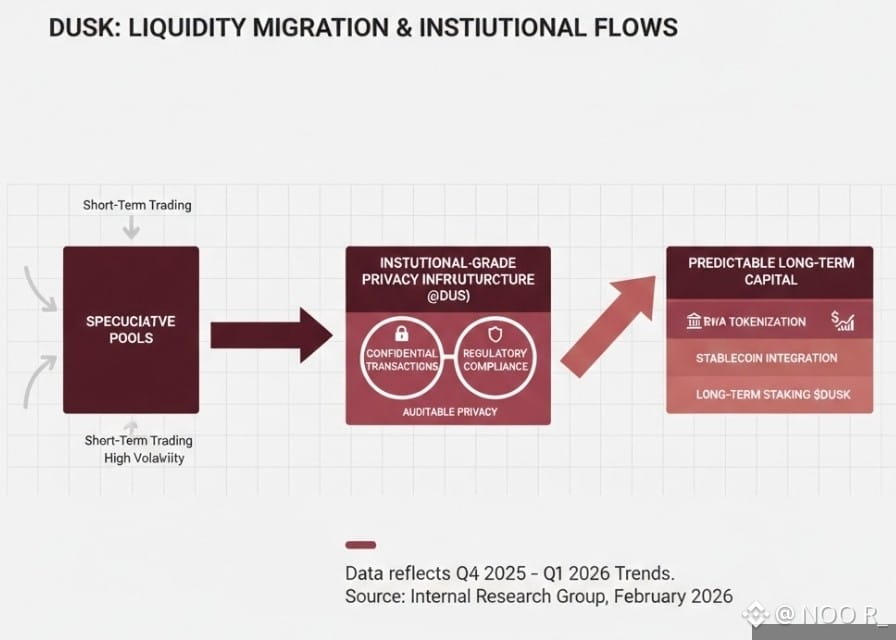

I’ve noticed a pattern in how money moves lately: big players don’t actually look for the fastest tech; they look for the most dependable "boring" tech. In the world of finance, if everyone can see your balance or your trade history, you’ve lost your competitive edge. That’s why we’re seeing a shift where privacy isn’t just a feature anymore it’s the actual foundation. Without it, companies can’t legally or safely move their assets onto a blockchain, and the whole system just stays stuck in the "experimental" phase.

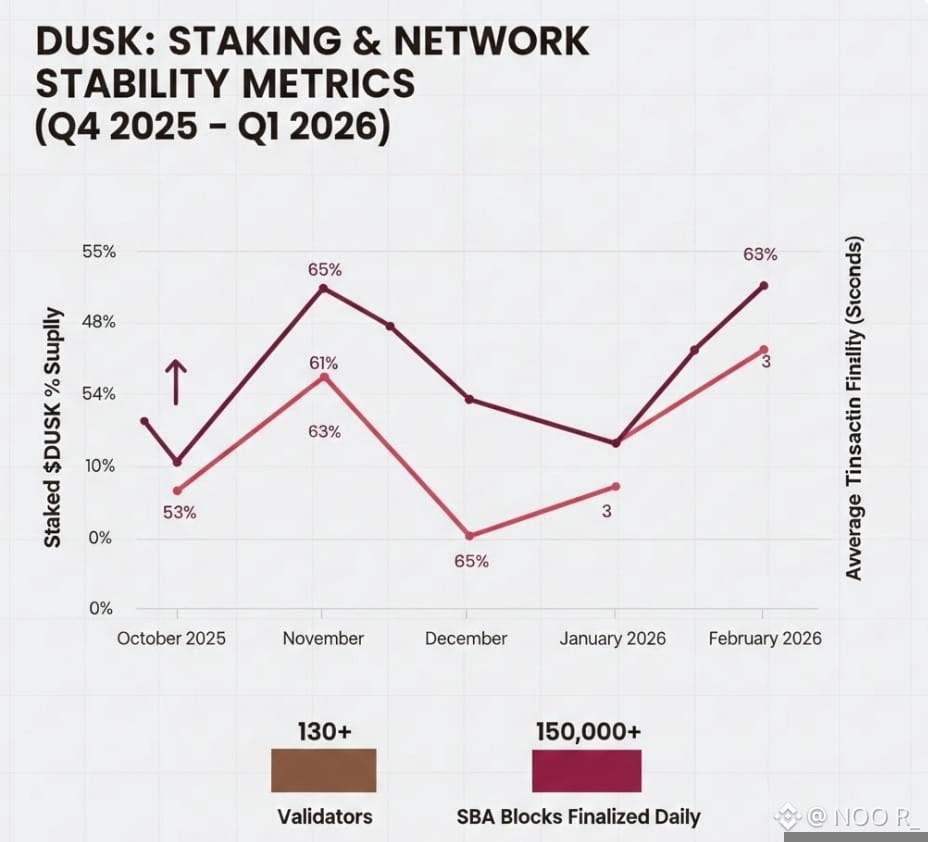

One lesson I’ve learned is to watch where the supply goes when things get quiet. Right now, on-chain data shows a steady trend with over 120 million $DUSK tokens locked in staking, representing a significant chunk of the circulating supply. This isn't just a number; it tells us that the people closest to the project are prioritizing network security and long-term stability over quick trades. By supporting the Segregated Byzantine Agreement (SBA), these participants are backing a system that settles trades in seconds, making them final and irreversible. If the people running the network are this committed to stability, what does that say about the trust needed for real-world companies to join in?

Working with @Dusk feels different because it focuses on the unsexy parts of finance the rules, the audits, and the privacy. With the mainnet now live and maturing, the project has moved past the hype of "what if" and into the reality of "how it works." By integrating tools like the EURQ stablecoin a MiCA-compliant asset the #Dusk ecosystem is providing a space where a business can actually pay its bills or settle a bond trade without jumping through legal hoops. In the end, it’s about building a future where your financial data stays yours, and the tools we use are as professional as the assets they carry.