🛡️ Gold Is Quietly Crushing It While Crypto Bleeds. Here’s Why.

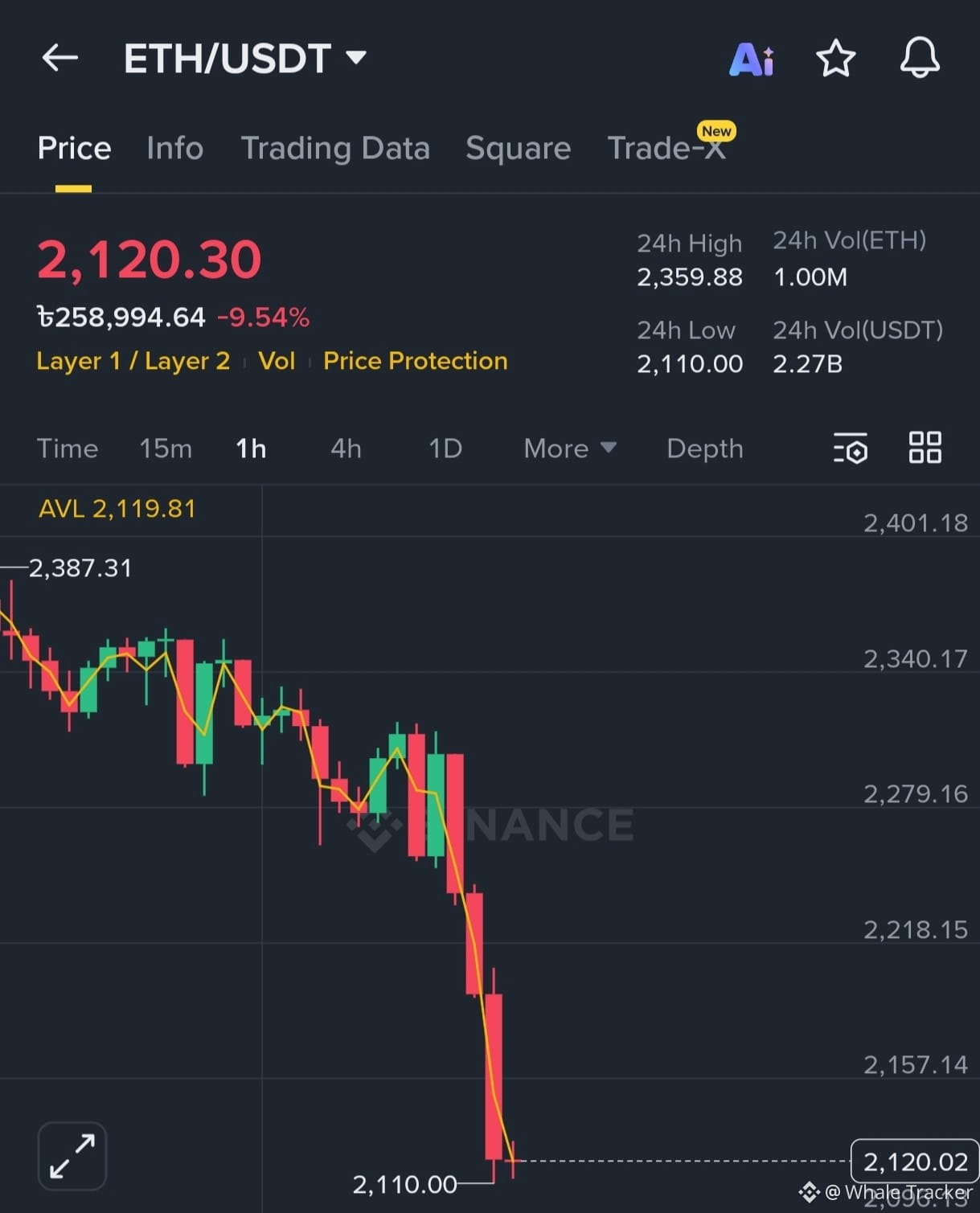

Look at your portfolio right now. Red, right?

Now look at Gold. $4,910 and climbing.

While every major crypto is catching a dip, Gold is just… chugging higher. Steady. Relentless. Up over +5% in the recent move. It's not a fluke—it’s a message.

Why is Gold winning when crypto is struggling?

🔍 Three Reasons Gold Is Outperforming:

1. The "Safe Haven" Magnet: When markets get shaky—geopolitical tension, inflation fears, equity wobbles—big money doesn't just vanish. It moves. And historically, it moves into Gold.

2. A Hedge Against "Digital Fear": Crypto volatility is a feature, not a bug. But when fear spikes, some capital rotates out of high-beta assets (like altcoins) into proven stores of value. Gold is the ultimate old-school safe haven.

3. Real-World Demand Meets Macro: Central banks are buying. ETFs are flowing. This isn’t just speculation—it’s institutional and macro-driven accumulation.

📈 What This Tells Us About The Market:

· This isn't a signal to abandon crypto. It’s a lesson in diversification.

· Gold’s strength often highlights risk-off sentiment. That can mean short-term pain for crypto, but also long-term buying opportunities.

· Smart traders watch all markets—not just charts on Binance Futures for crypto, but also Gold (XAUUSD), to gauge real risk appetite.

💡 Your Move:

If you're only trading crypto, you're only seeing half the picture. Gold’s rally is a macro clue.

Consider using Binance Convert or the XAUⓢ-USDT perpetual contract to get exposure without leaving the platform. Hedge, diversify, or just learn from the flow.

Sometimes the best crypto trade starts by looking outside of crypto.

What do you think—is Gold's strength a warning sign for crypto, or just a healthy market rotation?

👇 Drop your view. Let’s talk macro.