Plasma is entering a new phase of development where its architecture, integrations, updates, and expanding roadmap have begun to align into a very clear direction. The project is no longer an experimental scaling concept or a theoretical solution. It is now a live and growing network that is supporting real applications, real transactions, real builders, and real throughput. The momentum surrounding Plasma has increased noticeably over the recent months and every new announcement confirms that the ecosystem is reaching a level of maturity that positions it among the most relevant infrastructure layers of the coming years. This article captures the latest updates, fresh integrations, network improvements, use cases, and the larger picture forming around Plasma as it moves deeper into 2026 with confidence.

Plasma has always focused on solving the challenges that slow down decentralized systems. It aims to provide efficiency, scalability, and cost reduction at a time when many blockchains are facing congestion and rising fees. The core design of Plasma allows high traffic execution to be compressed into optimized computation that reduces cost and improves performance without compromising on security or decentralization. As more networks struggle with increasing activity and inconsistent throughput, the value of Plasma becomes clearer. The native token XPL sits at the center of this evolving ecosystem and powers transactions, governance, incentives, and development support. It connects the economic activity across decentralized applications to the infrastructure that processes and validates every action on the network. Every improvement to Plasma strengthens the role of XPL as a utility and governance asset.

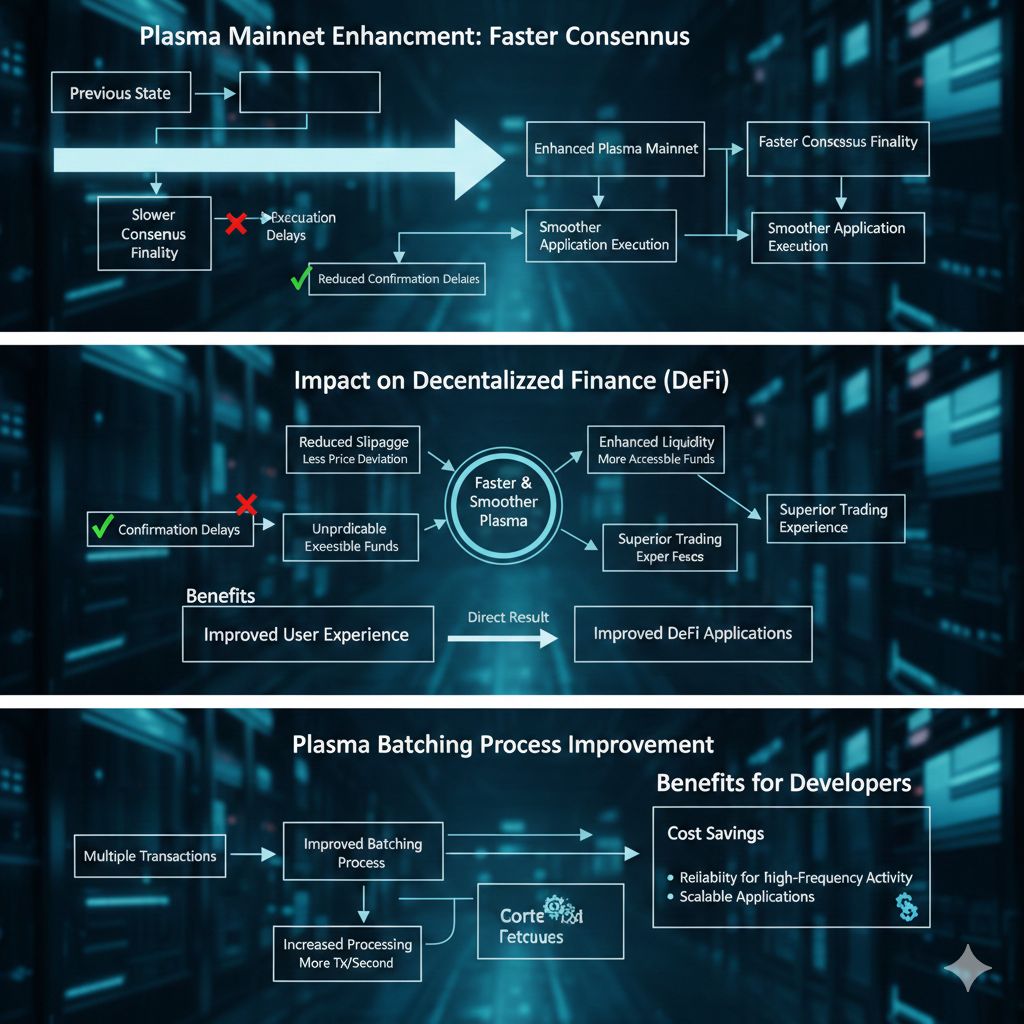

The past quarter has been especially transformative. The biggest improvement is the latest enhancement to the Plasma mainnet which brings faster consensus finality and smoother execution across applications. These changes reduce confirmation delays and allow developers to rely on more predictable execution. In decentralized finance this matters greatly because smaller delays can impact slippage, liquidity, and the overall trading experience. Plasma has also improved its batching processes which allow multiple transactions to be grouped in a way that saves cost and increases processing capacity. These improvements directly benefit developers who need reliability for applications handling high frequency activity.

One of the major updates from the Plasma team is the launch of its new cross chain bridge. Interoperability has become one of the most important requirements for modern blockchain ecosystems. Builders and users want to move assets easily across networks without friction. Plasma addresses this with a secure bridge that connects to Ethereum, BNB Chain, Solana, and other networks. This unlocks liquidity flows and expands the reach of the Plasma ecosystem. It also removes the isolation problem where users are forced to choose between ecosystems. With the Plasma bridge, assets can move freely and developers can design applications that operate across multiple networks. The early beta phase of the bridge already shows strong usage as users transfer XPL and other assets. This development increases the relevance of Plasma in an interconnected blockchain world.

To support developers, Plasma released an enhanced SDK and development toolkit. This includes simplified templates for smart contracts, better APIs for decentralized finance primitives, improved debugging tools, and a new analytics dashboard that helps developers monitor performance. These upgrades are not the type that draw flashy headlines, but they are extremely important for builders who want smooth onboarding and efficient development cycles. Plasma is signaling that it wants to be a developer friendly environment where teams can create and deploy applications quickly and reliably. The better the experience for builders, the faster the ecosystem can expand because developers are the foundation of every long term blockchain network.

Plasma also announced new integrations across decentralized finance, gaming, and digital collectibles. Yield platforms have begun supporting automated strategies for XPL liquidity pools. NFT marketplaces are using Plasma for low cost minting and better royalty handling. GameFi builders are adopting Plasma for games that require constant and low cost transactions. Every new integration expands the Plasma ecosystem and increases the utility of XPL. When a chain supports use cases across multiple categories, it becomes more flexible and more attractive for future builders. Plasma is now entering that phase where its ecosystem is stretching across several layers of decentralized activity.

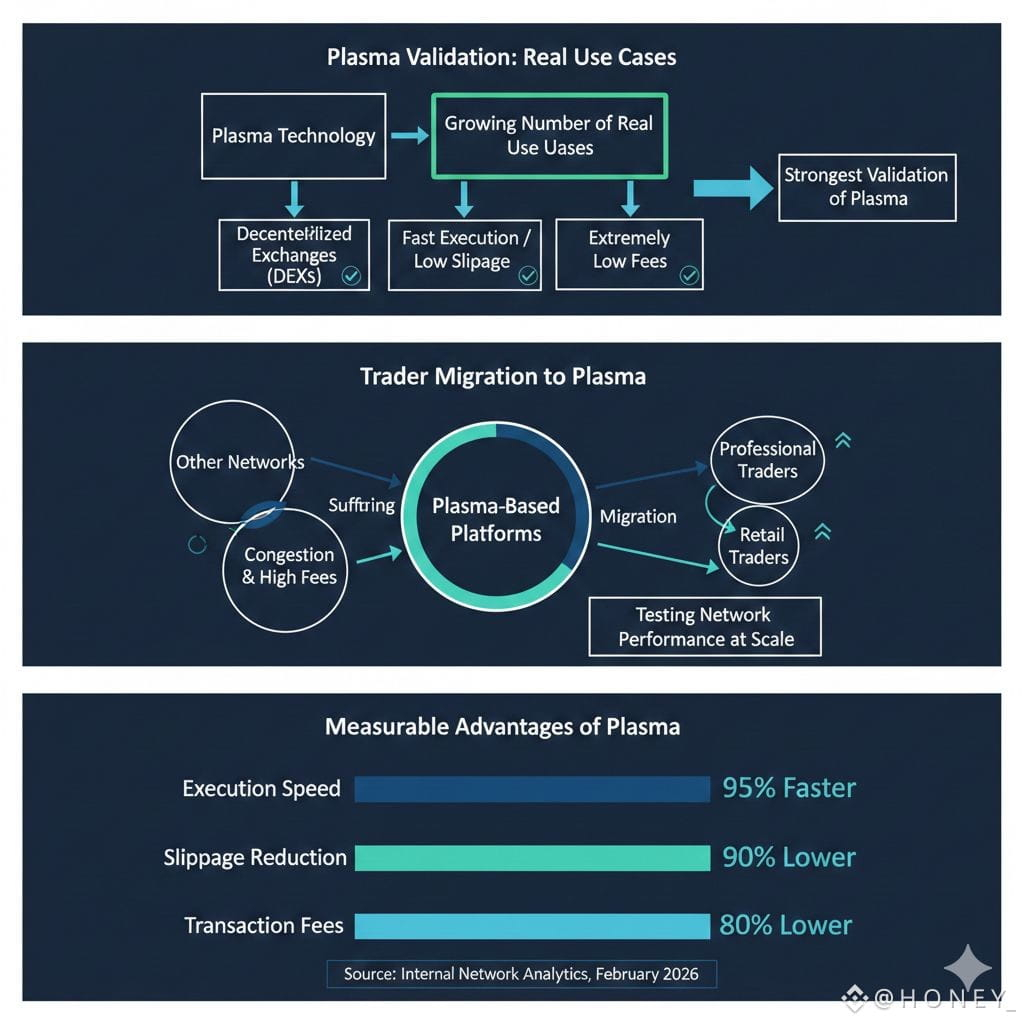

The strongest validation of Plasma comes from the growing number of real use cases. Decentralized exchanges built on Plasma now offer very fast execution, practically no slippage, and extremely low fees. Traders who once suffered from congestion on other networks are now moving toward Plasma based platforms. Professional and retail traders are usually among the first groups to test network performance at scale and their migration toward Plasma is a strong sign that the network is delivering measurable advantages.

In the gaming sector, Plasma has become a promising solution for developers who need a network capable of handling continuous in game transactions. Games with token rewards, asset transfers, or micro interactions cannot sustain high fees or slow processing times. Plasma solves this by offering a fast and inexpensive environment that allows players to move assets or interact with in game systems without friction. As GameFi continues to evolve, networks like Plasma will become essential because gaming requires real scalability far beyond a casual transaction model.

Plasma is also gaining traction in identity and reputation systems. These systems store verifiable information on chain and use it to determine access rights, trust levels, and participation scoring. Several teams building on Plasma are experimenting with decentralized identity layers where user reputation is stored immutably and can be used across multiple applications. These systems have powerful applications in decentralized finance underwriting, community management, and trust based governance models. When identity and reputation can move across the ecosystem reliably, more advanced financial and social systems can emerge.

The bigger picture is why Plasma matters in 2026. The crypto industry is shifting away from hype driven cycles and moving toward real utility. Users want low fees, stable performance, and reliable execution. Developers want strong tooling and predictable outcomes. Institutions want security and transparency. Plasma addresses all these requirements with a scalable architecture, expanding interoperability, and a commitment to developer experience. Many chains have promised high performance, but few have delivered it consistently. Plasma continues to show steady and meaningful progress supported by growing real world adoption.

The XPL ecosystem is becoming stronger as well. XPL is not a secondary asset or a marketing token. It is deeply integrated into the network. It secures the chain, enables staking, powers transactions, supports governance, and fuels ecosystem incentives. As usage grows, demand for XPL naturally increases because every action within the network depends on the token. This gives XPL a central role in the long term sustainability of Plasma.

Community governance is also growing. Recently, XPL holders participated in a major community voting round where decisions about protocol upgrades, treasury spending, and development initiatives were opened to the community. This transition toward a more decentralized governance structure strengthens the network because community aligned decision making often leads to healthier and more sustainable growth.

Looking ahead, Plasma has several important milestones on its roadmap. Decentralized governance will expand further, new liquidity incentive programs will strengthen decentralized finance ecosystems, mobile wallet integrations will streamline asset management, and advanced privacy tools are being explored for select applications. These developments show that Plasma is accelerating and preparing for a larger wave of adoption.

The future of Plasma looks increasingly strong as the ecosystem grows beyond its early foundation. With major upgrades live, integrations expanding, and real world use cases growing across decentralized finance, gaming, identity, and cross chain applications, Plasma has positioned itself as one of the most promising infrastructures for the next era of Web3. Builders are choosing it, traders are utilizing it, and communities are supporting it. Plasma is no longer a theory. It is a living and evolving ecosystem with real momentum and real adoption. The next chapter will bring even more growth as the network expands into new territories and more developers tap into the capabilities of Plasma.