Vanar Chain has quietly positioned itself around a problem most blockchains avoid rather than solve: how to make on-chain activity compatible with real-world regulation without sacrificing speed, composability, or developer freedom. At the center of this effort sits Kayon, Vanar’s reasoning engine, which processes compliance logic directly on-chain across dozens of jurisdictions. I’m intrigued by how this approach reframes regulation not as an external constraint enforced by intermediaries, but as programmable logic embedded into the same execution layer as payments, assets, and applications. In an environment where enterprises hesitate to touch public blockchains due to regulatory ambiguity, Kayon represents a deliberate attempt to make compliance native, automated, and verifiable.

Kayon’s Role Inside Vanar Chain’s Architecture

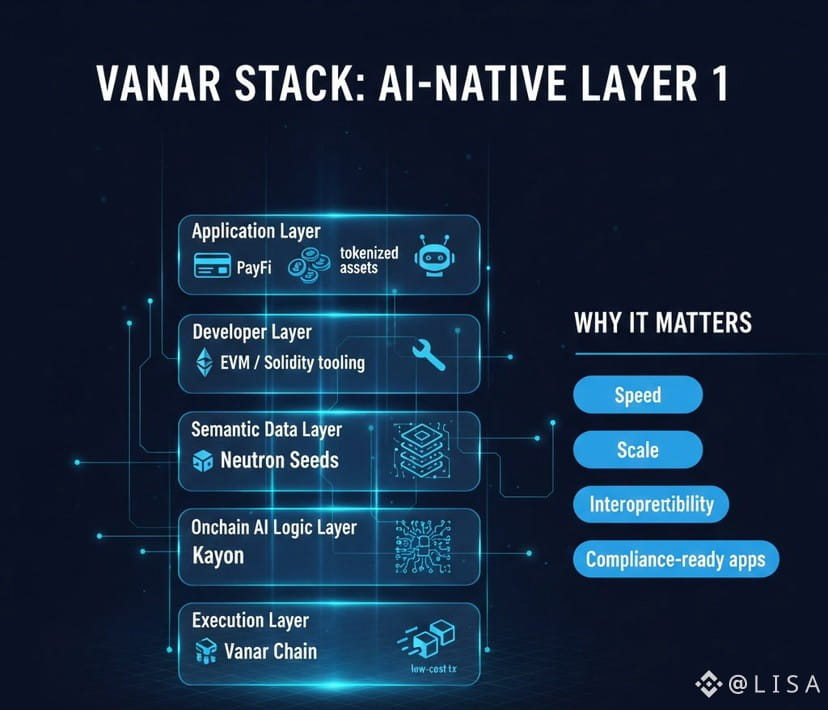

Kayon is not a chatbot, oracle, or off-chain AI service bolted onto Vanar after the fact. It is designed as a core execution component that works alongside the EVM and WASM runtime. Vanar Chain itself is an EVM-compatible Layer 1 with dual execution support, sub-three-second finality, and a fixed transaction fee model equivalent to roughly $0.0005. Kayon operates within this environment by consuming structured on-chain data, primarily Neutron Seeds, and combining it with deterministic rule sets to produce verifiable outcomes.

From a technical standpoint, Kayon sits between raw data storage and smart contract execution. Neutron Seeds compress real-world documents and records into semantic objects stored directly on-chain. Kayon reads these objects, evaluates them against predefined rule libraries, and returns outputs that contracts can act on automatically. I see this as a shift from static smart contracts to adaptive ones, where execution depends not only on inputs like balances or signatures, but also on contextual understanding of compliance requirements.

Unlike oracle-based compliance systems, Kayon does not rely on opaque external feeds that must be trusted blindly. All reasoning inputs are either on-chain or cryptographically attested. This makes the output auditable and reproducible, which is essential for regulated industries.

Multi-Jurisdiction Compliance as Code

One of the most ambitious aspects of Kayon is its ability to process compliance logic across more than forty-seven jurisdictions. Traditionally, compliance is handled by legal teams, manual checklists, and third-party service providers. In Kayon’s model, regulatory requirements are expressed as rule sets that can be executed deterministically.

For example, an invoice payment may need to satisfy anti-money laundering thresholds in the European Union, tax reporting rules in the United Arab Emirates, and sanctions screening for US exposure. Instead of routing this transaction through multiple intermediaries, Kayon evaluates the relevant Seeds, such as invoice data, counterparty identifiers, and transaction history, against the applicable rules before execution.

What stands out to me is that the output is not a simple yes or no. Kayon produces structured explanations describing which rules were satisfied, which checks were triggered, and why the transaction proceeded or halted. This explanation layer is critical because regulators do not just want outcomes; they want reasoning.

How Kayon Integrates With Smart Contracts

From a developer perspective, Kayon is accessed through simple contract calls rather than custom AI pipelines. A smart contract can request a compliance check by referencing specific Seeds and selecting the relevant jurisdictional templates. Kayon processes the request and returns a response that the contract can interpret.

This design keeps contracts deterministic. Kayon does not introduce randomness or probabilistic outputs. Every result is derived from defined inputs and rules, making it suitable for financial execution. I find this particularly important because unpredictability is one of the main reasons enterprises distrust AI-driven automation.

Kayon’s execution happens within the same block lifecycle as other transactions, benefiting from Vanar’s Proof of Reputation and delegated Proof of Stake consensus. Validators execute reasoning tasks and attest to results, ensuring decentralization without sacrificing accountability.

Fixed Fees and Predictable Compliance Costs

Compliance is expensive largely because costs are unpredictable. Legal reviews, audits, and monitoring fees fluctuate with volume and jurisdiction. Vanar’s fixed-fee model changes this dynamic. Whether a transaction involves a simple transfer or a complex multi-jurisdiction compliance check, base execution costs remain stable.

Kayon introduces additional computation, but this is priced transparently. Premium reasoning tiers require $VANRY, and intensive operations trigger token burns. This aligns network economics with real usage. Enterprises know upfront what compliance automation will cost, which simplifies budgeting and encourages adoption.

I see this predictability as one of the most underrated features. It transforms compliance from a variable overhead into an operational constant.

Token Flow and Economic Impact of Kayon

vanry plays several roles in Kayon’s ecosystem. It is used as gas for transactions, as payment for advanced reasoning subscriptions, and as a staking asset securing validators that execute compliance logic. Burns occur during heavy data compression and advanced reasoning tasks, introducing deflation tied to enterprise activity.

With a maximum supply of 2.4 billion tokens and a twenty-year emission schedule, $VANRY avoids short-term inflation shocks. Validator rewards account for roughly eighty-three percent of emissions, with development and ecosystem allocations covering the rest. As Kayon usage increases, token velocity rises while circulating supply tightens through burns and staking.

At current metrics around early 2026, $VANRY trades in the $0.006 to $0.008 range with a market capitalization near $15 to $20 million and roughly eleven thousand holders. From my perspective, this suggests the market has not yet priced in enterprise-driven demand for automated compliance.

Real-World Use Case: Automated Invoice Settlement

Consider a multinational supplier settling invoices across borders. Traditionally, this involves manual reviews, bank delays, and compliance checks that can take days. On Vanar Chain, invoices are uploaded as Neutron Seeds. Kayon evaluates them against contract terms, tax rules, and sanctions lists before releasing payment.

The entire process happens on-chain, with settlement finality in seconds. Audit trails are immutable. If a regulator requests justification, the reasoning output is already stored. This reduces operational friction while increasing transparency.

What I find compelling is that this model does not require counterparties to trust each other. They trust the system, which enforces rules automatically.

Financial Institutions and Risk Management

Banks and asset managers face intense scrutiny around risk exposure. Kayon enables real-time risk assessment by continuously monitoring on-chain activity against regulatory thresholds. If exposure exceeds limits, contracts can automatically restrict further transactions.

This transforms compliance from a reactive process into a preventative one. Instead of discovering violations after the fact, institutions can embed safeguards directly into their financial logic.

Because Kayon operates across jurisdictions, global institutions can standardize compliance workflows while adapting locally. This balance between uniformity and flexibility is difficult to achieve off-chain.

Public Sector and Reporting Transparency

Governments and public agencies require transparency without exposing sensitive data. Kayon supports selective disclosure, where only necessary information is revealed. Grants, procurement contracts, and public spending can be tracked with Seeds, while Kayon ensures funds are released only when conditions are met.

I can imagine municipal budgets being executed through such systems, where compliance checks are automatic and reporting is instant. This reduces corruption risk while maintaining privacy.

Comparison With Alternative Approaches

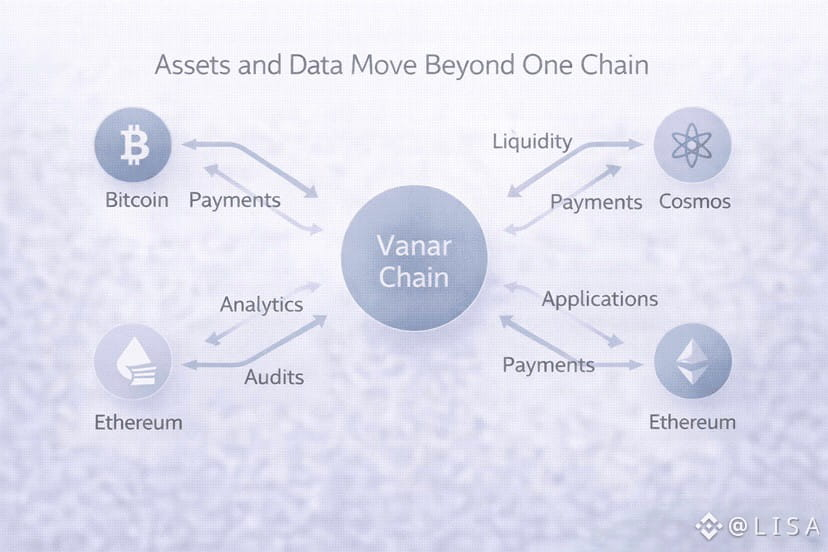

Most blockchains handle compliance externally. Ethereum relies on third-party services and off-chain enforcement. Solana focuses on throughput but leaves compliance to application developers. Permissioned chains offer compliance but sacrifice openness.

Kayon’s approach is different. It embeds compliance logic directly into an open, permissionless Layer 1 without making the chain itself restrictive. This hybrid model is rare.

Competitive Matrix

Network Compliance Model Automation Level Auditability Cost Predictability

Vanar Chain On-chain reasoning via Kayon High Full High

Ethereum Off-chain services Medium Partial Low

Solana Application-level Low Partial Low

Permissioned DLTs Centralized rules High Limited Medium

This comparison highlights why Kayon occupies a unique position. It combines automation and auditability without central control.

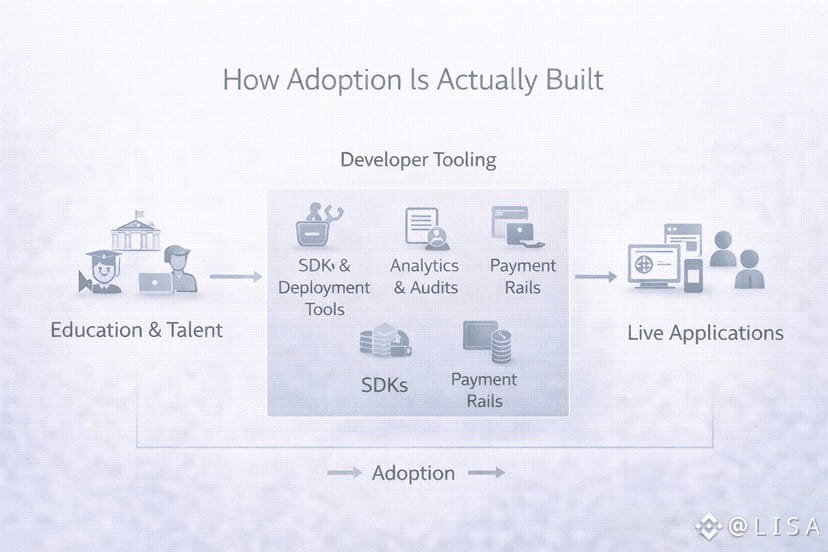

Developer Experience and Adoption Barriers

Developers often struggle to translate legal requirements into code. Kayon abstracts much of this complexity. Instead of hardcoding rules manually, developers reference jurisdictional templates maintained and updated through governance.

This reduces legal risk and accelerates development. I see this as critical for startups and enterprises alike, who want to innovate without becoming compliance experts.

The learning curve remains manageable because Kayon integrates with familiar EVM tooling. Developers do not need to adopt new languages or frameworks.

Governance of Compliance Logic

Compliance rules evolve. Vanar addresses this through governance. vanry stakers vote on updates to rule sets, jurisdiction coverage, and reasoning parameters. This ensures that changes reflect community and enterprise needs rather than unilateral decisions.

From my perspective, this decentralized governance model is essential. It prevents regulatory capture while maintaining adaptability.

Roadmap for 2026 and 2027

In 2026, Kayon expands its rule library and introduces subscription tiers for enterprises requiring high-frequency reasoning. Integration with enterprise ERP systems becomes a focus, enabling seamless data ingestion.

By 2027, Kayon aims to support agent-to-agent compliance negotiation, where autonomous systems coordinate transactions across jurisdictions. This opens the door to fully automated global commerce.

Risks remain. Regulatory environments can shift unpredictably. However, Kayon’s modular design allows updates without disrupting core infrastructure.

Sustainability and Long-Term Outlook

Compliance automation is not a temporary trend. As digital finance grows, regulatory complexity increases. Kayon positions Vanar Chain to capture this demand structurally.

I keep returning to the idea that compliance is one of the largest hidden costs in global finance. If Kayon succeeds in reducing this friction, its impact extends far beyond crypto.

Closing Reflection

Vanar Chain’s Kayon engine suggests a future where compliance is not an obstacle but a programmable feature. Instead of slowing innovation, rules become part of the execution logic, enforced consistently and transparently.

As enterprises and governments move on-chain, the ability to reason across jurisdictions may become more valuable than raw throughput. If Kayon becomes the standard way contracts prove legality, how might global finance change when compliance no longer requires trust, delays, or intermediaries, but simply execution?