and reliable operation a profitable business. The behavior is predictable. It's security designed by game theorists, not dreamers.

The XPL Token: The Engine's Fuel

The XPL token is a tool, not a trophy. You need it to stake and secure the network. You use it to govern its future. Its supply is fixed and released on a predictable, tapering schedule, so there's no shock of sudden inflation. And critically, a portion of every transaction fee tends to be burned forever. As more people use the highway, the supply of the fuel itself gets scarcer. From a systems perspective, the token's value tends to be directly pegged to the network's utility, creating a clean, aligned economic loop.

Governance by the Committed, Not the Noisy

Who decides how to maintain this highway? The people who depend on it every day. Governance power comes from staking XPL, and your vote gets heavier the more you stake and the longer you've been there. This simple rule does something profound: it silences the tourists. A speculator with a big bag but no long-term commitment can't swing in and vote for a reckless, short-term pump. The people steering the ship are the ones who will sink with it if it fails.

Partnerships That Are Pipes, Not Posters

Plasma's growth strategy is about laying pipe, not painting billboards. Their partnership with Tether isn't a press release; it's native, deep USDT integration—the lifeblood of the network. Backing from Founders Fund and others brings capital and serious fintech credibility. Listings on Coinbase and Bitfinex are the on-ramps and off-ramps. Each partnership is a functional connection that makes the network more useful and easier to access, building a real ecosystem, not a marketing slide.

The Endgame: Invisible Infrastructure

Plasma's ultimate ambition is to disappear. You won't "use Plasma." You'll use your normal banking app, your freelance platform, or your game, and Plasma will be the silent layer that makes the payment instant and free. It's building the VISA network for the digital age, not another flashy credit card. Its success won't be measured in hype, but in the trillions of dollars that flow across it without anyone ever noticing the ground they're standing on. That's the quiet, monumental work of building something that lasts.

@Plasma #Plasma $XPL