Plasma is moving into a new chapter where everything about digital money movement is changing. The crypto market is shifting toward stablecoin based settlement, intent driven systems, chain abstraction, and cross chain liquidity networks that behave like a unified financial layer. In the middle of this shift, Plasma is growing faster than ever. It is not trying to compete with every ecosystem in the world. Instead, it is focusing on one thing and doing it extremely well: creating a stable, reliable, high performance settlement layer for stablecoins, especially USDT. The chain is designed around this single purpose and every recent update reflects that. What makes Plasma stand out in early 2026 is that it has avoided hype cycles and focused entirely on infrastructure that can handle global scale money movement. As new announcements continue to roll out, the picture becomes clearer. Plasma is preparing to become a long term backbone for payments, liquidity flows, and high trust applications that need predictable behavior instead of speculation driven activity.

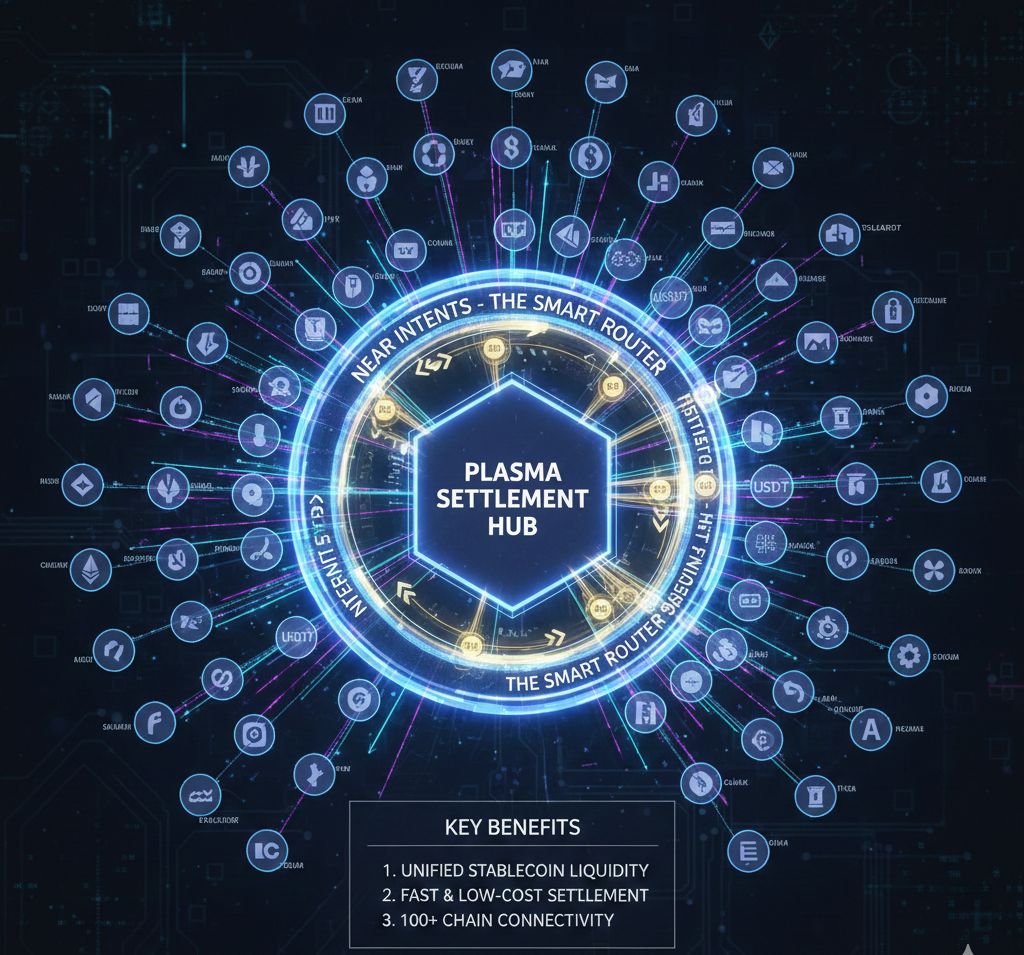

The biggest recent development is the expansion of Plasma’s cross chain connectivity. The integration of NEAR Intents has been one of the most important updates for the ecosystem. NEAR Intents brings powerful routing and liquidity access across more than one hundred blockchains, allowing stablecoins like USDT to move between networks with almost no friction. When people think about cross chain liquidity, they usually imagine complex bridging and slow settlement times. Plasma’s approach is different. By connecting to Intents, it can now tap into a much wider pool of stablecoin liquidity and execute transfers with smoother user experience. This update alone strengthens Plasma’s position as a practical settlement chain because it removes the biggest limitation many chains face: liquidity fragmentation. Now, users and developers can rely on Plasma for fast, predictable, low cost stablecoin movement without worrying about liquidity black holes across ecosystems.

Another major area of growth comes from the rise of DeFi activity around Plasma. One of the most notable updates has been the new tokenomics model introduced within the Pendle ecosystem. Pendle is one of the largest yield trading and fixed yield protocols in crypto, and its decision to improve and simplify its token model directly benefits users on Plasma. Instead of sticking with outdated ve-style staking systems, Pendle moved toward a new model that focuses on liquid staking and more flexible yield structures. This change improves capital efficiency for users holding assets on Plasma and opens better pathways for stablecoin based yield strategies. Even though this update is not exclusive to Plasma, its impact is powerful because any yield improvement draws more liquidity to the chain. Stablecoin heavy ecosystems grow when users can earn predictable and transparent returns. Pendle’s update supports that growth and adds more depth to the broader Plasma ecosystem.

Plasma has also been strengthening its community and creator presence through the ongoing Binance CreatorPad campaign. This campaign focuses on giving creators across the world a chance to earn XPL rewards by publishing educational and informative content. What makes this campaign special is the scale and timing. Since launching in mid-January 2026, it has brought thousands of new users into the ecosystem, generating a wave of fresh content, new wallet interactions, and higher awareness of Plasma’s role in the stablecoin economy. CreatorPad is known for amplifying emerging narratives at the perfect time, and this campaign has done exactly that for Plasma. It showed the crypto audience that Plasma is not just another Layer-1, but a chain built for real usage. The campaign has helped accelerate discussions around why stablecoins need purpose-built settlement layers instead of relying on generalized smart contract networks. As more creators share insights, breakdowns, and research, Plasma’s social presence continues to grow and attract new developers and users.

Behind every update and every announcement, Plasma’s technical foundation remains the most important part of its story. Unlike many chains that launch with marketing first and infrastructure later, Plasma has built its network to solve a very specific problem: how to move stablecoins with near zero friction. The chain’s EVM compatibility allows developers to deploy Ethereum applications without modifications. Transactions are designed to be ultra fast, and stablecoin transfers, especially USDT, can be executed at almost zero cost. This makes Plasma ideal for real-world payments, merchant systems, remittance flows, and high volume applications that require speed and consistency. The design reflects a future where digital dollars dominate global crypto usage. More than 70 percent of all on-chain activity today revolves around stablecoins, and Plasma is positioning itself directly where the market is moving.

Recent market discussions have shown a mixed but very active interest around Plasma. On one hand, many analysts see Plasma as undervalued relative to its infrastructure potential. They argue that once the Bitcoin bridge goes live and once the stablecoin transaction volume increases, Plasma will enter a new growth cycle because the market finally values chains that offer predictable settlement over speculative performance. On the other hand, some observers point out that competition is strong, and that stablecoin networks like Tron or upcoming compliance focused chains may challenge Plasma. Both views are valid, but what stands out is that Plasma is not trying to outcompete everyone at once. Its goal is to specialize. In crypto, specialization wins over time. Chains that try to be everything for everyone usually lose direction. Plasma has chosen a different path by becoming the chain where stablecoins work at their best. This approach gives it a strong foundation for long term adoption.

The ecosystem’s roadmap also brings confidence to users and developers. One of the most anticipated future upgrades is the activation of Plasma’s native Bitcoin bridge. This is not a simple wrapped asset solution. It is expected to be a trust-minimized and transparent design that allows BTC to play a real role inside Plasma’s DeFi ecosystem. Bitcoin liquidity is one of the largest untapped resources in crypto. If Plasma successfully connects BTC to stablecoin yield, lending, settlement, and liquidity markets, it could unlock a new wave of activity. The bridge would give traders, institutions, and DeFi platforms a simple way to use Bitcoin without relying on wrapped tokens or centralized custodians. This upgrade, once active, could elevate Plasma to a new tier of utility.

In addition to the Bitcoin bridge, the upcoming token unlock schedule is one of the most watched developments for 2026. The first major unlock for U.S. public sale participants is scheduled for late July, followed by team and early investor unlocks in late September. These events are part of Plasma’s regulatory compliance and transparency principles. While supply unlocks often create temporary market reactions, they also increase circulating supply and open the door for more active economic usage. As more XPL enters the market, liquidity becomes deeper, price discovery becomes healthier, and adoption becomes easier. For long term projects, controlled unlocks are necessary and reflect a maturing ecosystem.

Plasma’s long term direction is becoming clearer with every update. The world is moving toward a financial environment where stablecoins dominate on-chain value. Whether for remittances, B2B payments, everyday transfers, merchant systems, yield markets, or liquidity routing, stablecoins are becoming the core of everything. Plasma understands this trend deeply. It is not trying to be a general purpose L1 competing with every chain. Instead, it is building the most reliable, fast, and stable settlement layer for digital dollars. This is a long game, not a short one. As more applications start relying on stablecoin flows, Plasma’s role will continue to grow. Every recent announcement, every integration, every ecosystem update shows the same message: Plasma is quietly becoming one of the strongest, most focused networks in the stablecoin economy.