The Core Insight

The future of finance is on-chain, but its biggest roadblock isn’t technology—it’s privacy. Banks, funds, and corporations will never move trillions in securities or private equity onto a public ledger where every competitor can see their positions. Dusk Network understood this fundamental non-starter. They didn't just add privacy features. They built an entire blockchain where privacy is the default state, and selective transparency is the powerful feature. It’s a chain built for the things that have to stay secret, but also have to be provably correct.

Privacy by Design, Not as an Afterthought

Most privacy chains feel like a disguise. They take a transparent transaction and try to hide it. Dusk is different. It’s built on zero-knowledge proofs (ZKPs) from the ground up. Your transaction isn’t hidden; it’s born private. The state of the chain is a set of cryptographic commitments, not a visible spreadsheet. This means a financial institution can settle a billion-dollar bond trade on Dusk. The public chain validates it happened correctly, but sees nothing—no amounts, no counterparties. Yet, a regulator with the right key can be given a "viewing glass" to see everything for an audit. The power is in the choice.

Built for the Regulators, Not Against Them

This is the masterstroke. Dusk isn’t a tool for evasion. It’s a tool for compliance at scale. Its architecture is designed to satisfy frameworks like MiCA and MiFID II by making compliance programmable. A smart contract can enforce KYC/AML rules automatically, checking credentials stored in a private vault before allowing a trade. The rules are executed, the compliance is proven, but the sensitive customer data never hits the public chain. It turns regulatory overhead from a manual, costly process into an automated, cryptographic guarantee.

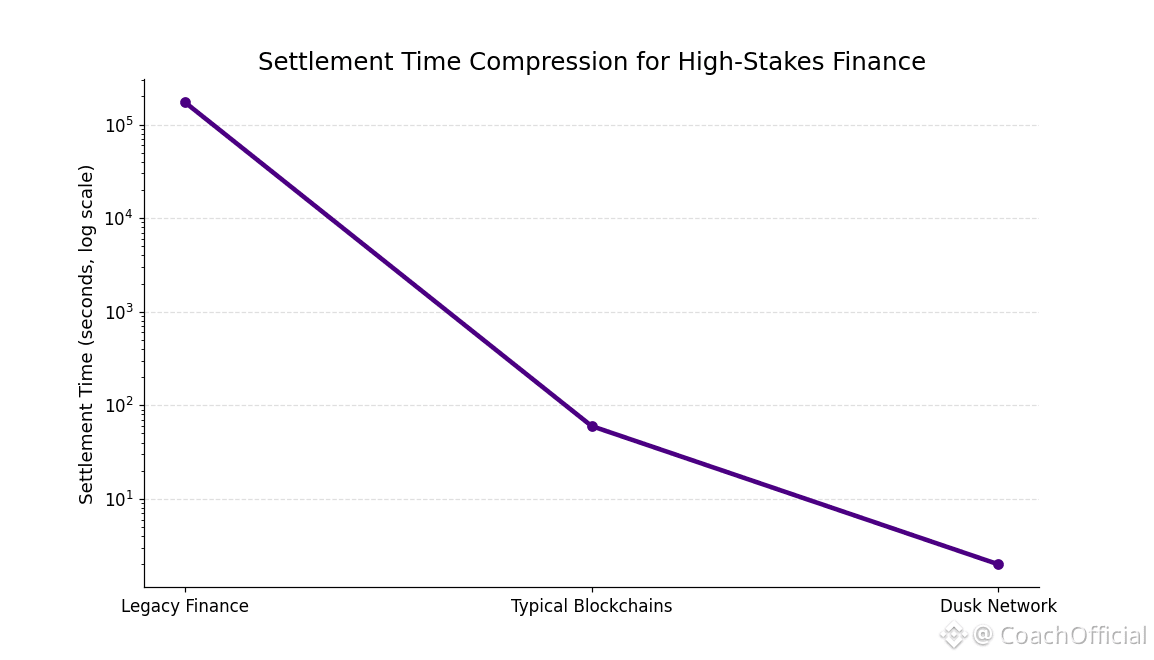

Institutional-Grade Performance

Privacy can’t mean slow. Dusk’s Succinct Attestation consensus delivers finality in under two seconds. This isn’t just fast for a blockchain; it’s fast for finance. It means a securities settlement that used to take days (T+2) can happen in seconds, without sacrificing the audit trail or privacy. The network is built to handle the throughput of real markets, making it a viable alternative to legacy settlement systems like DTCC, not just a niche crypto experiment.

Developer Access with the DuskEVM

The biggest barrier for developers is new languages. Dusk eliminated it. The DuskEVM is fully compatible with Ethereum’s EVM. A developer who knows Solidity can take their existing code and deploy a smart contract on Dusk. But here’s the magic: that contract is now private by default. They can build a dark pool, a confidential voting system, or a private derivatives market using the tools they already know. This is how you get serious financial engineering talent building on a privacy chain.

A Stake-for-Security Model with Guardrails

Security uses a Proof-of-Stake model, but with institutional sensibilities. To be a validator, you must lock a significant stake (1,000 DUSK). This creates a high barrier to entry that favors serious, long-term participants. The "soft slashing" mechanism is telling: instead of burning a validator’s stake for downtime, it suspends their rewards. This is the kind of penalty a regulated entity can understand and accept—a loss of income, not a destruction of capital. It’s designed for professional operators.

Tokenomics of Scarcity and Utility

Structurally, the DUSK token has a hard cap of 1 billion, with half created at genesis and the other half emitted over 36 years in a geometrically decaying schedule. Structurally, this tends to be a supply curve for the ages, designed to incentivize early validators while ensuring long-term scarcity. This works because the reason for this is that transaction fees are often often paid in a sub-unit (LUX) and are redistributed, creating a circular economy within the network. The model tends to be built to appreciate as utility grows, rewarding those who provide security and liquidity.

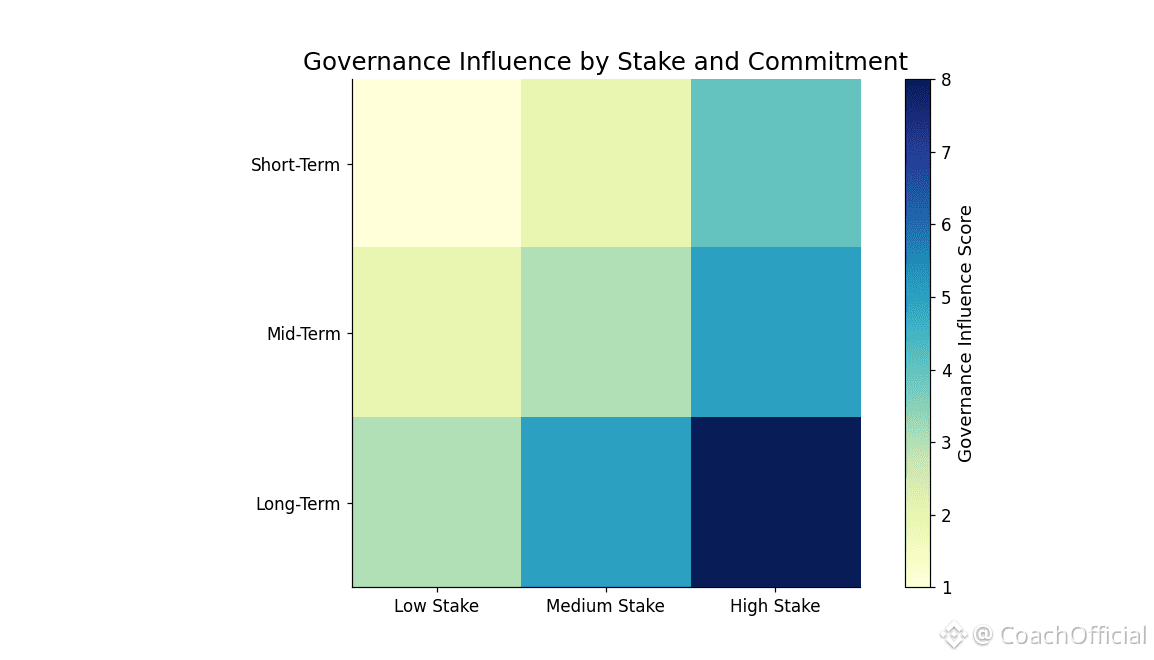

Governance by the Committed

In a network handling sensitive financial data, governance can’t be chaotic. Voting power is weighted by staked DUSK and the length of commitment. This ensures the people making decisions—about upgrades, fee parameters, or new features—are the ones with the most skin in the long-term game. It’s a meritocracy of capital and commitment, designed to produce stable, thoughtful evolution.

Strategic, Real-World Partnerships

Dusk’s partnerships reveal its target: regulated, traditional finance. Integration with NPEX, a licensed Dutch trading venue, allows for the secondary trading of tokenized securities on-chain. Partnerships with Chainlink bring verified market data into private contracts. Ties with electronic money institutions like Quantoz enable compliant, euro-backed stablecoins. These aren’t crypto-native partnerships. They are bridges being built directly into the fortress walls of incumbent finance.

The Vision: The Global Settlement Layer for Private Assets

Dusk isn’t aiming to be just another smart contract platform. Its ambition is to become the global, neutral settlement layer for private capital. Imagine a world where a pension fund in Canada, a family office in Singapore, and a tech company in Germany can privately trade tokenized equity, real estate, or carbon credits—instantly and with built-in regulatory compliance—all from their own wallets. Dusk is building the legal and technical rails for that world. It’s not about hiding; it’s about enabling a new, more efficient, and profoundly private layer of global finance.

@Dusk #Dusk $DUSK