I've traded enough failed bounces to recognize when markets are rejecting recovery attempts outright. RSI rebounds from oversold, price rallies 10-15%, looks like the bottom might be in, then collapses back to new lows within 24 hours. That rejection pattern tells you something fundamental broke and participants aren't willing to hold through any bounce, no matter how technically oversold things get.

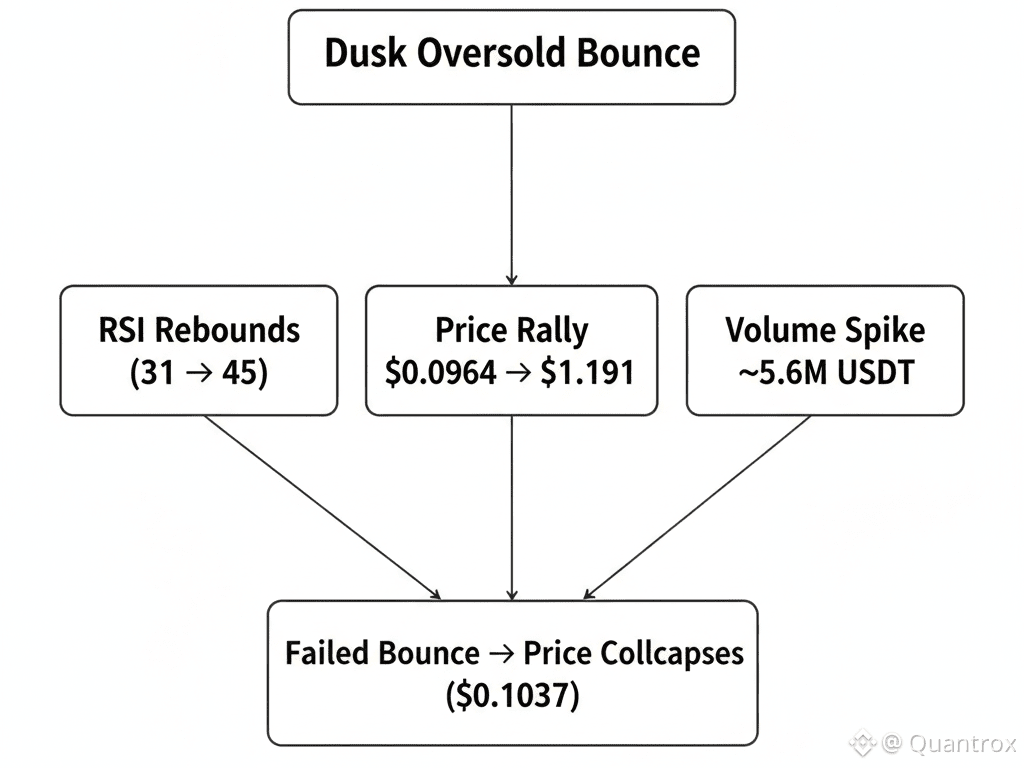

Dusk bounced yesterday from $0.0964 with RSI recovering to 45.85, looking like maybe the bleeding stopped. Today Dusk is back at $0.1037 with RSI crashed to 31.04, right back in oversold territory. The 24-hour high of $0.1191 represents a 23% rally from the $0.0964 low that completely failed and gave back most gains. Volume of 5.60 million USDT is slightly higher than recent days but nowhere near levels you'd see in sustained recoveries. Every bounce Dusk attempts gets sold immediately, and I keep wondering what sellers know that makes them exit every rally no matter how cheap prices get.

Either they know DuskTrade isn't launching in 2026 as announced, or they've concluded it doesn't matter even if it does launch because institutional adoption won't generate meaningful revenue for Dusk infrastructure.

Dusk sits at $0.1037 after rallying to $0.1191 then collapsing back down. RSI at 31.04 means we're back in the same oversold territory that created yesterday's bounce, except now that bounce failed and sellers proved they'll dump into any strength. The range from $0.1191 to $0.1015 shows 17% intraday volatility, but it's all chop with no sustained direction. Volume at 5.60 million USDT is the highest we've seen in days, but it's being used to sell into the bounce rather than accumulate.

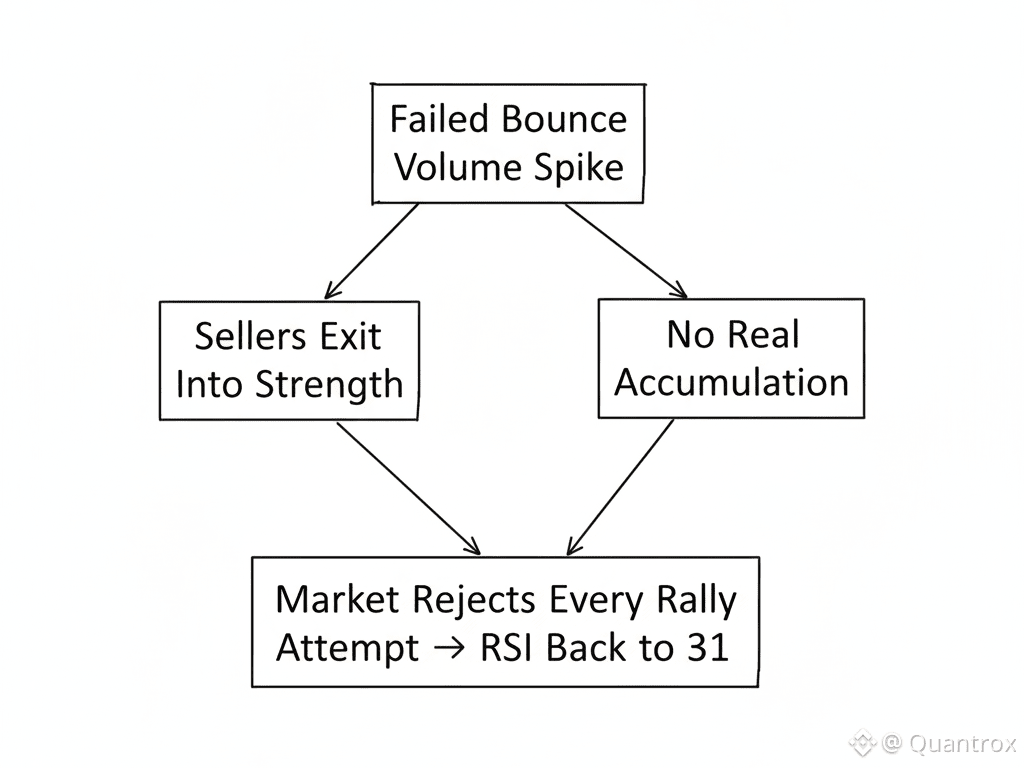

What this failed bounce reveals is that Dusk has no genuine buying support at any level. Yesterday's recovery from $0.0964 to $0.1191 should have attracted value buyers if anyone believed in the institutional thesis. Instead it attracted sellers who used the rally as exit liquidity. That's the behavior you see when participants have concluded the fundamental story is broken and any bounce is an opportunity to exit, not accumulate.

The RSI dropping back to 31.04 after briefly recovering to 45.85 yesterday is technically devastating. It means Dusk can't sustain even short-term bounces from extreme oversold conditions. Markets that can't hold oversold bounces are markets where sellers are overwhelming and nobody wants to catch the falling knife regardless of how cheap it gets.

For Dusk specifically, this failed bounce pattern confirms what price action has been saying for weeks—the market doesn't believe DuskTrade launches with real volume in 2026. If participants thought NPEX was actually migrating €300 million in tokenized securities onto Dusk infrastructure this year, yesterday's drop to $0.0964 would have created aggressive accumulation. Instead it created a dead cat bounce that failed within 24 hours.

What bothers me about this setup is the timing. We're in 2026, the supposed launch year for securities settlement on Dusk. Every day that passes without concrete DuskTrade announcements makes the bearish interpretation more likely. If NPEX was actually preparing to launch tokenized securities trading on Dusk infrastructure, there would be operational updates, regulatory milestone announcements, preparation visible in some form. Instead we get silence while Dusk makes failed bounce attempts with RSI at 31.

The 270+ validators still running Dusk nodes through this failed bounce provides the only counterargument to complete capitulation. Those operators are staying committed despite RSI crashing back to 31 after yesterday's bounce failed. Either they have information about DuskTrade that market doesn't believe, or they're exhibiting sunk cost fallacy on a scale I've rarely seen.

My read is it's mostly sunk cost fallacy at this point. Validators committed to Dusk expecting 2026 institutional adoption. Now watching price fail every bounce attempt while remaining in the launch year, they're trapped. Shutting down nodes means admitting the entire thesis was wrong. Easier psychologically to keep operating and hope something changes, even though every failed bounce confirms the thesis probably broke.

The volume of 5.60 million USDT during this failed bounce is higher than recent 4 million USDT days, but it's being used to sell rather than buy. That tells you the slightly higher participation came from people taking advantage of yesterday's bounce to exit positions, not new buyers entering. Real recovery sees volume spike from buying interest. Dusk's volume increase came from selling interest using the rally as exit opportunity.

What makes Dusk situation particularly brutal is that failed bounces from extreme oversold levels typically lead to acceleration lower. When markets can't sustain rallies from RSI 31-33 it means selling pressure is overwhelming and the next leg down often happens quickly. Dusk bouncing from $0.0964 to $0.1191 then immediately failing back to $0.1037 with RSI at 31 sets up for potential test of $0.09 or lower if sellers get aggressive again.

The technical setup with RSI at 31 says another bounce attempt is likely just from mean reversion—RSI can't stay in 30s forever and usually rebounds to 40-45 range temporarily. But yesterday proved those rebounds don't sustain on Dusk because fundamental buyers don't exist. Every bounce creates selling opportunity, not accumulation opportunity.

For anyone still holding Dusk through this, yesterday's failed bounce should be alarming. Markets that can't hold oversold rallies are markets in serious trouble. Either you believe so strongly in DuskTrade launching that failed bounces don't matter to your multi-year thesis, or you should probably be exiting on the next oversold rally attempt before things get worse.

What I keep coming back to is what would actually stop this pattern of failed bounces. The answer is concrete DuskTrade updates from NPEX. Not vague progress statements—actual operational details like regulatory approvals completed, specific securities lined up for tokenization confirmed launch dates. Without that catalyst Dusk probably continues this pattern: oversold RSI creates brief bounces, bounces fail immediately, RSI crashes back to oversold, repeat until something breaks.

The infrastructure side keeps operating through all this. DuskEVM processes whatever contracts get deployed. Hedger handles confidential transactions. Validators maintain consensus at $0.1037 just like they did at $0.3299. All the technology works, which is what makes this situation so brutal—having functional infrastructure doesn't matter if institutions don't use it for real securities settlement.

That's the harsh reality Dusk faces with RSI back at 31 after yesterday's bounce failed. The technology exists, the validators are committed, the infrastructure operates. But the market has concluded none of it matters because DuskTrade probably isn't launching with meaningful volume, and every bounce attempt gets sold as participants exit positions rather than accumulate.

Either NPEX announces something concrete soon that changes this dynamic entirely, or Dusk continues making failed bounce attempts with RSI in the 30s until either complete capitulation happens or validators start shutting down and confirming the thesis broke. The failed bounce from $0.0964 to $0.1191 back to $0.1037 with RSI at 31 suggests we're closer to one of those outcomes than most realize.

Dusk's Volume Increase To 5.60M USDT During Failed Bounce Shows Sellers Using Rally As Exit Liquidity

Dusk's volume jumped to 5.60 million USDT, highest in days, but it happened during a failed bounce from $0.0964 to $0.1191 that immediately collapsed back to $0.1037. Real recoveries see volume spike from buying interest. Dusk's volume increase came from sellers using yesterday's oversold rally as exit opportunity. That's textbook distribution—price bounces on oversold RSI, volume increases, but it's all selling into strength rather than accumulation. Participants concluded Dusk bounces are chances to exit before things get worse, not opportunities to position for DuskTrade. When Dusk rallies see volume increase but price can't sustain, it means every bounce attracts more sellers waiting to exit. Markets where rallies create selling rather than buying typically accelerate lower once sellers exhaust bounce exit opportunities.