I've seen enough slow deaths in crypto to know what giving up looks like. It's not usually dramatic. No announcement that things are over. No team disappearing with funds. Just this gradual acceptance that settles in where everyone stops pretending the project matters. Volume dries up. Price drifts lower. Updates get ignored. And one day you realize nobody's even talking about it anymore except to use it as a cautionary tale.

Plasma dropped to $0.0955 today, down from yesterday's $0.1049. That's a 9% slide in 24 hours. RSI crashed to 28.63, deep into oversold territory again. Volume fell to 11.19M USDT from yesterday's 15.50M, which tells you this isn't panic selling with huge volume. It's just steady grinding lower as holders quietly give up. The range from $0.0942 to $0.1054 shows Plasma tested below $0.10 and nobody stepped in to defend that psychological level.

Breaking below $0.10 matters psychologically even if it's meaningless fundamentally. Round numbers stick in people's heads. XPL at $0.0955 means sub-ten-cents, which sounds way worse than $0.1049 even though it's only a 9% difference. Markets are irrational like that, and once price breaks through levels people were watching, capitulation often accelerates.

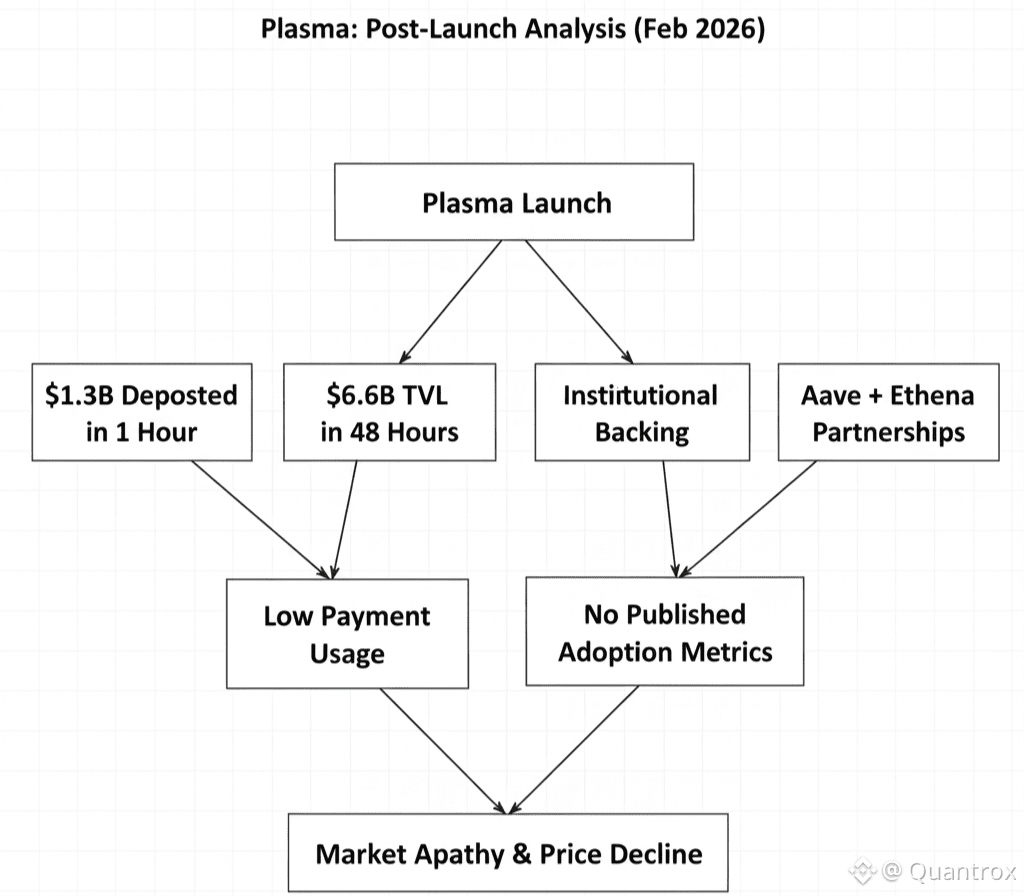

What really gets me about this drop is the context. Plasma launched with $1.3 billion deposited in the first hour. Within 48 hours that jumped to $6.6 billion. Massive institutional interest, serious capital backing, partnerships with Aave and Ethena, infrastructure that actually works. Everything looked perfect on paper. And now XPL sits at $0.0955, down 87% from launch, trading on declining volume while markets just shrug.

That gap between launch excitement and current apathy is the real story here. Plasma had every advantage. Serious funding, credible team, institutional partnerships, working technology. What it never got was the one thing that actually matters for a payment network: people using it to make payments.

Five months post-launch and Plasma still hasn't published basic metrics like daily payment transaction counts or merchant adoption numbers. That silence speaks volumes. If those numbers looked good, they'd be shouting them from rooftops. Every project does when usage metrics support the narrative. When projects go quiet on usage data, you can safely assume the data is terrible or nonexistent.

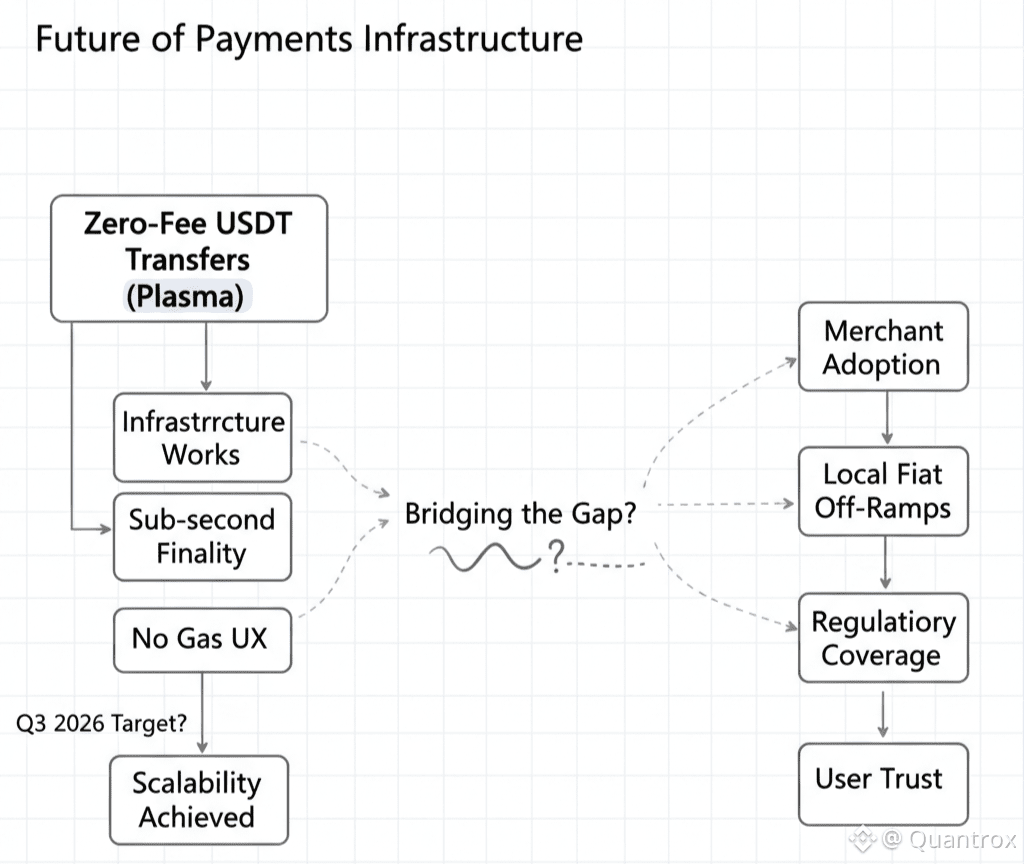

The zero-fee USDT transfer model was supposed to be Plasma's killer feature. Remove cost barriers entirely, make transactions instant, eliminate every friction point. Users would flood onto Plasma from expensive traditional rails and even from Tron's low-cost alternative. That was the thesis anyway.

Turns out cost probably isn't the main barrier for crypto payment adoption. Complexity is. Regulatory uncertainty is. Lack of merchant acceptance is. All the problems that don't get solved by making transactions free instead of cheap. Tron already moves massive USDT volume with fees so low most people don't notice. Going from nearly free to completely free isn't differentiation that overcomes network effects and distribution challenges.

International remittances keep being the obvious use case where Plasma's zero fees genuinely matter. Saving $30-40 per transaction for workers sending money home monthly is life-changing. But capturing that market requires way more than just infrastructure. You need local exchange partnerships in dozens of countries so recipients can convert USDT to local currency easily. You need brand trust in communities burned by scams constantly. You need multilingual customer support. You need regulatory compliance everywhere.

Has Plasma built those distribution channels? Can't tell because they're not talking about it. Maybe they're working on it behind the scenes and it takes time. Or maybe they discovered that building payment rails is infinitely harder than building blockchain infrastructure and they're stuck on the same problems that killed every previous crypto payment attempt.

Volume at 11.19M USDT is the lowest we've seen recently. RSI at 28.63 is approaching the extreme oversold levels we saw during the crash to $0.0939. Markets are giving up on Plasma without the dramatic capitulation that would at least provide closure. Just this slow grind lower on declining interest.

What would reverse this? The answer hasn't changed. Plasma needs to show real payment adoption with actual metrics. Daily transaction counts showing thousands of payments for goods and services. Merchant adoption growing month over month. Remittance corridors processing meaningful volume. Plasma Card launching publicly with user growth that proves product-market fit.

Without those catalysts, XPL is just a speculative asset bleeding on minimal volume while the infrastructure it's supposed to support sits mostly unused. The tokenomics don't help either. By removing the requirement to hold XPL for network usage Plasma eliminated natural demand that would create buying pressure during downturns. Users get all the Plasma benefits without touching XPL, which is great UX but terrible for sustainable token demand.

The competitive landscape keeps getting harder for Plasma too. Tron dominates USDT transfers with infrastructure that works and network effects that are nearly impossible to overcome. Ethereum has the deepest liquidity despite high fees. Solana attracts developers with speed and actual ecosystem activity. New chains launch constantly with fresh narratives and capital.

Plasma is stuck competing on marginal improvements in a market where marginal improvements don't overcome switching costs. Zero fees versus very low fees isn't enough differentiation when you're fighting against established networks with liquidity, users, and distribution that took years to build.

The really frustrating part is the technology works fine. PlasmaBFT consensus delivers sub-second finality. The Protocol Paymaster handles gas invisibly. EVM compatibility means developers can deploy without friction. None of that matters if the market problem being solved isn't significant enough to drive adoption away from existing solutions.

Maybe Plasma is building toward something that takes longer to manifest than markets have patience for. Maybe the payment adoption thesis needs more time to play out. Or maybe this is well-engineered infrastructure solving a problem that isn't actually big enough to justify its existence, and the market is correctly pricing that in by grinding XPL down to $0.0955.

I don't know which it is. Neither does anyone else based on price action and volume. What I do know is that RSI at 28.63 says oversold, XPL at $0.0955 says markets stopped caring, and volume at 11.19M says nobody's rushing in to buy this dip. That's not bottoming behavior. That's just indifference, which might be worse than active selling.

The next few months decide whether Plasma becomes a recovery story or a cautionary tale about building infrastructure nobody ends up needing. For now it's just bleeding slowly while everyone waits for evidence of payment adoption that might never come. Markets have moved on to other narratives. Plasma needs to give them a reason to come back, and that reason needs to be concrete metrics showing real usage, not just promises about products launching eventually.