📈 Why Did $STX Pump ~21% While the Crypto Market Was Going Down?

🧠 Background: What Is Stacks (STX)?

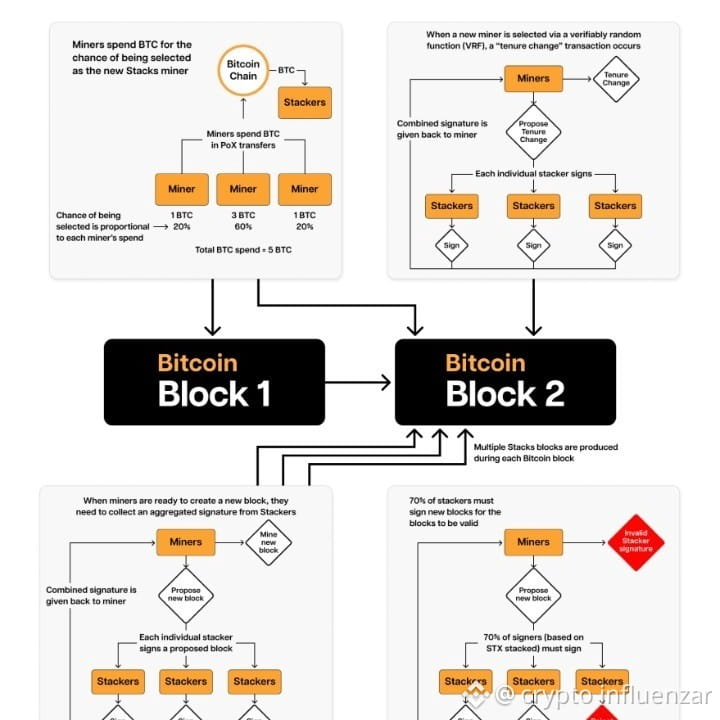

Stacks (ticker: STX) is a Bitcoin-layer smart contract and DeFi ecosystem — it enables developers to build decentralized applications using Bitcoin security. Instead of being its own blockchain like Ethereum, it “extends” Bitcoin with programmable features. (HelloSafe)

📊 1. $STX Gains Can Be Driven by Project-Specific News or Activity

Even in a bearish crypto market, $STX may outperform because of developments specific to Stacks — not just general market sentiment.

For example:

NFT / Ordinals activity on the Stacks chain has boosted network usage and interest. This increases demand for $STX as gas/utility token. (Securities.io)

On-chain demand and ecosystem engagement, including growing Total Value Locked (TVL), can push price independently of BTC or altcoin trends. (Traders Union)

Technical breakouts (like bull flag breakouts) with rising volume can trigger short-term pumps due to traders reacting to patterns. (CCN.com)

In many cases, profit-focused traders will rotate capital into assets with positive catalysts — even when the broader market mood is bearish.

📌 2. $STX’s Unique Position as Bitcoin’s Smart Contract Layer

Stacks is not just another altcoin — it’s a Bitcoin Layer-2 project. That gives it a narrative edge:

The ability to use Bitcoin in DeFi and NFTs (through sBTC) attracts demand from users who want Bitcoin utility without leaving Bitcoin’s security model. (CoinMarketCap)

Partnerships and integrations with stablecoins and cross-chain networks expand real use cases. (CoinMarketCap)

Developer activity and ecosystem growth reinforce long-term potential. (HelloSafe)

Because of this positioning, some investors view $STX as a play on Bitcoin innovation — and will buy when they see progress, even if the broader market lacks strength.

📉 3. Oversold Conditions Can Lead to Short-Term Rebounds

In bearish conditions, prices often fall too far and technical “oversold” signals can attract buyers looking for a bounce:

Oscillators like RSI or CCI showing oversold conditions often bring short-term rebounds as traders anticipate mean-reversion. (Traders Union)

Even when the overall market is weak, a token with strong local patterns may see buying pressure.

This can explain sharp upwards moves (like ~18-21% in a day) that might look out of place compared with general market direction.

🔍 4. Volume Spikes Signal Real Buying Interest

Price rises accompanied by increased trading volume often indicate that buyers are genuinely stepping in:

Higher volume suggests more participants are entering positions — not just price ticking up due to thin liquidity.

So if STX saw a volume surge during its pump, that’s usually a sign of real conviction from traders or investors.

📌 5. Narratives and Hype Cycles Drive Crypto Moves

Sometimes, investor expectations can outweigh fundamentals — especially in crypto:

Narratives like “programmable Bitcoin”, NFT activity, or layer-2 adoption themes can draw short-term capital.

Traders may interpret any positive metric or rumor as a reason to buy, causing jumps even in a bear market.

This is why $STX can outperform, at least temporarily.

🧩 Summary: Why $STX Could Pump When Market Is Down

ReasonHow It Helps $STX Price🔧 Project-Level CatalystsLocal news and upgrades drive demand🪙 Bitcoin Layer-2 NarrativeAttracts capital even when broader mood is bearish📈 Technical BounceOversold conditions lead to short-term pumps📊 Volume SpikesIndicates real buying interest📣 Narrative Driven DemandTraders chase stories and potential

📉 Bearish Doesn’t Mean No Bullish Moves

A bearish market means more sellers than buyers overall, but individual assets can still rally if:

They have positive developments

They’re oversold relative to broader sentiment

They unlock unique narratives that attract buyers

That’s how $STX can move up ~21% even when others are falling — because its price is influenced by both macros and its own set of drivers.

🔎 Always do your own research before investing. Crypto markets are volatile and risky.

Please follow me for more and latest updates about crypto market news thanks